Question: Please analysis the case study must including identification of issues, situational analysis, identification of recommendations, financial risk analysis, total cost analysis, supplier evaluation and selection

Please analysis the case study must including identification of issues, situational analysis, identification of recommendations, financial risk analysis, total cost analysis, supplier evaluation and selection analysis, sourcing risk management plan, evaluation of single sourcing versus multiple sourcing options, evaluation of short-term versus longer-term contracts and a final recommendation and implementation time line:

Esorb Inc. Case

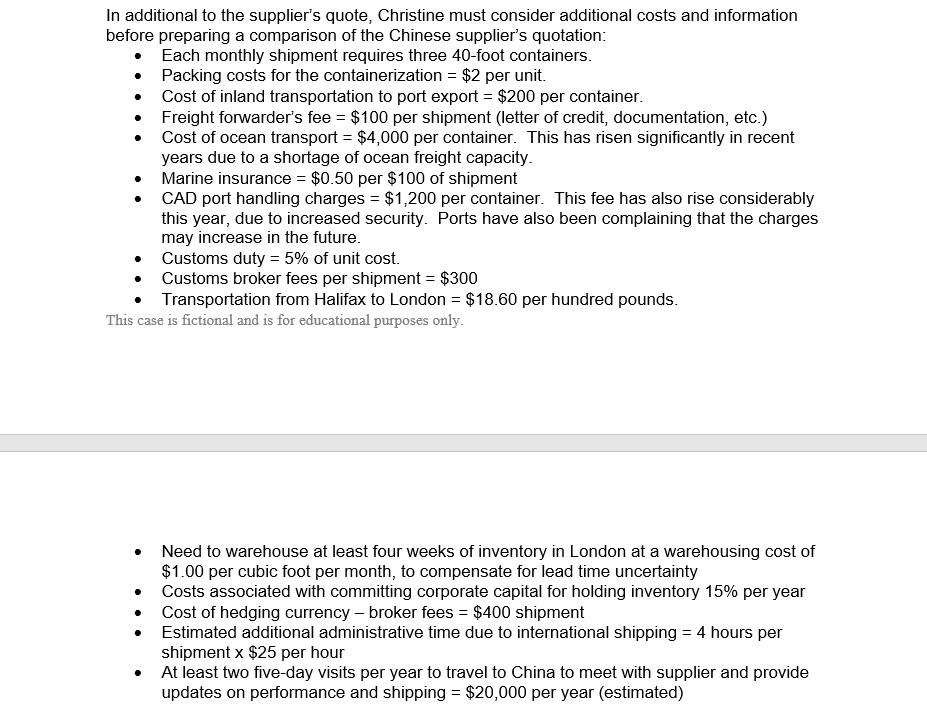

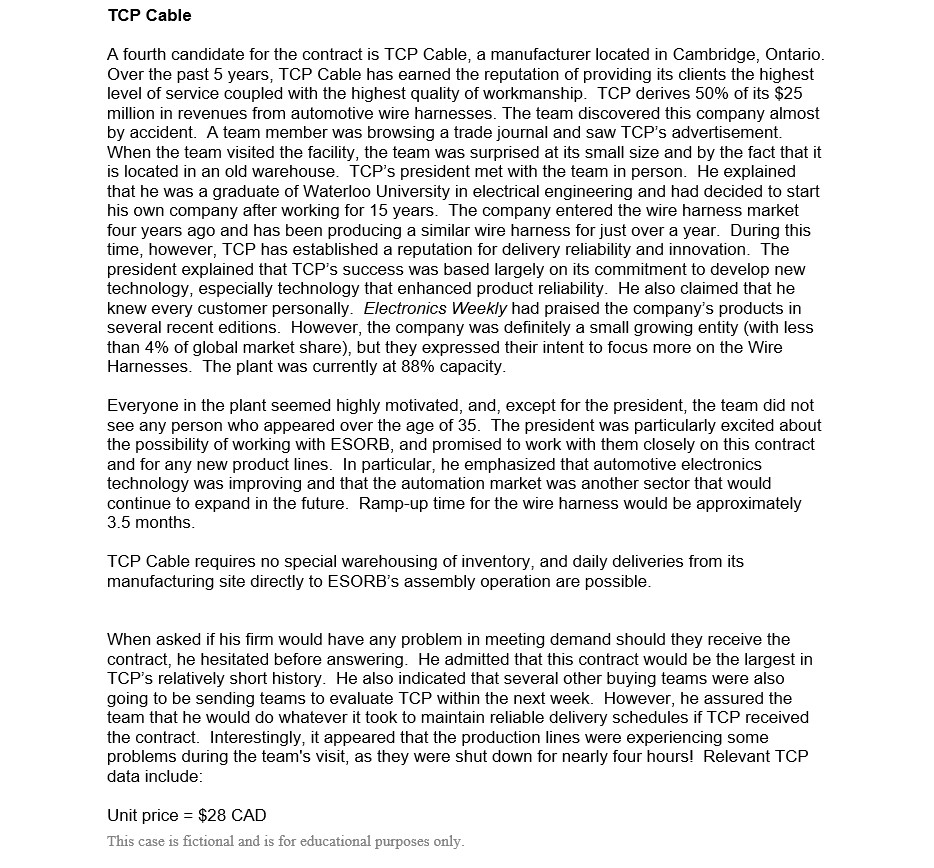

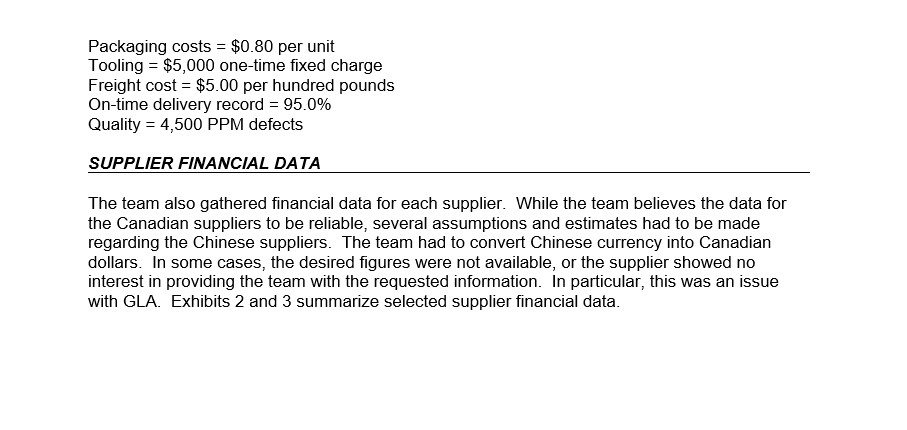

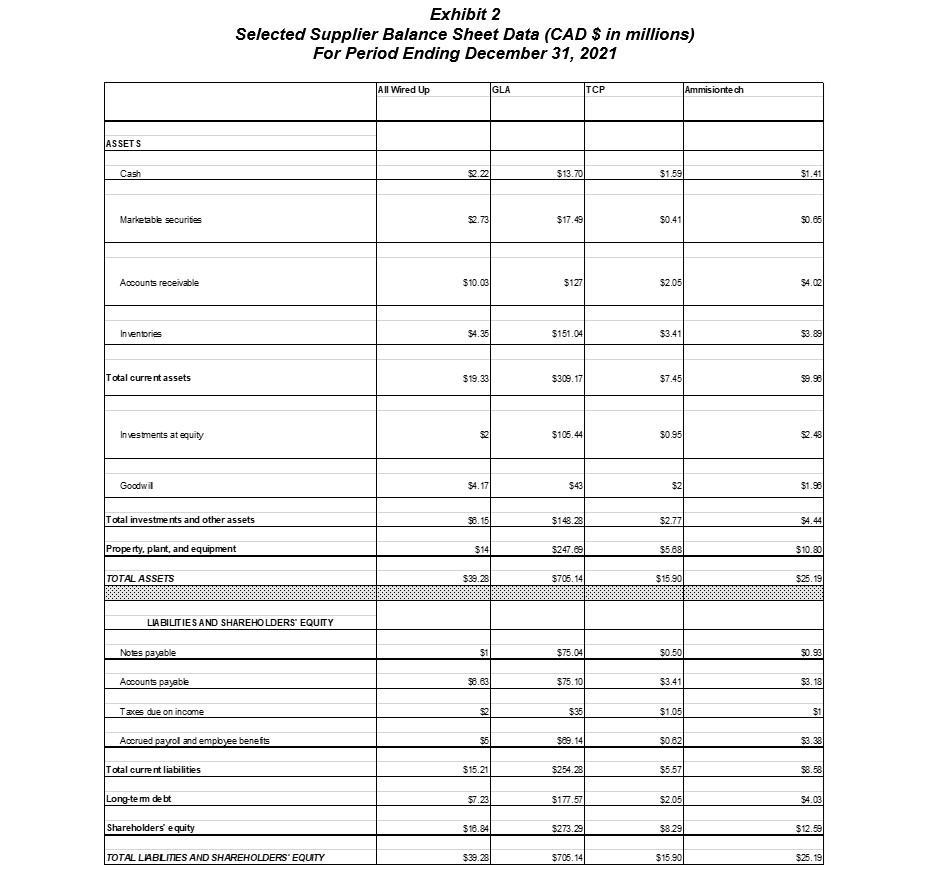

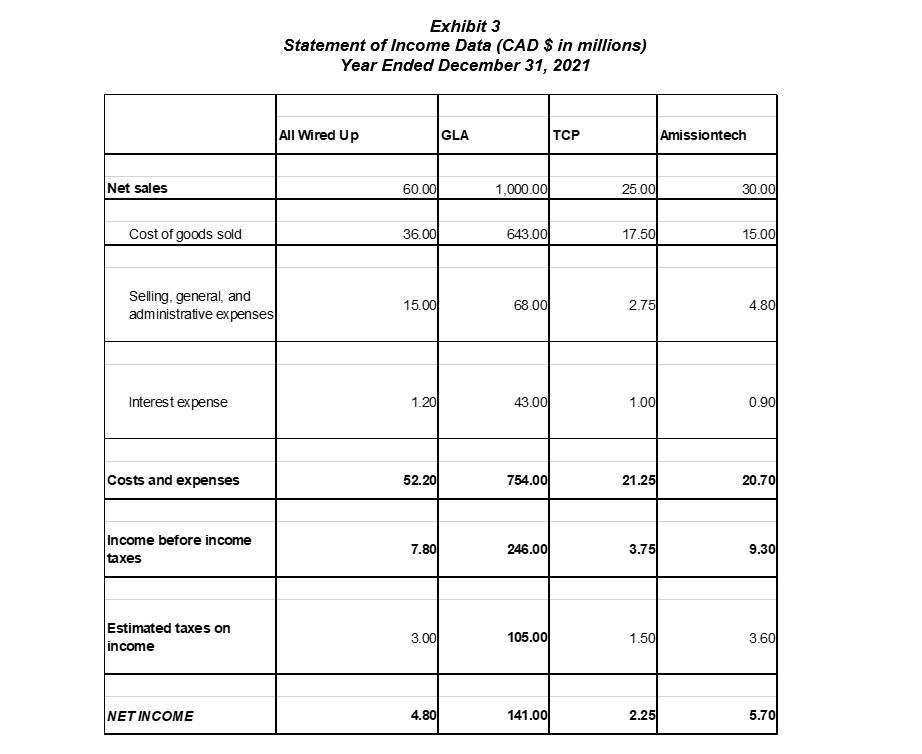

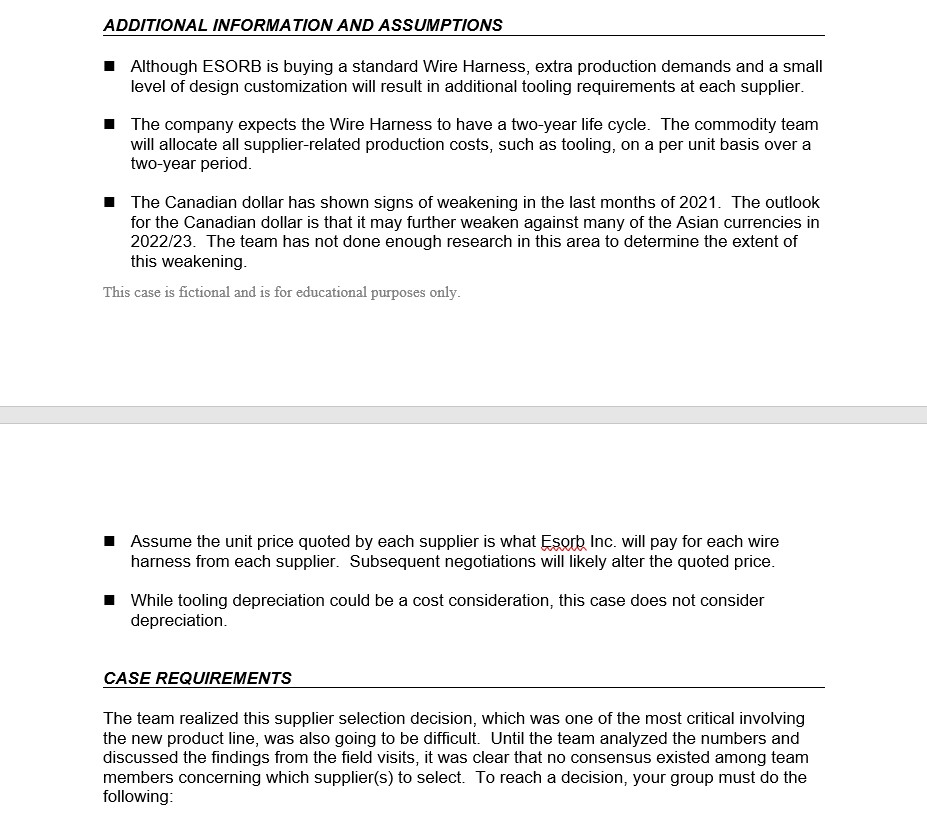

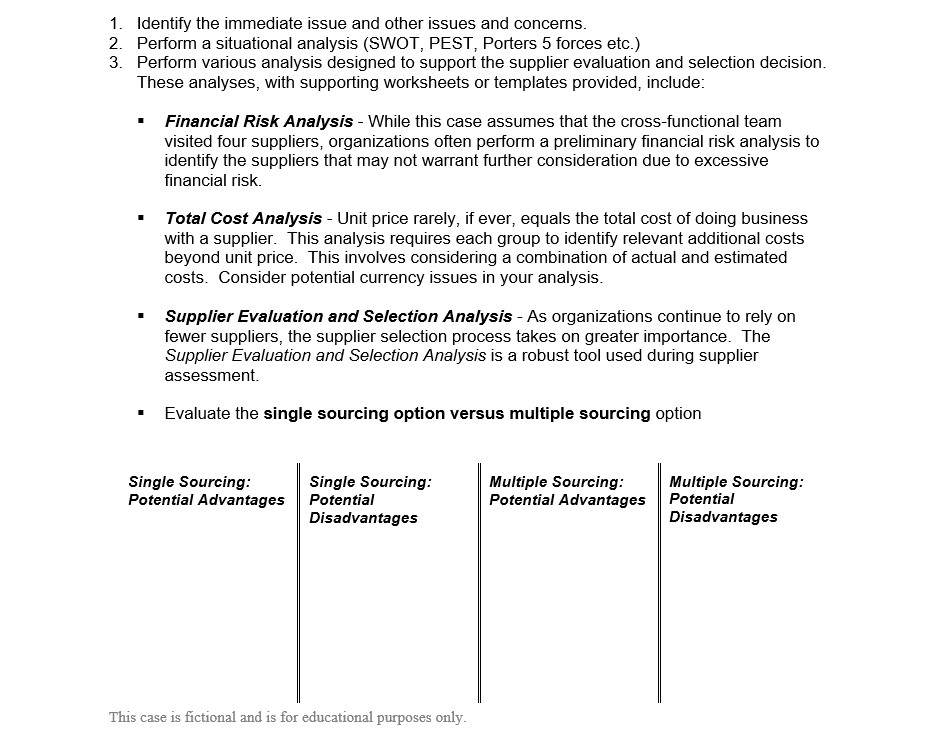

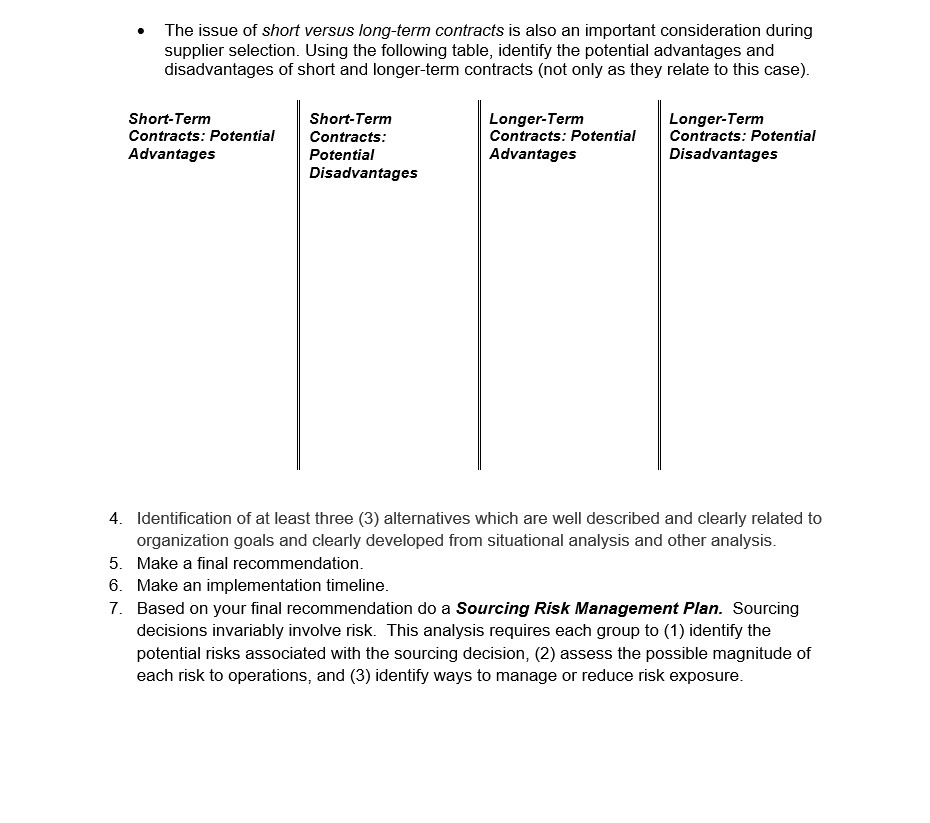

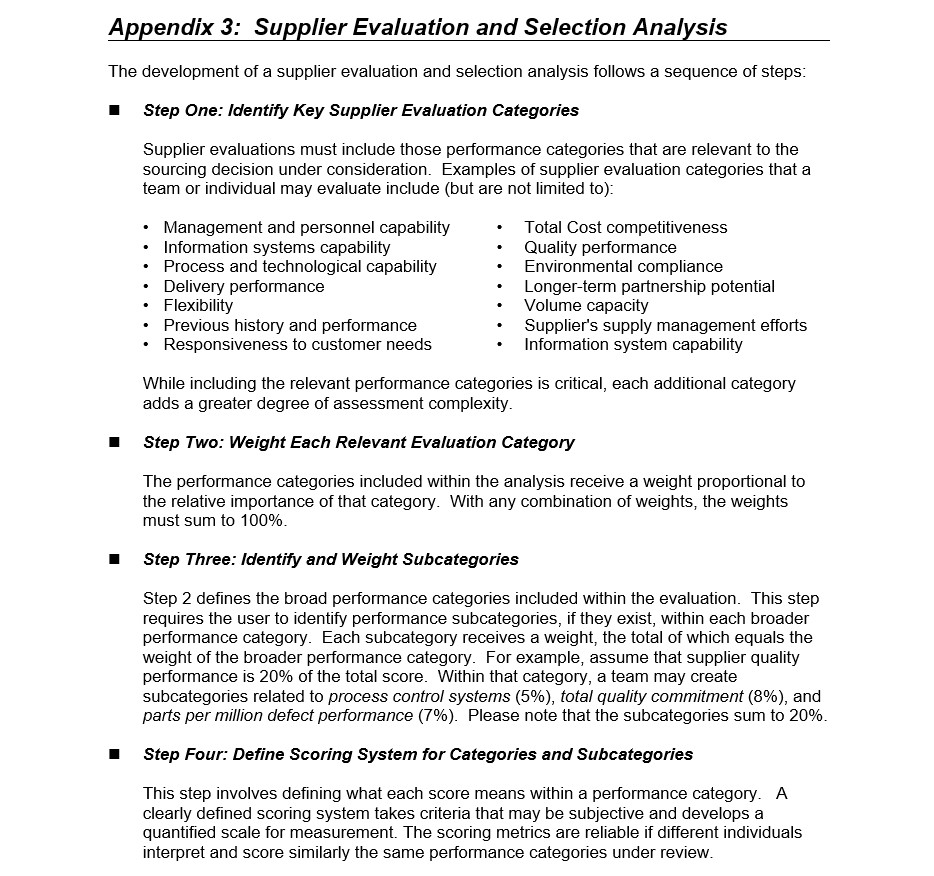

OVERVIEW Esork Inc. is a company that started in 1908 and has become an international successful company with about 26,000 employees at 62 locations in 23 countries. It started as a trading company for automobile accessories and eventually expanded into the production of automobile components in Germany. In the 1950s Esorb manufactured handles, hatches, hinges, latches, sun visors, defrostable windows and canisters. They were the first company to produce power windows starting in the 1960s. They eventually started producing seat recliners and adjustable back rests for automobiles. By the 1970s they were the first to produce power seat adjusters and electronic control-units for power window regulators in the 1980s. At the end of the nineties ESORB had production sites in Germany, England, Spain, America, Mexico, Japan and France. By 2005 ESORB had 8900 employees in 37 locations and in 19 different countries. Throughout the years ESORB continued to strive for lightweight design to optimize fuel efficiency and CO2 emissions. In 2008 ESORB added electric drives for window regulators, sunroofs and seatbelt retractors to its product range. In 2009 it formed joint ventures in China and Thailand to start production in those locations. In 2011 ESORB entered a joint venture in South Korea. In 2014 they built new facilities in South Africa. Now in 2022 the core competence of Esork Inc. is the production of technology for doors and liftgates, adjustment systems for front and rear seats and electric motors and drives. Esorb Inc. strives to play active roles in shaping the social environment. They use environmentally friendly technology and are involved in the communities they are in. They are involved with food drives, habitat for humanity and mental health charities. They are committed to protecting the health and safety of their employees. The principles of ESORB Inc are: putting the company's interest ahead of their own, to be innovative to secure leading market position and best price-performance ratio, acting fairly towards employees on all levels and in all locations, delivering top performance to their customers, all stakeholders act as one team with trust, making fast decisions and assuming responsibility for their actions. In 2005 ESORB Inc started two plants in London, Ontario, Canada. There are currently over 400 employees who work in production, skilled trades, administration and management in London, Ontario. In 2005 ESORB mainly produced seat adjusters, seat components and doors systems. Now they focus on the production of seat systems. ESORB in London, Ontario's main customers are Volkswagon, Ford, and Chrylser. The London, Ontario plant has received the London Chamber of Commerce Excellence in Human Resources Award, Ivey Academy This case is fictional and is for educational purposes only. Manufacturer of the Year, ASQ Quality Award of Excellence, London Economic Leadership Award, the FCA supplier of the Year Award, Volkswagon. "A: Rating and Ford Q1 Certification. As ESORB is a global company, they manage the procurement of production materials, services and capital equipment through a global sourcing network. They impose challenging standards on suppliers. In return they offer stable relationship with growth prospects with their suppliers. Christine Jackson, a buyer at ESORB in London, Ontario, has sent out requests for quotations for a wiring harness they use in their doors for a new automobile model. Marketing estimates that the demand for harness is 5,000 units a month in year one with a 20% growth expected for year two. The chosen supplier will incur some costs to retool for this particular harness. The harness will be prepackaged in 24126 inch cartons. Each packaged unit weighs approximately 10 pounds. As with most automotive component companies, adequate supplier capacity is a critical issue. Taking a lesson from the demands placed on it by its current customers, Esorb Inc. will seek some assurance from its suppliers that they can increase the supply of components by 25% within four week's notice of changing market conditions. Supplier responsiveness and ability to satisfy Esorb Inc.'s volume requirements will be critical. Wire Harness Market Information Esork Inc. recognizes that demand is growing rapidly, although actual numbers are difficult to obtain. One of the challenges ESORB faces, and perhaps a major reason why ESORB may want to quickly "lock in" supplier capacity, is that other products use similar wire harnesses as are used in the doors and liftgates and cars are having more and more components that are powered and require wire harnesses. In sum, ESORB Inc must share their market with the growing power and automotive market, and assess their relative leverage in the market given other market demands for the wire harnesses. ESORB Inc is targeting the price of this particular wire harness at $30. This is not unreasonable given current market pricing. However, the market for wire harnesses extends well beyond the automotive industry, and is not without its share of uncertainty and disruptions. In the automotive industry, today's customers demand defect-free products. With intense price competition and narrow profit margins, a single product defect, particularly when the automobile is in the customers' hands, can "wipe out" any profit from the sale. Poor quality will also adversely affect market reputation and future sales. Although exact numbers are difficult to obtain, financial analysts at Eserb Inc. calculate, based on experience and assumptions, that each defect will result, on average, in $130 in non-conformance costs that Fsorb Inc. must bear (including lost customer qoodwill). The company plans to introduce the new line of door technology to the market place in March 2023. It must have inventory by January 2019 to begin process proving and pilot production. The March date coincides with preparing for the new model year sales season. It is now early August 2022. This case is fictional and is for educational purposes only. Eserk Inc. relies on cross-functional commodity teams to develop sourcing strategies for key purchased items. This team is led by buyer Christine Jackson. Executive management views the supplier selection decision as a critical part of the new door technology development. The commodity team has spent the last several weeks visiting four wire harness suppliers and is currently evaluating various supply options. The team expects to begin negotiation with one or more suppliers within the next several weeks. Information regarding the suppliers under consideration is presented in the following section. THE SUPPLY ALTERNATIVES The team developed a market analysis of wire harness suppliers, and narrowed their search to four specific suppliers. Requests for quotations for the wiring harness were sent to the four prospective suppliers. These four suppliers were selected as final contenders based on: a) cost competitiveness given ESORBs initial target cost, and/or b) location proximity to ESORB's London, Ontario assembly site. The team was somewhat divided, as some members felt that ESORB should globalize its sourcing initiatives, while others felt that local suppliers would be a better choice in terms of working arrangements. Engineering supported the commodity team's preliminary efforts by purchasing off-the-shelf wire harness's for testing. This helped determine if the suppliers had a product that initially satisfied ESORB's expectations. Relying on product samples, while providing preliminary insight into the capability and technology of each supplier, was not sufficient to support a final supplier selection decision. Hence, the need for direct visits by the commodity team became apparent. The team decided to visit the four suppliers directly to collect detailed information. The visits ranged from one to two days each, with both visits completed within a two-week period. These visits were time-consuming and exhausting, particularly since two suppliers are in China. Eserb Inc. does not have an International Purchasing Office (IPO) to support its international procurement activities. Furthermore, no one on the team spoke Chinese. Fortunately, the other suppliers are located in the Ontario and were much easier to visit. In fact they were located only 50 kilometers from the ESORB's assembly facility. The following sections summarize data collected during the commodity team's visits to the two suppliers. All Wired Up The first quote received was received from All Wired Up in Woodstock, Ontario. Woodstock is about 50 kilometers from ESORB's facility so the quote was delivered in person. When Christine and the buying team toured their facility they were greeted by the sales agent and an engineering representative. While touring the facility the sales agent noted that engineering would be happy to work closely with ESORB in developing the unit and would also be interested in future business that might involve finding ways to reduce costs. The sales agent also noted that they were hungry for business, as they were losing a lot of customers to companies from China. The quote included unit price, tooling and packaging. The quoted unit price does not include shipping costs. All Wired Up requires no special warehousing of inventory, and daily deliveries from its manufacturing site directly to ESORB's assembly operation are possible. During the team's visit the plant manager claimed that capacity was not an issue, and that the company would be willing to commit the required production capacity to the ESORB contract. Similar wiring harnesses accounted for about 40% of All Wired Up's $60 million in 2021 sales. The plant is currently at 90% capacity. The plant manager pointed out that the company has committed significant resources to setting up a JIT production system for the wiring harness line. Indeed, the ESORB team was impressed with the performance of the kanban signals and flow-through workstations. All Wired Up also had a solid reputation within the industry for working with its customers on future product development. Upon visiting the quality department, the quality manager seemed particularly preoccupied and "on edge." When the plant manager left for a few minutes to answer a phone call, the group asked the quality manager if the company had experienced any significant problems recently. He confessed that the last shipment of Wiring Harnesses had several quality problems, and the number of returns from large distributors had increased dramatically. This was creating some fairly severe disruptions to production scheduling and delivery. However, he assured the ESORB team that the design engineers were working full-time on the problem and that it would be solved well before ESORB placed an order. When the plant manager returned, the quality manager made no further mention of the problem. The plant manager estimated that the rampup time for the first shipment would be very short, approximately 3 months. Unit price =$30 CAD Packaging costs =$0.75 per unit Tooling =$6,000 one-time fixed charge Freight cost =$5.20 per hundred pounds On-time delivery record =99.0% Quality =4,000 PPM defects Good Luck Assemblies The second quote received is from Good Luck Assemblies (GLA) of Guangdong Province, China. The supplier must pack the harnesses in a container and ship via inland transportation to the port of Shanghai in China, have the shipment transferred to a container ship, ship material to Halifax Nova Scotia, and then have material transported inland to London. The quoted unit price does not include international shipping costs, which the buyer will assume. GLA was the largest supplier the team visited (sales of $1 billion). The plant covered ten acres, with a wide variety of automotive components produced in the facility. Wiring harnesses represent a large segment of GLA production (GLA commits 15% of total capacity to wiring harnesses and derives 15% of revenues from the sales of these power systems). Because of its size, however, the company seemed most interested in large contracts ( $1 million or more annually). The plant is currently at 97% capacity. The highest-ranking manager that met with the ESORB team was a sales manager, who took the team to visit various departments. The division vice-president and plant manager were in conference with a wiring harness customer, who the ESORB team found out had formed a strategic supply alliance with GLA. The ESORB commodity team felt a bit "snubbed" at the facility, particularly the group's female members. The facility was efficient, spotless, and modern. When the team visited engineering, they spoke with a manager in design. The engineer estimated, based on previous experience, that the ramp-up time to begin production that would satisfy Esorb's specifications would be about 2 months This case is fictional and is for educational purposes only. The sales manager was particularly proud of GLA's new Internet-based electronic data ERP system. This system allowed direct communication with customers. He was also proud that GLA was "the price leader" for the industry, and was producing Wiring Harnesses for several of the major automotive companies. He also talked about the company's extensive investment in research and development. When the sales manager heard that the Wiring Harness order, based on 60,000 units in year one, would likely not exceed $2 million per year, he hesitated, saying that he would need to discuss the order with management. Moreover, he indicated that the company typically was not interested in orders of less than $10 million per annum, but that exceptions might be possible. The economics associated with large orders is what made GLA a low-cost producer. In additional to the supplier's quote, Christine must consider additional costs and information before preparing a comparison of the Chinese supplier's quotation: - Each monthly shipment requires three 40 -foot containers. - Packing costs for the containerization =$2 per unit. - Cost of inland transportation to port export =$200 per container. - Freight forwarder's fee =$100 per shipment (letter of credit, documentation, etc.) - Cost of ocean transport =$4,000 per container. This has risen significantly in recent years due to a shortage of ocean freight capacity. - Marine insurance =$0.50 per $100 of shipment - CAD port handling charges =$1,200 per container. This fee has also rise considerably this year, due to increased security. Ports have also been complaining that the charges may increase in the future. - Customs duty =5% of unit cost. - Customs broker fees per shipment =$300 - Transportation from Halifax to London =$18.60 per hundred pounds. - Need to warehouse at least four weeks of inventory in London at a warehousing cost of $1.00 per cubic foot per month, to compensate for lead time uncertainty - Costs associated with committing corporate capital for holding inventory 15% per year - Cost of hedging currency - broker fees =$400 shipment - Estimated additional administrative time due to international shipping =4 hours per shipment x$25 per hour - At least two five-day visits per year to travel to China to meet with supplier and provide updates on performance and shipping =$20,000 per year (estimated) Amissiontech Co, is also a Chinese company located in Guangdon. China. Amissiontech provided a bid of $21.50CAD per unit. During the team's visit the plant manager claimed that capacity was not an issue, and that the company would be willing to commit the required production capacity to the Wiring Harness contract. Similar Wiring Harnesses accounted for about 40% of Amissiontech's $30 million in 2021 sales. The plant was currently at 90% capacity. The commodity team felt much more comfortable at Amissiontech than at the other Chinese supplier's. While this supplier has minimal experience doing business with North American firms, the company seemed quite anxious for the contract. The company has several large Taiwanese and Japanese automotive manufacturers as customers. At this time Amissiontech has no Canadian facilities or support staff. The team had some concerns about becoming Amissiontech's, first major North American customer. The company's product was excellent. Every Wiring Harness system went through an extensive testing procedure that assured few problems would occur. In fact, Amissiontech's process control and testing were more thorough than any other supplier the team visited. However, the combination of the testing process and geographic distance meant that delivery cycle times were much longer, up to 9 weeks per order, although the on-time delivery performance for the facility was excellent. The team was not sure if current Asian delivery performance would be indicative of delivery performance to the Canada. The facility appeared well maintained, clean, and orderly. The team noticed that the wiring harness facility was extremely busy and wondered if the plant manager's claim about adequate capacity was accurate. All employees worked closely together in work cells and knew each other by name. Industry experts viewed Amissiontech as one of the most promising and dynamic companies in the industry. The rampup time for the delivery of the first shipment was quoted as 3 months. Relevant Amissiontech data include: Quoted price =$21.50 (quoted at $1CAD=5.09 Chinese Yen) Shipping Lead Time =9 weeks On-time delivery record =99.0% Quality =4,000 PPM defects Tooling =$2,500CAD Ramp Up time =3 months In additional to the supplier's quote, Christine must consider additional costs and information before preparing a comparison of the Chinese supplier's quotation: - Each monthly shipment requires three 40 -foot containers. - Packing costs for the containerization =$2 per unit. - Cost of inland transportation to port export =$200 per container. - Freight forwarder's fee =$100 per shipment (letter of credit, documentation, etc.) - Cost of ocean transport =$4,000 per container. This has risen significantly in recent years due to a shortage of ocean freight capacity. - Marine insurance =$0.50 per $100 of shipment - CAD port handling charges =$1,200 per container. This fee has also rise considerably this year, due to increased security. Ports have also been complaining that the charges may increase in the future. - Customs duty =5% of unit cost. - Customs broker fees per shipment =$300 - Transportation from Halifax to London =$18.60 per hundred pounds. This case is fictional and is for educational purposes only. - Need to warehouse at least four weeks of inventory in London at a warehousing cost of $1.00 per cubic foot per month, to compensate for lead time uncertainty - Costs associated with committing corporate capital for holding inventory 15% per year - Cost of hedging currency - broker fees =$400 shipment - Estimated additional administrative time due to international shipping =4 hours per shipment x$25 per hour - At least two five-day visits per year to travel to China to meet with supplier and provide updates on performance and shipping =$20,000 per year (estimated) A fourth candidate for the contract is TCP Cable, a manufacturer located in Cambridge, Ontario. Over the past 5 years, TCP Cable has earned the reputation of providing its clients the highest level of service coupled with the highest quality of workmanship. TCP derives 50% of its $25 million in revenues from automotive wire harnesses. The team discovered this company almost by accident. A team member was browsing a trade journal and saw TCP's advertisement. When the team visited the facility, the team was surprised at its small size and by the fact that it is located in an old warehouse. TCP's president met with the team in person. He explained that he was a graduate of Waterloo University in electrical engineering and had decided to start his own company after working for 15 years. The company entered the wire harness market four years ago and has been producing a similar wire harness for just over a year. During this time, however, TCP has established a reputation for delivery reliability and innovation. The president explained that TCP's success was based largely on its commitment to develop new technology, especially technology that enhanced product reliability. He also claimed that he knew every customer personally. Electronics Weekly had praised the company's products in several recent editions. However, the company was definitely a small growing entity (with less than 4% of global market share), but they expressed their intent to focus more on the Wire Harnesses. The plant was currently at 88% capacity. Everyone in the plant seemed highly motivated, and, except for the president, the team did not see any person who appeared over the age of 35 . The president was particularly excited about the possibility of working with ESORB, and promised to work with them closely on this contract and for any new product lines. In particular, he emphasized that automotive electronics technology was improving and that the automation market was another sector that would continue to expand in the future. Ramp-up time for the wire harness would be approximately 3.5 months. TCP Cable requires no special warehousing of inventory, and daily deliveries from its manufacturing site directly to ESORB's assembly operation are possible. When asked if his firm would have any problem in meeting demand should they receive the contract, he hesitated before answering. He admitted that this contract would be the largest in TCP's relatively short history. He also indicated that several other buying teams were also going to be sending teams to evaluate TCP within the next week. However, he assured the team that he would do whatever it took to maintain reliable delivery schedules if TCP received the contract. Interestingly, it appeared that the production lines were experiencing some problems during the team's visit, as they were shut down for nearly four hours! Relevant TCP data include: Unit price =$28CAD Packaging costs =$0.80 per unit Tooling =$5,000 one-time fixed charge Freight cost =$5.00 per hundred pounds On-time delivery record =95.0% Quality =4,500 PPM defects SUPPLIER FINANCIAL DATA The team also gathered financial data for each supplier. While the team believes the data for the Canadian suppliers to be reliable, several assumptions and estimates had to be made regarding the Chinese suppliers. The team had to convert Chinese currency into Canadian dollars. In some cases, the desired figures were not available, or the supplier showed no interest in providing the team with the requested information. In particular, this was an issue with GLA. Exhibits 2 and 3 summarize selected supplier financial data. Exhibit 2 Selected Supplier Balance Sheet Data (CAD \$ in millions) Far Parind Fndinn Meramhar 312021 Exhibit 3 Statement of Income Data (CAD \$ in millions) ADDITIONAL INFORMATION AND ASSUMPTIONS - Although ESORB is buying a standard Wire Harness, extra production demands and a small level of design customization will result in additional tooling requirements at each supplier. The company expects the Wire Harness to have a two-year life cycle. The commodity team will allocate all supplier-related production costs, such as tooling, on a per unit basis over a two-year period. The Canadian dollar has shown signs of weakening in the last months of 2021. The outlook for the Canadian dollar is that it may further weaken against many of the Asian currencies in 2022/23. The team has not done enough research in this area to determine the extent of this weakening. This case is fictional and is for educational purposes only. - Assume the unit price quoted by each supplier is what Esork Inc. will pay for each wire harness from each supplier. Subsequent negotiations will likely alter the quoted price. - While tooling depreciation could be a cost consideration, this case does not consider depreciation. CASE REQUIREMENTS The team realized this supplier selection decision, which was one of the most critical involving the new product line, was also going to be difficult. Until the team analyzed the numbers and discussed the findings from the field visits, it was clear that no consensus existed among team members concerning which supplier(s) to select. To reach a decision, your group must do the following: 1. Identify the immediate issue and other issues and concerns. 2. Perform a situational analysis (SWOT, PEST, Porters 5 forces etc.) 3. Perform various analysis designed to support the supplier evaluation and selection decision. These analyses, with supporting worksheets or templates provided, include: - Financial Risk Analysis - While this case assumes that the cross-functional team visited four suppliers, organizations often perform a preliminary financial risk analysis to identify the suppliers that may not warrant further consideration due to excessive financial risk. - Total Cost Analysis - Unit price rarely, if ever, equals the total cost of doing business with a supplier. This analysis requires each group to identify relevant additional costs beyond unit price. This involves considering a combination of actual and estimated costs. Consider potential currency issues in your analysis. - Supplier Evaluation and Selection Analysis - As organizations continue to rely on fewer suppliers, the supplier selection process takes on greater importance. The Supplier Evaluation and Selection Analysis is a robust tool used during supplier assessment. - Evaluate the single sourcing option versus multiple sourcing option This case is fictional and is for educational purposes only. - The issue of short versus long-term contracts is also an important consideration during supplier selection. Using the following table, identify the potential advantages and disadvantages of short and longer-term contracts (not only as they relate to this case). 4. Identification of at least three (3) alternatives which are well described and clearly related to organization goals and clearly developed from situational analysis and other analysis. 5. Make a final recommendation. 6. Make an implementation timeline. 7. Based on your final recommendation do a Sourcing Risk Management Plan. Sourcing decisions invariably involve risk. This analysis requires each group to (1) identify the potential risks associated with the sourcing decision, (2) assess the possible magnitude of each risk to operations, and (3) identify ways to manage or reduce risk exposure. Purchasers assess supplier financial health for several reasons. The most important reason involves managing supply base risk. The analysis may highlight difficulties that will interfere with the smooth and timely flow of material. A supplier may be experiencing capacity constraint problems, have difficulty meeting its payables, have too many receivables, have poor inventory management as revealed by low inventory turns, or have cash flow problems as noted by current liabilities exceeding current assets. A supplier financial analysis is likely whenever a purchaser is attempting to reduce a pool of potential supply sources. If a supplier does not meet certain thresholds as defined by the purchaser, then the supplier will likely not move to the next level of consideration. Financial ratios are a key part of a supplier financial analysis. Of course, the key to a supplier financial analysis is a purchaser's ability to obtain reliable and complete financial data, which can be a challenge when evaluating closely or privately held corporations. Besides calculating and attempting to interpret the meaning of financial ratios, comparing ratio data can provide even greater insight into a supplier's financial condition. While no correct answers exist for financial ratios, a comparison of a supplier's ratios to published industry norms can help identify if further financial analysis is necessary. An analyst should also compare several years of supplier financial data, if available, to identify favorable or unfavorable trends. Another comparison involves comparing a supplier's ratios with specific competitors, which is likely when a purchaser has collected data from more than one supplier. Please use the following template to calculate selected financial ratios for the four suppliers being considered for the Wiring Harness. Note: Shareholders equity includes stock and retained earnings. This value is also referred to as Net Worth. Conclusions and Interpretation: This case is fictional and is for educational purposes only. Appendix 2: Total Cost Analysis This template requires each group to quantify costs that are in addition to the quoted unit price. Using cost information provided in the case for each supplier, calculate the estimated per unit total cost from each supplier for year one. Total Cost Analysis Worksheet--Year One Conclusions and Comments: Appendix 3: Supplier Evaluation and Selection Analysis The development of a supplier evaluation and selection analysis follows a sequence of steps: Step One: Identify Key Supplier Evaluation Categories Supplier evaluations must include those performance categories that are relevant to the sourcing decision under consideration. Examples of supplier evaluation categories that a team or individual may evaluate include (but are not limited to): - Management and personnel capability - Information systems capability - Process and technological capability - Delivery performance - Flexibility - Previous history and performance - Responsiveness to customer needs - Total Cost competitiveness - Quality performance - Environmental compliance - Longer-term partnership potential - Volume capacity - Supplier's supply management efforts - Information system capability While including the relevant performance categories is critical, each additional category adds a greater degree of assessment complexity. Step Two: Weight Each Relevant Evaluation Category The performance categories included within the analysis receive a weight proportional to the relative importance of that category. With any combination of weights, the weights must sum to 100%. Step Three: Identify and Weight Subcategories Step 2 defines the broad performance categories included within the evaluation. This step requires the user to identify performance subcategories, if they exist, within each broader performance category. Each subcategory receives a weight, the total of which equals the weight of the broader performance category. For example, assume that supplier quality performance is 20% of the total score. Within that category, a team may create subcategories related to process control systems (5\%), total quality commitment (8\%), and parts per million defect performance (7\%). Please note that the subcategories sum to 20%. Step Four: Define Scoring System for Categories and Subcategories This step involves defining what each score means within a performance category. A clearly defined scoring system takes criteria that may be subjective and develops a quantified scale for measurement. The scoring metrics are reliable if different individuals interpret and score similarly the same performance categories under review. Step Five: Review Evaluation Results and Make Selection Decision The primary output from this step is a recommendation concerning which supplier(s) should receive a purchase contract. As with any tool, the outcome from this analysis is only as good as the planning and effort put forth. This case is fictional and is for educational purposes only. Appendix 4: Sourcing Risk Management Plan Please complete this exercise after the group has made its selection decision. For the selected supplier(s), identify any concerns by Potential Concern Area and make note of your plan to reduce the potential risk. Sourcing Risk Management Plan Supplier: This case is fictional and is for educational purposes only. \begin{tabular}{|l|l|l|} \hline PotentialConcernArea & Risk or Concern & Risk Reduction Plan \\ \hline & & \\ \hline Financial Issues & & \\ \hline Other Commercial Issues & & \\ \hline \end{tabular}

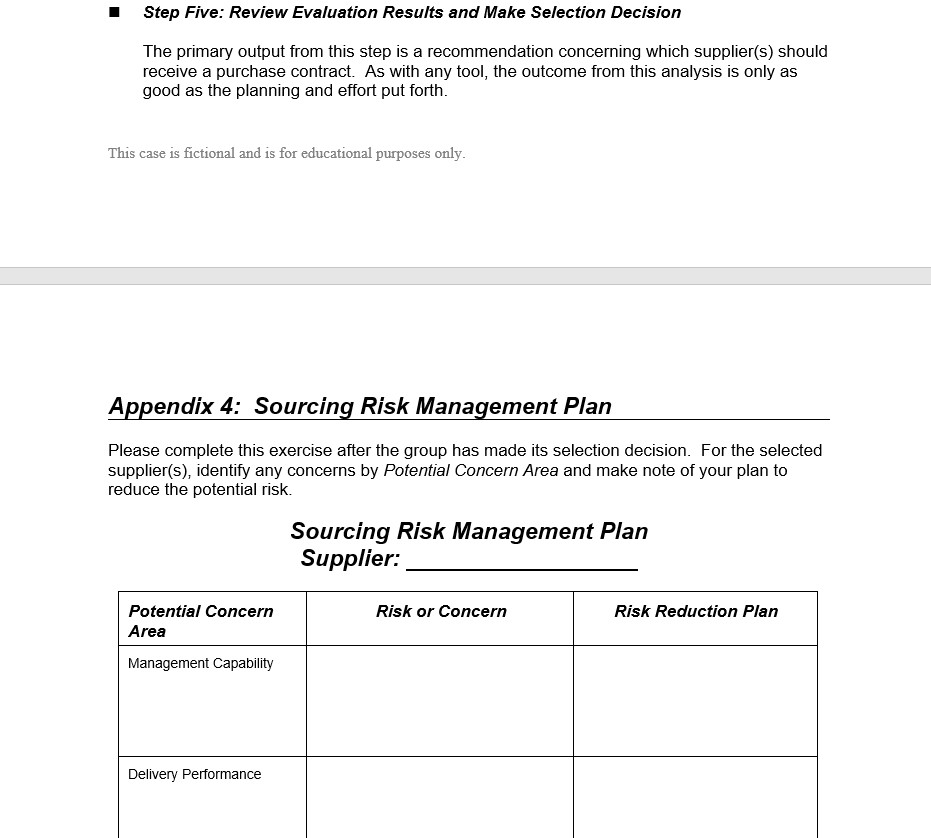

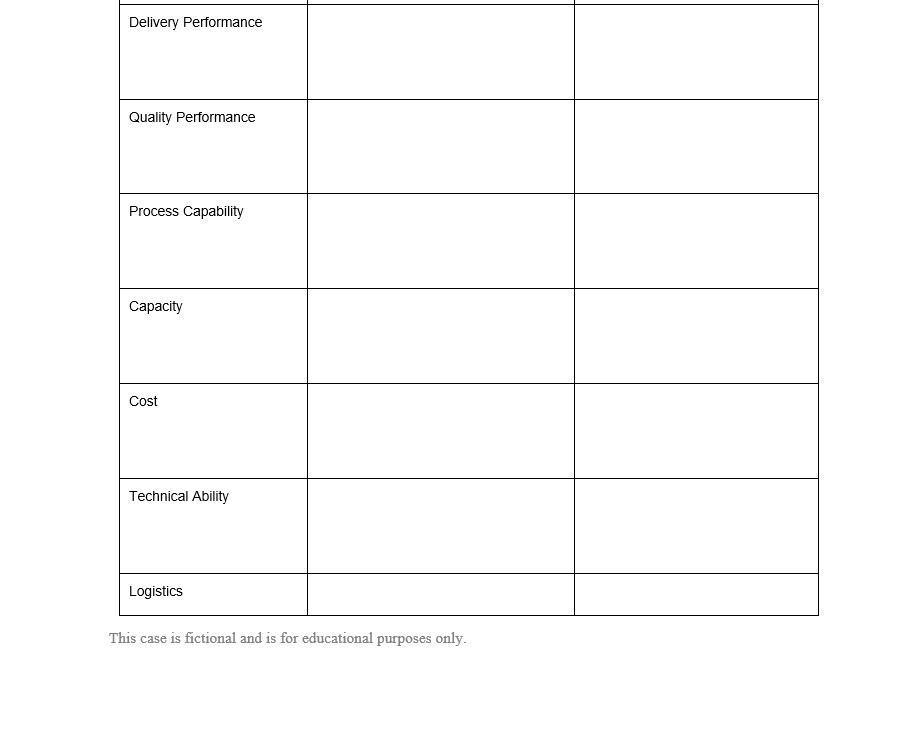

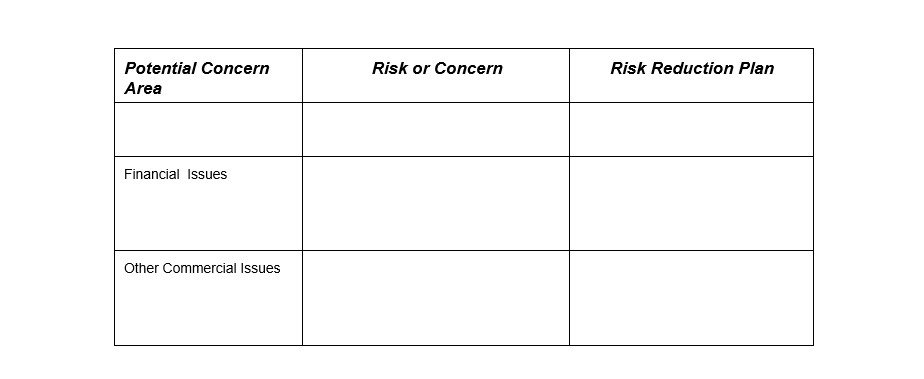

Step by Step Solution

There are 3 Steps involved in it

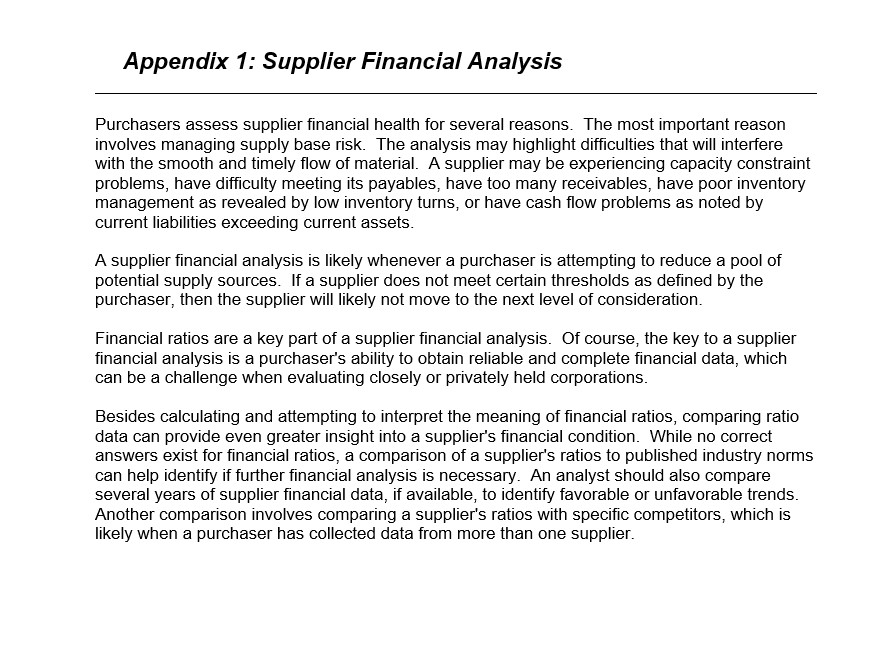

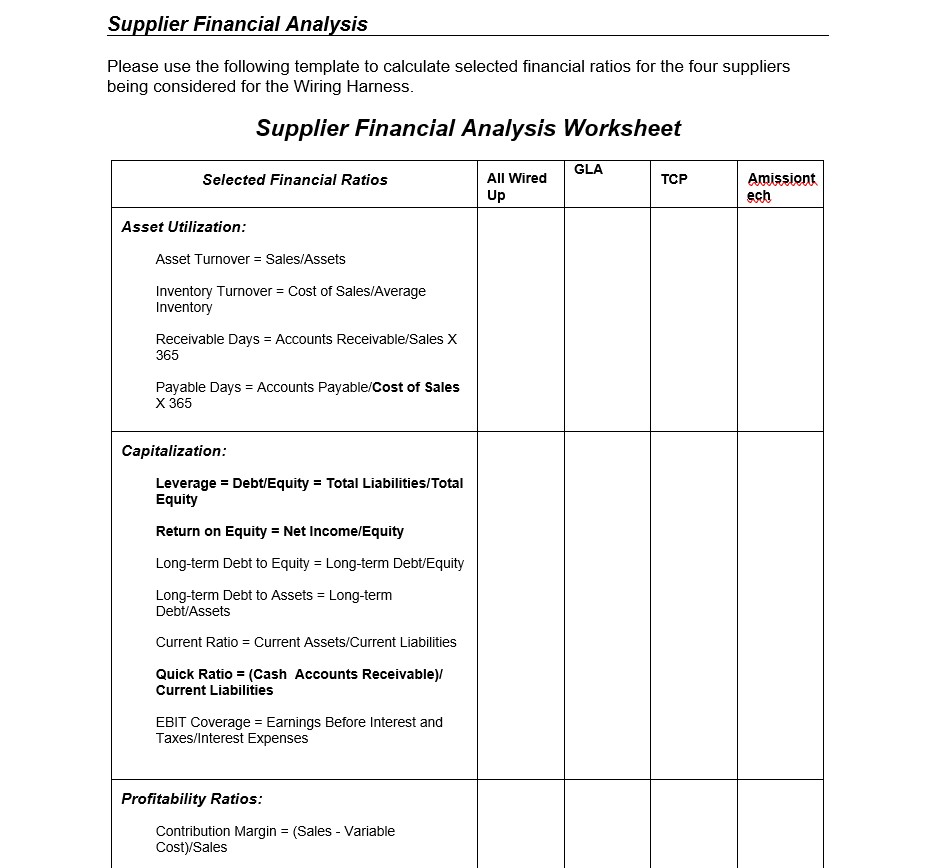

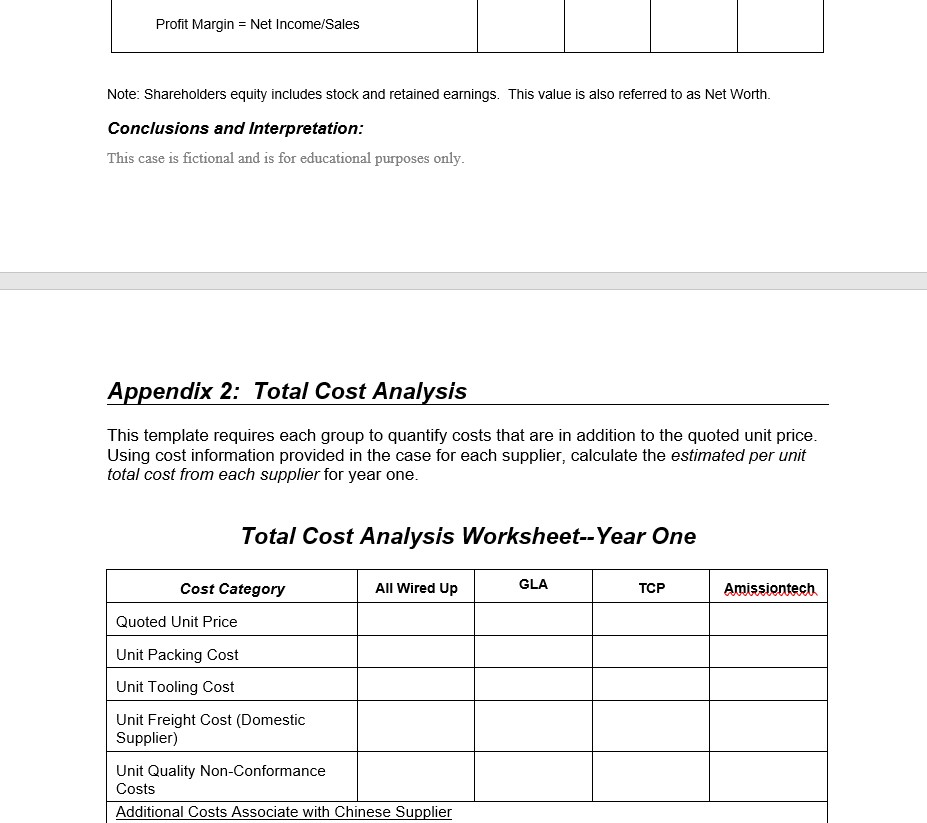

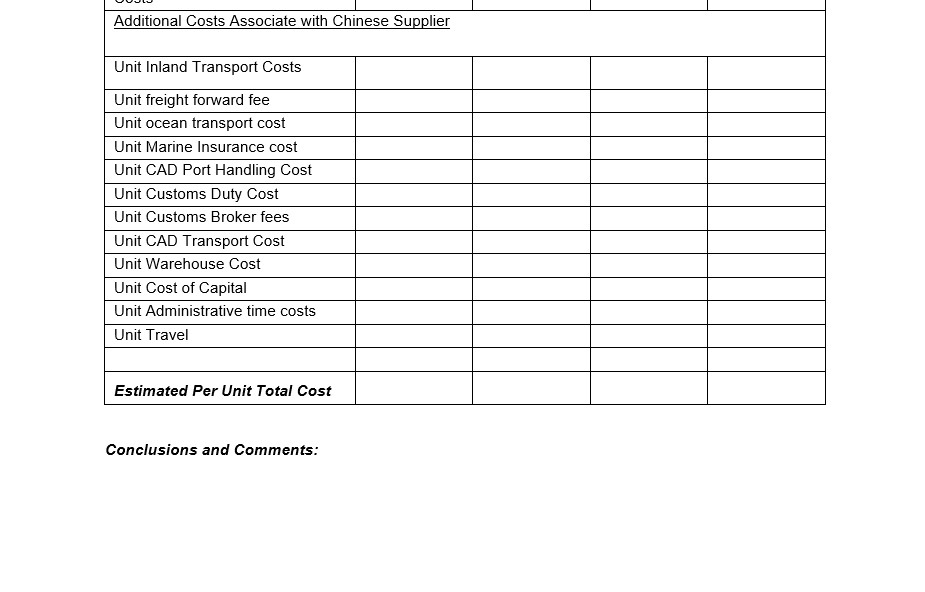

Get step-by-step solutions from verified subject matter experts