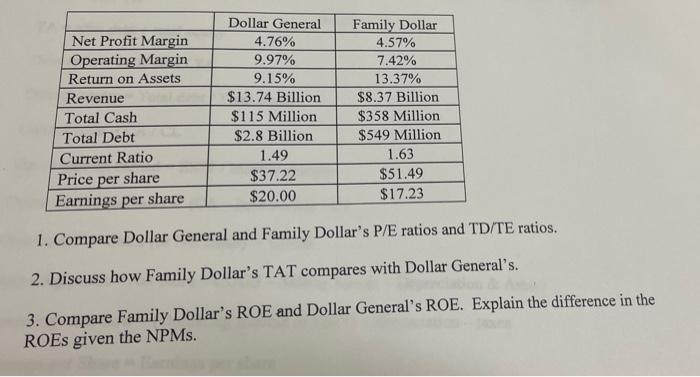

Question: Please answer 1, 2, & 3 Net Profit Margin Operating Margin Return on Assets Revenue Total Cash Total Debt Current Ratio Price per share Earnings

Net Profit Margin Operating Margin Return on Assets Revenue Total Cash Total Debt Current Ratio Price per share Earnings per share Dollar General 4.76% 9.97% 9.15% $13.74 Billion $115 Million $2.8 Billion 1.49 $37.22 $20.00 Family Dollar 4.57% 7.42% 13.37% $8.37 Billion $358 Million $549 Million 1.63 $51.49 $17.23 1. Compare Dollar General and Family Dollar's P/E ratios and TD/TE ratios. 2. Discuss how Family Dollar's TAT compares with Dollar General's. 3. Compare Family Dollar's ROE and Dollar General's ROE. Explain the difference in the ROEs given the NPMs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts