Question: please amswer asap this is all the info given. options are Yes or No a. b. c. Angle and her daughter, Ann, who are the

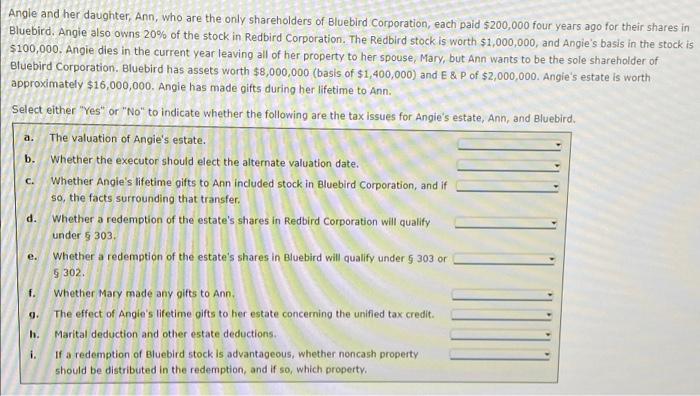

a. b. c. Angle and her daughter, Ann, who are the only shareholders of Bluebird Corporation, each paid $200,000 four years ago for their shares in Bluebird, Angie also owns 20% of the stock in Redbird Corporation. The Redbird stock is worth $1,000,000, and Angie's basis in the stock is $100,000. Angie dies in the current year leaving all of her property to her spouse, Mary, but Ann wants to be the sole shareholder of Bluebird Corporation. Bluebird has assets worth $8,000,000 (basis of $1,400,000) and E&P of $2,000,000. Angie's estate is worth approximately $16,000,000. Angie has made gifts during her lifetime to Ann. Select either "Yes" or "No" to indicate whether the following are the tax issues for Angie's estate, Ann, and Bluebird. The valuation of Angie's estate. Whether the executor should elect the alternate valuation date. Whether Angie's lifetime gifts to Ann included stock in Bluebird Corporation, and if so, the facts surrounding that transfer. Whether a redemption of the estate's shares in Redbird Corporation will qualify under 303. Whether a redemption of the estate's shares in Bluebird will qualify under $ 303 or 5 302 Whether Mary made any gifts to Ann. The effect of Angie's lifetime gifts to her estate concerning the unified tax credit. Marital deduction and other estate deductions If a redemption of Bluebird stock is advantageous, whether noncash property should be distributed in the redemption, and if so, which property d. e. f. 0. h

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts