Question: please ans a,b,c Problem 11-21 Question Help Suppose General Motors stock has an expected return of 15% and a volatility of 39%, and Molson-Coors Brewing

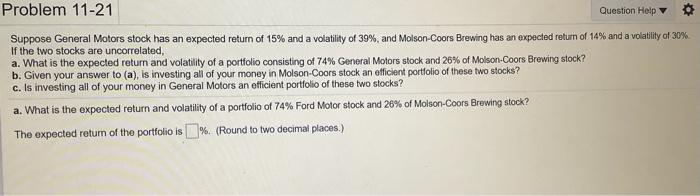

Problem 11-21 Question Help Suppose General Motors stock has an expected return of 15% and a volatility of 39%, and Molson-Coors Brewing has an expected return of 14% and a volatility of 30% If the two stocks are uncorrelated, a. What is the expected return and volatility of a portfolio consisting of 74% General Motors stock and 26% of Molson-Coors Brewing stock? b. Given your answer to (a), is investing all of your money in Molson-Coors stock an efficient portfolio of these two stocks? c. Is investing all of your money in General Motors an officient portfolio of these two stocks? a. What is the expected return and volatility of a portfolio of 74% Ford Motor stock and 26% of Molson-Coors Brewing stock? The expected return of the portfolio is % (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts