Question: Please answer 1 and 2. For 6 please show work I am having troubling calculating D E F F B C Income Statement 1 2

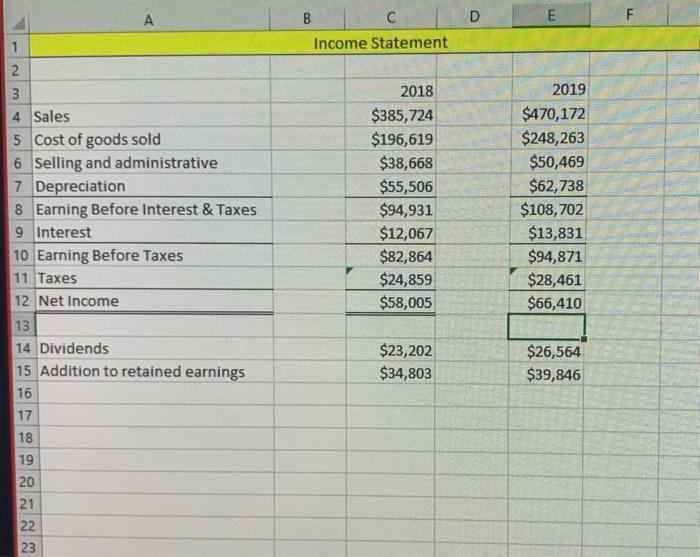

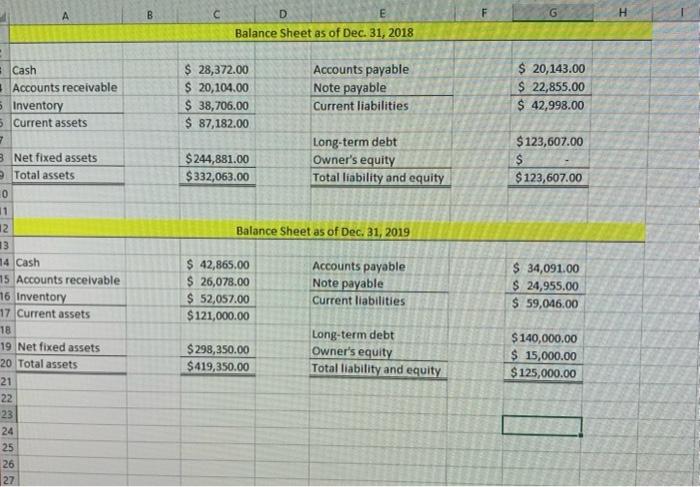

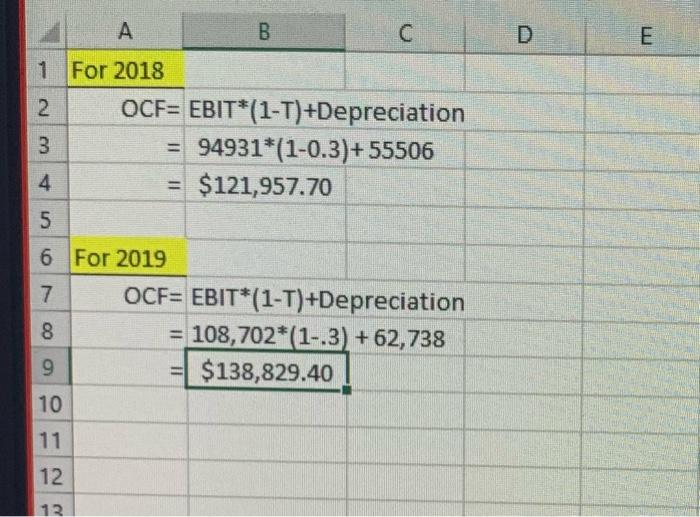

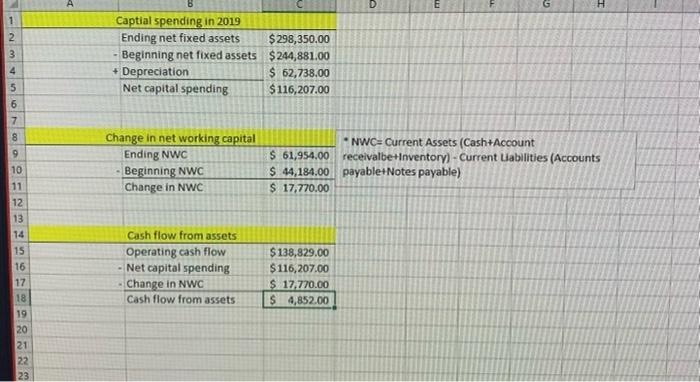

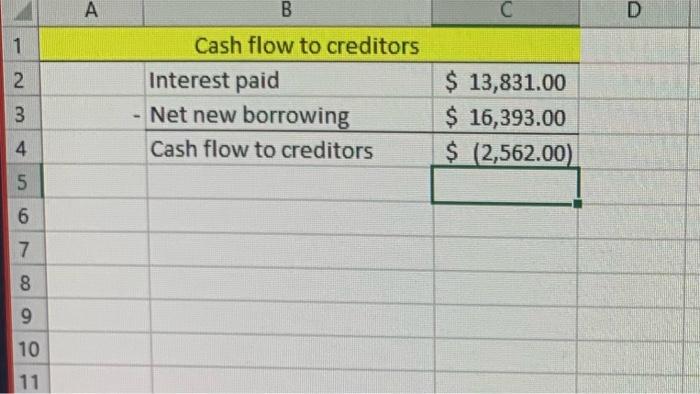

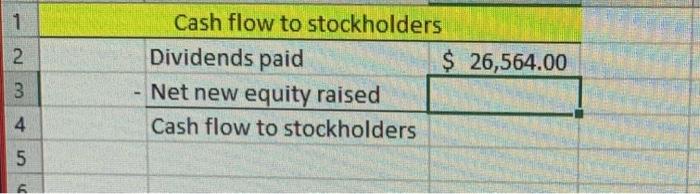

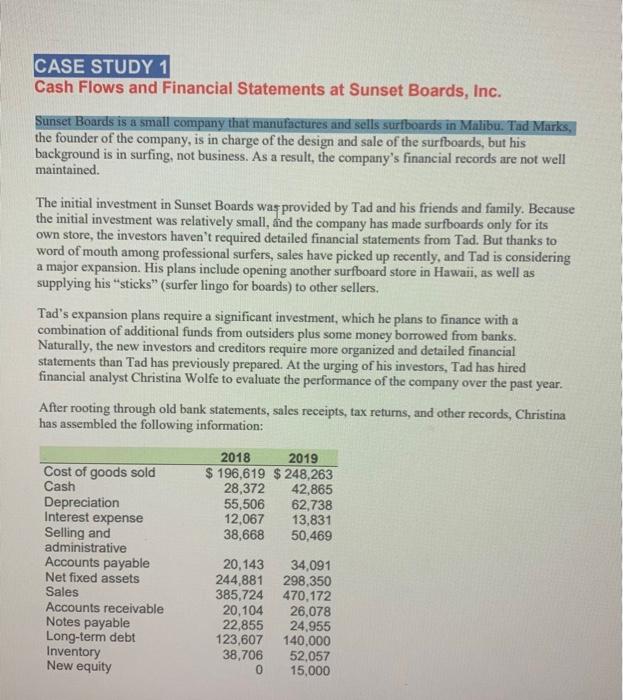

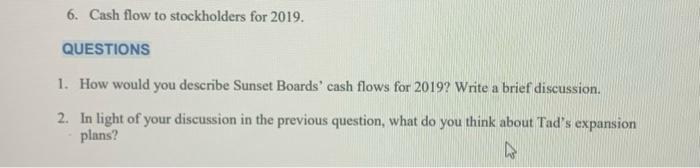

D E F F B C Income Statement 1 2 3 4 Sales 5 Cost of goods sold 6 Selling and administrative 7 Depreciation 8 Earning Before Interest & Taxes 9 Interest 10 Earning Before Taxes 11 Taxes 12 Net Income 13 14 Dividends 15 Addition to retained earnings 16 17 18 19 2018 $385,724 $196,619 $38,668 $55,506 $94,931 $12,067 $82,864 $24,859 $58,005 2019 $470,172 $248,263 $50,469 $62,738 $108,702 $13,831 $94,871 $28,461 $66,410 $23,202 $34,803 $26,564 $39,846 20 21 22 23 B C D Balance Sheet as of Dec. 31, 2018 $ 28,372.00 $ 20,104.00 $ 38,706.00 $ 87,182.00 Accounts payable Note payable Current liabilities $ 20,143.00 $ 22,855.00 $ 42,998.00 $ 244,881.00 $332,063.00 Long-term debt Owner's equity Total liability and equity $ 123,607.00 $ $ 123,607.00 Balance Sheet as of Dec. 31, 2019 Cash Accounts receivable 5 Inventory 5 Current assets 7 3 Net fixed assets Total assets 0 11 12 33 14 Cash 15 Accounts receivable 16 Inventory 17 Current assets 18 19 Net fixed assets 20 Total assets 21 22 23 24 25 26 27 $ 42,865.00 $ 26,078.00 $ 52,057.00 $121,000.00 Accounts payable Note payable Current liabilities $ 34,091.00 $ 24,955.00 $ 59,046.00 $ 298,350.00 $ 419,350.00 Long-term debt Owner's equity Total liability and equity $ 140,000.00 $ 15,000.00 $125,000.00 A B C D E = 1 For 2018 2 OCF= EBIT*(1-T) +Depreciation 3 94931*(1-0.3)+55506 4 = $121,957.70 5 6 For 2019 7 OCF= EBIT*(1-T)+Depreciation 8 = 108,702*(1-.3) + 62,738 9 $138,829.40 10 11 12 12. G 1 2 3 4 5 6 7 8 Captial spending in 2019 Ending net fixed assets $ 298,350.00 Beginning net fixed assets $244,881.00 +Depreciation $ 62,738.00 Net capital spending $116, 207.00 9 Change in net working capital Ending NWC Beginning NWC Change in NWC NWC- Current Assets (Cash+Account $ 61,954.00 receivalbe+Inventory) - Current Liabilities (Accounts $ 44,184.00 payable Notes payable) $ 17,770.00 10 11 12 13 14 15 16 17 18 19 20 21 22 23 Cash flow from assets Operating cash flow - Net capital spending Change in NWC Cash flow from assets $ 138,829.00 $116,207.00 $ 17,770.00 $ 4,852.00 A C D 1 2 B Cash flow to creditors Interest paid - Net new borrowing Cash flow to creditors 3 $ 13,831.00 $ 16,393.00 $ (2,562.00) 4 5 6 7 8 8 9 10 11 1 N Cash flow to stockholders Dividends paid $ 26,564.00 Net new equity raised Cash flow to stockholders 3 4 5 CASE STUDY 1 Cash Flows and Financial Statements at Sunset Boards, Inc. Sunset Boards is a small company that manufactures and sells surfboards in Malibu. Tad Marks, the founder of the company, is in charge of the design and sale of the surfboards, but his background is in surfing, not business. As a result, the company's financial records are not well maintained. The initial investment in Sunset Boards was provided by Tad and his friends and family. Because the initial investment was relatively small, and the company has made surfboards only for its own store, the investors haven't required detailed financial statements from Tad. But thanks to word of mouth among professional surfers, sales have picked up recently, and Tad is considering a major expansion. His plans include opening another surfboard store in Hawaii, as well as supplying his "sticks" (surfer lingo for boards) to other sellers, Tad's expansion plans require a significant investment, which he plans to finance with a combination of additional funds from outsiders plus some money borrowed from banks. Naturally, the new investors and creditors require more organized and detailed financial statements than Tad has previously prepared. At the urging of his investors, Tad has hired financial analyst Christina Wolfe to evaluate the performance of the company over the past year. After rooting through old bank statements, sales receipts, tax returns, and other records, Christina has assembled the following information: 2018 2019 $ 196,619 $ 248,263 28,372 42,865 55,506 62,738 12,067 13,831 38,668 50,469 Cost of goods sold Cash Depreciation Interest expense Selling and administrative Accounts payable Net fixed assets Sales Accounts receivable Notes payable Long-term debt Inventory New equity 20,143 244,881 385,724 20,104 22,855 123,607 38,706 0 34,091 298,350 470.172 26,078 24,955 140,000 52,057 15,000 6. Cash flow to stockholders for 2019. QUESTIONS 1. How would you describe Sunset Boards' cash flows for 2019? Write a brief discussion. 2. In light of your discussion in the previous question, what do you think about Tad's expansion plans? D E F F B C Income Statement 1 2 3 4 Sales 5 Cost of goods sold 6 Selling and administrative 7 Depreciation 8 Earning Before Interest & Taxes 9 Interest 10 Earning Before Taxes 11 Taxes 12 Net Income 13 14 Dividends 15 Addition to retained earnings 16 17 18 19 2018 $385,724 $196,619 $38,668 $55,506 $94,931 $12,067 $82,864 $24,859 $58,005 2019 $470,172 $248,263 $50,469 $62,738 $108,702 $13,831 $94,871 $28,461 $66,410 $23,202 $34,803 $26,564 $39,846 20 21 22 23 B C D Balance Sheet as of Dec. 31, 2018 $ 28,372.00 $ 20,104.00 $ 38,706.00 $ 87,182.00 Accounts payable Note payable Current liabilities $ 20,143.00 $ 22,855.00 $ 42,998.00 $ 244,881.00 $332,063.00 Long-term debt Owner's equity Total liability and equity $ 123,607.00 $ $ 123,607.00 Balance Sheet as of Dec. 31, 2019 Cash Accounts receivable 5 Inventory 5 Current assets 7 3 Net fixed assets Total assets 0 11 12 33 14 Cash 15 Accounts receivable 16 Inventory 17 Current assets 18 19 Net fixed assets 20 Total assets 21 22 23 24 25 26 27 $ 42,865.00 $ 26,078.00 $ 52,057.00 $121,000.00 Accounts payable Note payable Current liabilities $ 34,091.00 $ 24,955.00 $ 59,046.00 $ 298,350.00 $ 419,350.00 Long-term debt Owner's equity Total liability and equity $ 140,000.00 $ 15,000.00 $125,000.00 A B C D E = 1 For 2018 2 OCF= EBIT*(1-T) +Depreciation 3 94931*(1-0.3)+55506 4 = $121,957.70 5 6 For 2019 7 OCF= EBIT*(1-T)+Depreciation 8 = 108,702*(1-.3) + 62,738 9 $138,829.40 10 11 12 12. G 1 2 3 4 5 6 7 8 Captial spending in 2019 Ending net fixed assets $ 298,350.00 Beginning net fixed assets $244,881.00 +Depreciation $ 62,738.00 Net capital spending $116, 207.00 9 Change in net working capital Ending NWC Beginning NWC Change in NWC NWC- Current Assets (Cash+Account $ 61,954.00 receivalbe+Inventory) - Current Liabilities (Accounts $ 44,184.00 payable Notes payable) $ 17,770.00 10 11 12 13 14 15 16 17 18 19 20 21 22 23 Cash flow from assets Operating cash flow - Net capital spending Change in NWC Cash flow from assets $ 138,829.00 $116,207.00 $ 17,770.00 $ 4,852.00 A C D 1 2 B Cash flow to creditors Interest paid - Net new borrowing Cash flow to creditors 3 $ 13,831.00 $ 16,393.00 $ (2,562.00) 4 5 6 7 8 8 9 10 11 1 N Cash flow to stockholders Dividends paid $ 26,564.00 Net new equity raised Cash flow to stockholders 3 4 5 CASE STUDY 1 Cash Flows and Financial Statements at Sunset Boards, Inc. Sunset Boards is a small company that manufactures and sells surfboards in Malibu. Tad Marks, the founder of the company, is in charge of the design and sale of the surfboards, but his background is in surfing, not business. As a result, the company's financial records are not well maintained. The initial investment in Sunset Boards was provided by Tad and his friends and family. Because the initial investment was relatively small, and the company has made surfboards only for its own store, the investors haven't required detailed financial statements from Tad. But thanks to word of mouth among professional surfers, sales have picked up recently, and Tad is considering a major expansion. His plans include opening another surfboard store in Hawaii, as well as supplying his "sticks" (surfer lingo for boards) to other sellers, Tad's expansion plans require a significant investment, which he plans to finance with a combination of additional funds from outsiders plus some money borrowed from banks. Naturally, the new investors and creditors require more organized and detailed financial statements than Tad has previously prepared. At the urging of his investors, Tad has hired financial analyst Christina Wolfe to evaluate the performance of the company over the past year. After rooting through old bank statements, sales receipts, tax returns, and other records, Christina has assembled the following information: 2018 2019 $ 196,619 $ 248,263 28,372 42,865 55,506 62,738 12,067 13,831 38,668 50,469 Cost of goods sold Cash Depreciation Interest expense Selling and administrative Accounts payable Net fixed assets Sales Accounts receivable Notes payable Long-term debt Inventory New equity 20,143 244,881 385,724 20,104 22,855 123,607 38,706 0 34,091 298,350 470.172 26,078 24,955 140,000 52,057 15,000 6. Cash flow to stockholders for 2019. QUESTIONS 1. How would you describe Sunset Boards' cash flows for 2019? Write a brief discussion. 2. In light of your discussion in the previous question, what do you think about Tad's expansion plans

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts