Question: PLease and thank you! Your answer is partially correct. Try again. Burger Botanicals produces a wide range of herbal supplements sold nationwide through independent distributors.

PLease and thank you!

PLease and thank you!

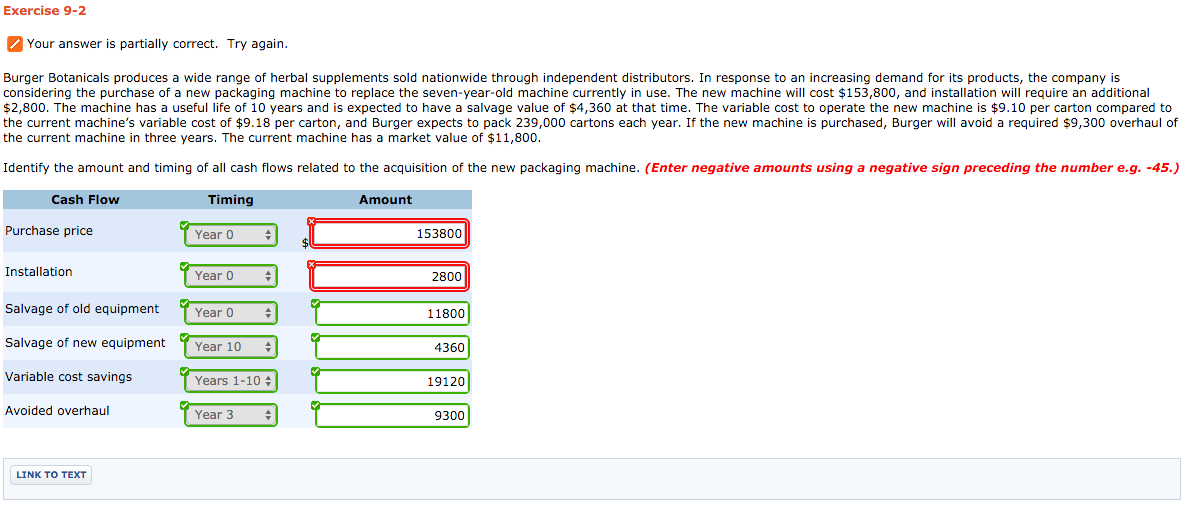

Your answer is partially correct. Try again. Burger Botanicals produces a wide range of herbal supplements sold nationwide through independent distributors. In response to an increasing demand for its products, the company is considering the purchase of a new packaging machine to replace the seven-year-old machine currently in use. The new machine will cost $153,800, and installation will require an additional $2,800. The machine has a useful life of 10 years and is expected to have a salvage value of $4,360 at that time. The variable cost to operate the new machine is $9.10 per carton compared to the current machine's variable cost of $9.18 per carton, and Burger expects to pack 239,000 cartons each year. If the new machine is purchased, Burger will avoid a required $9,300 overhaul of the current machine in three years. The current machine has a market value of $11,800. Identify the amount and timing of all cash flows related to the acquisition of the new packaging machine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts