Question: Please also include work in the BA 2 Plus Calculator if possible with this question. Summers Corp. currently has an EPS of $2.40, and the

Please also include work in the BA 2 Plus Calculator if possible with this question.

Please also include work in the BA 2 Plus Calculator if possible with this question.

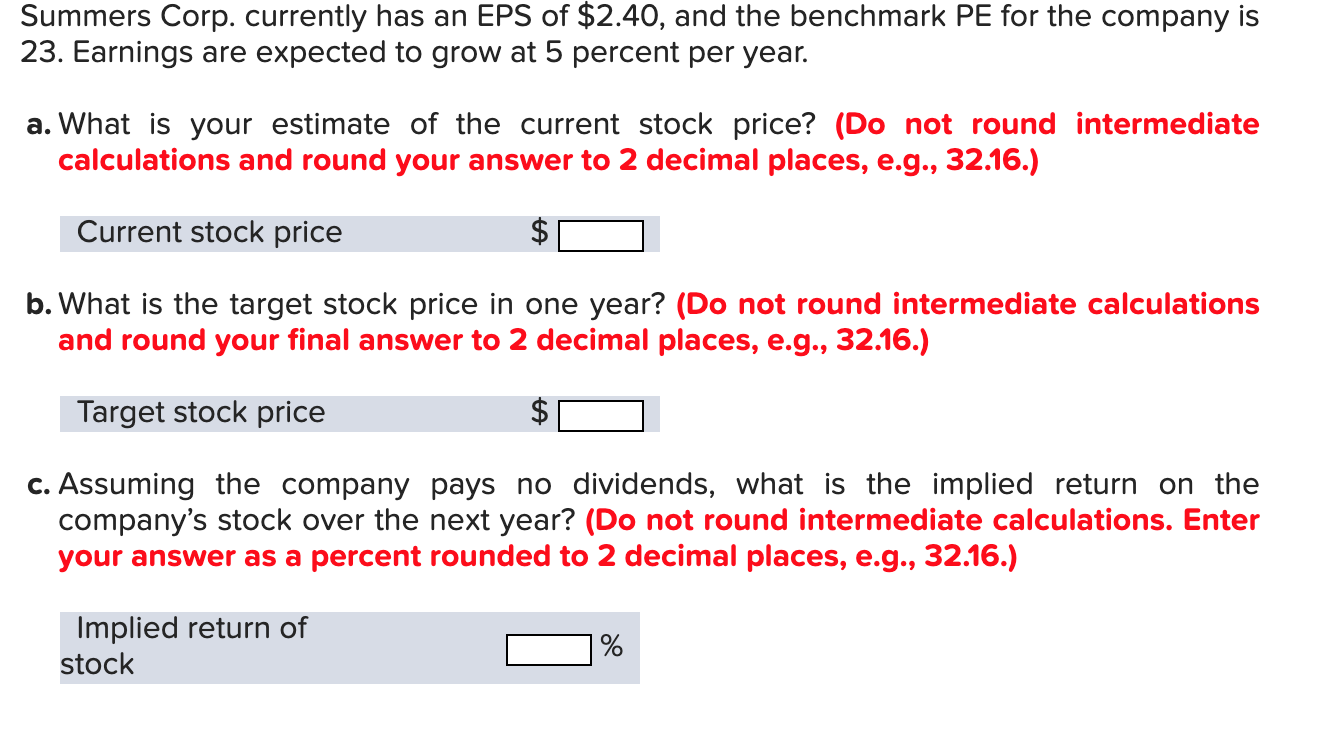

Summers Corp. currently has an EPS of $2.40, and the benchmark PE for the company is 23. Earnings are expected to grow at 5 percent per year. a. What is your estimate of the current stock price? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Current stock price $ [ b. What is the target stock price in one year? (Do not round intermediate calculations and round your final answer to 2 decimal places, e.g., 32.16.) Target stock price C. Assuming the company pays no dividends, what is the implied return on the company's stock over the next year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Implied return of stock D %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts