Question: please ans only question C n D ABC Bank is the writer of a call option with a premium of USD 10 and ACE Corporate

please ans only question C n D

please ans only question C n D

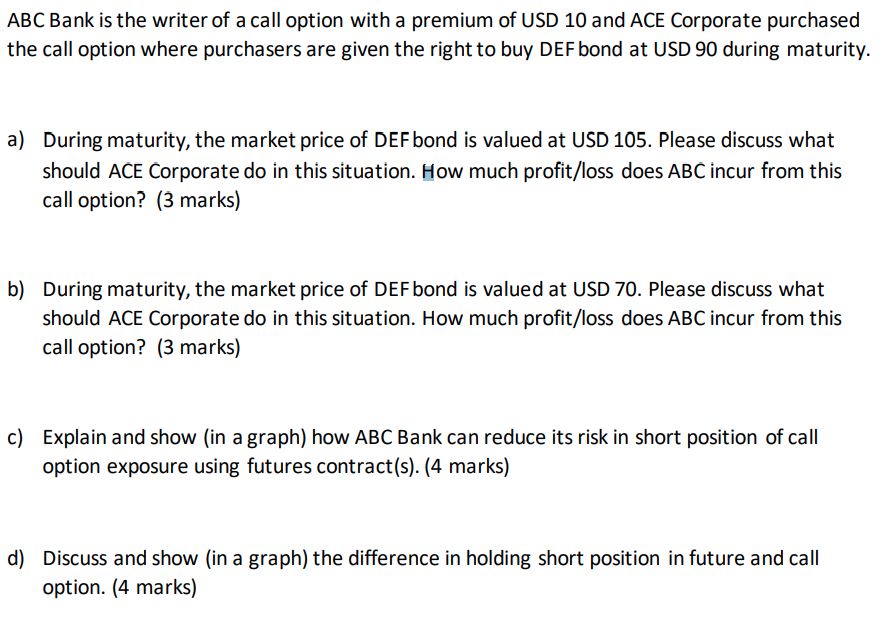

ABC Bank is the writer of a call option with a premium of USD 10 and ACE Corporate purchased the call option where purchasers are given the right to buy DEF bond at USD 90 during maturity. a) During maturity, the market price of DEF bond is valued at USD 105. Please discuss what should AE orporate do in this situation. How much profit/loss does ABC incur from this call option? (3 marks) b) During maturity, the market price of DEF bond is valued at USD 70. Please discuss what should ACE Corporate do in this situation. How much profit/loss does ABC incur from this call option? (3 marks) c) Explain and show (in a graph) how ABC Bank can reduce its risk in short position of call option exposure using futures contract(s). (4 marks) d) Discuss and show in a graph) the difference in holding short position in future and call option. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts