Question: Please and thank you! Homework: Chapter 14 Homework Save Score: 0 of 3 pts 6 of 6 (3 complete) HW Score: 18.18%, 2 of 11

Please and thank you!

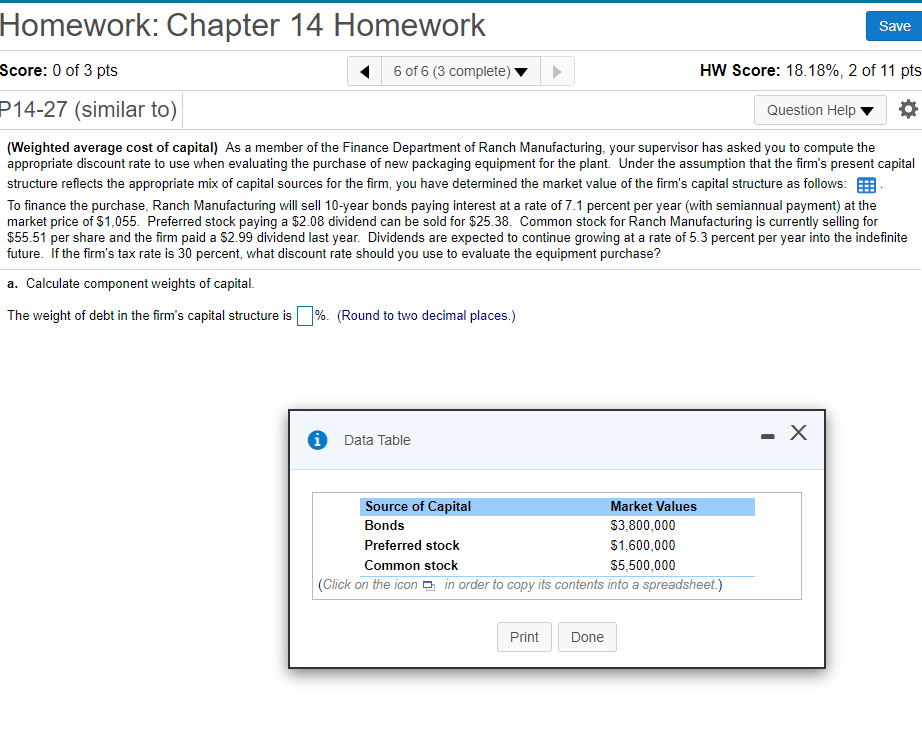

Homework: Chapter 14 Homework Save Score: 0 of 3 pts 6 of 6 (3 complete) HW Score: 18.18%, 2 of 11 pts P14-27 (similar to) Question Help 0 (Weighted average cost of capital) As a member of the Finance Department of Ranch Manufacturing, your supervisor has asked you to compute the appropriate discount rate to use when evaluating the purchase of new packaging equipment for the plant. Under the assumption that the firm's present capital structure reflects the appropriate mix of capital sources for the firm, you have determined the market value of the firm's capital structure as follows: 5 To finance the purchase, Ranch Manufacturing will sell 10-year bonds paying interest at a rate of 7.1 percent per year (with semiannual payment) at the market price of $1,055. Preferred stock paying a $2.08 dividend can be sold for $25.38. Common stock for Ranch Manufacturing is currently selling for $55.51 per share and the firm paid a $2.99 dividend last year. Dividends are expected to continue growing at a rate of 5.3 percent per year into the indefinite future. If the firm's tax rate is 30 percent, what discount rate should you use to evaluate the equipment purchase? a. Calculate component weights of capital. The weight of debt in the firm's capital structure is %. (Round to two decimal places.) Data Table -X Source of Capital Market Values Bonds $3,800,000 Preferred stock $1,600,000 Common stock $5,500,000 (Click on the icon 2. in order to copy its contents into a spreadsheet.) Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts