Question: please analyze and answer the question below, thanks Overview You are the controller of a public Fortune 5 0 0 airline, TransGlobal Airlines. The airline

please analyze and answer the question below, thanks

Overview

You are the controller of a public Fortune airline, TransGlobal Airlines. The airline utilizes a fleet of corporate jets for private charter by Fortune clients at several major airports. Your company is looking to acquire smaller aviation firms as part of an overall growth strategy.

In addition to creating an acquisition proposal, the CFO has asked you to create a report recommending a few performanceimprovement strategies so that the company will meet your overall sustainability goals.

Prompt

Create a report to recommend performanceimprovement strategies that will help TransGlobal Airlines be more sustainable. Specifically, you must address the following criteria:

Use the TransGlobal Airlines Information document to identify a strategic goal for the company's sustainability practices.

Based on your understanding and research about sustainability objectives and practices, where do you envision the company will be in years with respect to its sustainability measures?

In addition to creating an acquisition proposal, the CFO has asked you to create a report recommending a few performanceimprovement strategies so that the company will meet your overall sustainability goals.

Prompt

Create a report to recommend performanceimprovement strategies that will help TransGlobal Airlines be more sustainable. Specifically, you must address the following criteria:

Use the TransGlobal Airlines Information document to identify a strategic goal for the company's sustainability practices.

Based on your understanding and research about sustainability objectives and practices, where do you envision the company will be in years with respect to its sustainability measures?

Identify a KPI and corresponding target measures for the sustainability goal identified.

Recommend at least two performance improvement strategies that will help achieve the sustainability objectives of the company. Support your recommendations with a clear causeandeffect rationale.

MBA TransGlobal Airlines Information

Location, Size, and Age of the Firm

Name: TransGlobal Airlines

Home Country: USA

HQ Location: Miami, FL

Size: employees

Age: began operations in

Customer Segment and Target Market

Class: global airliner with dominant US presence

Market: global

Destinations: destinations serving countries across six continents

Market segment: first class, luxury, business class, and economy

Global market share: ranked nd American is number one at

US market share: ranked nd Southwest first at

Retention: return customers

New customer growth: annually prior to COVID

Passenger kilometers: billion American is number one at billion

Major Competitors

All international and domestic US airlines

Company Leadership

Publicly held with a board, president, VP admin, CEO, CFO, COO, VP sales, division VPs subsidiaries

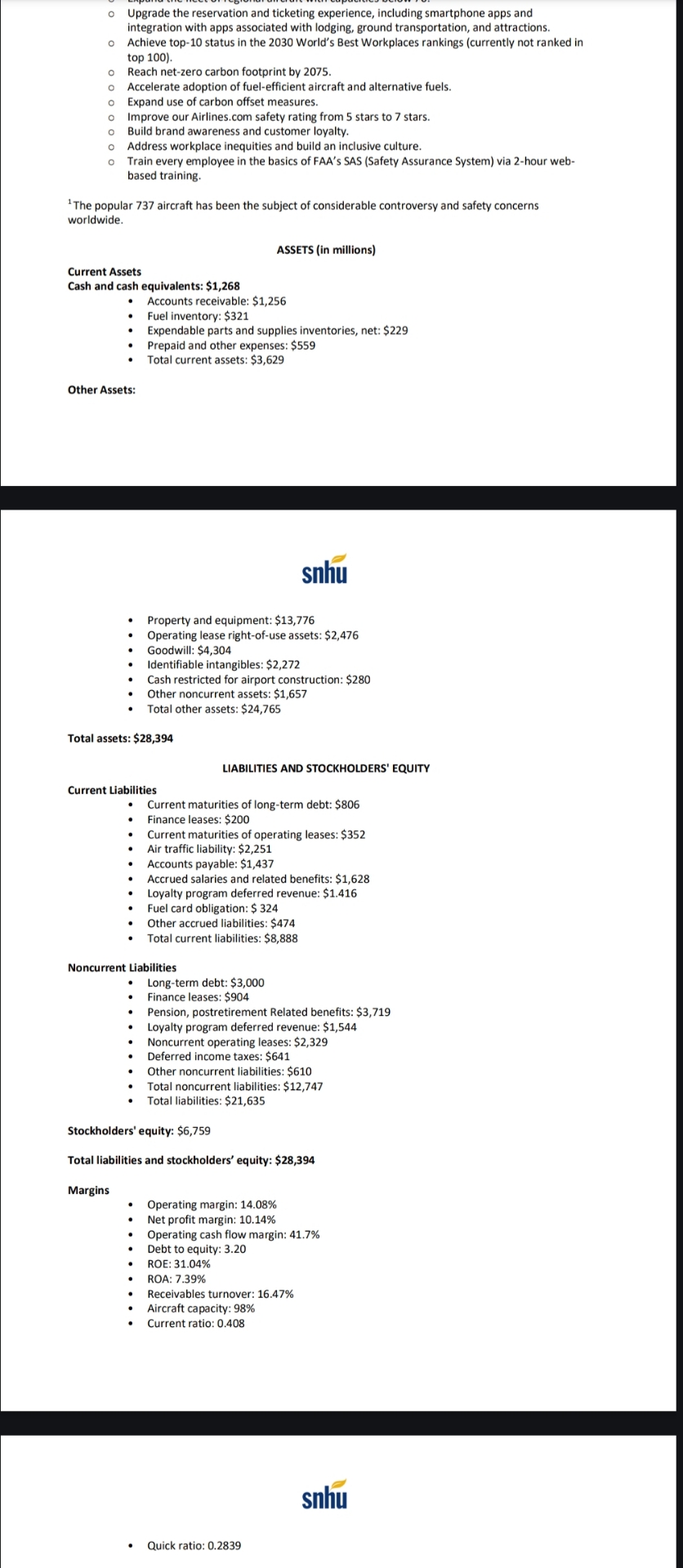

Current Financials

Annual gross revenues: $ billion

Annual net income: $ billion

Adjusted earnings per share of $ a increase yearoveryear

Delivery of new aircraft during the year

Number of aircraft in fleet, end of period:

Average age of aircraft: years

Domestic revenue grew in the last quarter on higher passenger unit revenue PRASM and higher capacity. Domestic premium product revenue grew and corporate revenue grew driven by strength in business and leisure demand through the holiday period. Revenue and margin improved in all domestic hubs, with revenue up in coastal hubs and in core hubs.

Atlantic revenue grew in the last quarter on higher capacity and a decline in PRASM, driven almost entirely by foreign exchange rates.

Latin revenue grew on a increase in unit revenue and higher capacity. This revenue improvement was driven by continued doubledigit unit revenue growth in Brazil and Mexico.

Pacific revenue was down vs the prior year on a decline in unit revenue primarily due to continued softness in China. This was a point improvement vs the September quarter on improved trends in Japan.

Strategic Plans and Goals

The board of direct

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock