Question: Please also submit the financial Please answer Starbuck's financial statement statements-i.e., balance sheet, income statement, and statement of cash flows-- that shows how you get

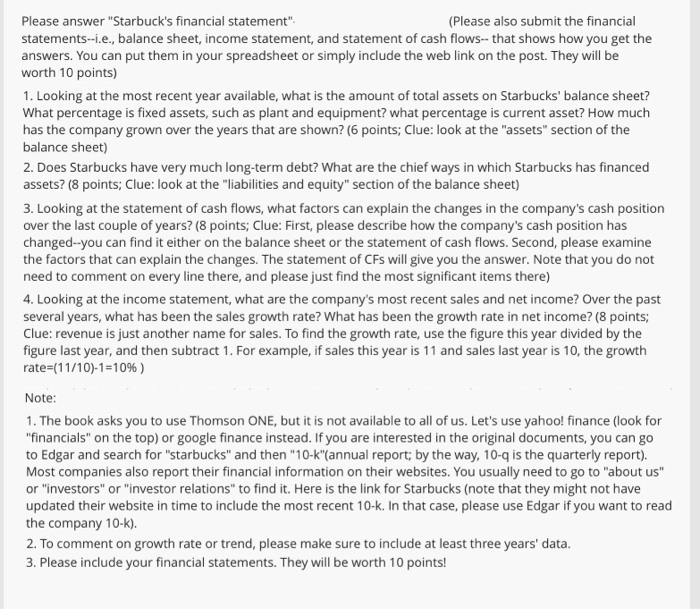

Please also submit the financial Please answer "Starbuck's financial statement" statements-i.e., balance sheet, income statement, and statement of cash flows-- that shows how you get the answers. You can put them in your spreadsheet or simply include the web link on the post. They will be worth 10 points) 1. Looking at the most recent year available, what is the amount of total assets on Starbucks' balance sheet? What percentage is fixed assets, such as plant and equipment? what percentage is current asset? How much has the company grown over the years that are shown? (6 points; Clue: look at the "assets" section of the balance sheet) 2. Does Starbucks have very much long-term debt? What are the chief ways in which Starbucks has financed assets? (8 points; Clue: look at the "liabilities and equity" section of the balance sheet) 3. Looking at the statement of cash flows, what factors can explain the changes in the company's cash position over the last couple of years? (8 points; Clue: First, please describe how the company's cash position has changed--you can find it either on the balance sheet or the statement of cash flows. Second, please examine the factors that can explain the changes. The statement of CFs will give you the answer. Note that you do not need to comment on every line there, and please just find the most significant items there) 4. Looking at the income statement, what are the company's most recent sales and net income? Over the past several years, what has been the sales growth rate? What has been the growth rate in net income? (8 points; Clue: revenue is just another name for sales. To find the growth rate, use the figure this year divided by the figure last year, and then subtract 1. For example, if sales this year is 11 and sales last year is 10, the growth rate=(11 /10). 1-10% ) Note: 1. The book asks you to use Thomson ONE, but it is not available to all of us. Let's use yahoo! finance (look for "financials" on the top) or google finance instead. If you are interested in the original documents, you can go to Edgar and search for "starbucks" and then "10-k(annual report; by the way, 10-q is the quarterly report). Most companies also report their financial information on their websites. You usually need to go to "about us" or "investors" or "investor relations" to find it. Here is the link for Starbucks (note that they might not have updated their website in time to include the most recent 10-k. In that case, please use Edgar if you want to read the company 10-k). 2. To comment on growth rate or trend, please make sure to include at least three years' data 3. Please include your financial statements. They will be worth 10 points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts