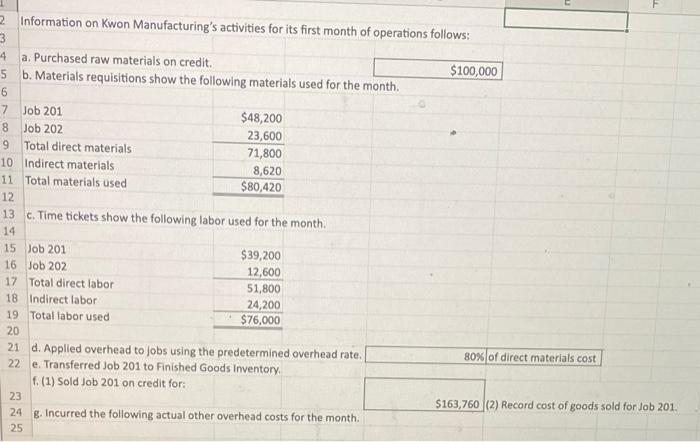

Question: please answer 1 and 2 in excel form 2 Information on Kwon Manufacturing's activities for its first month of operations follows: 3 4 a. Purchased

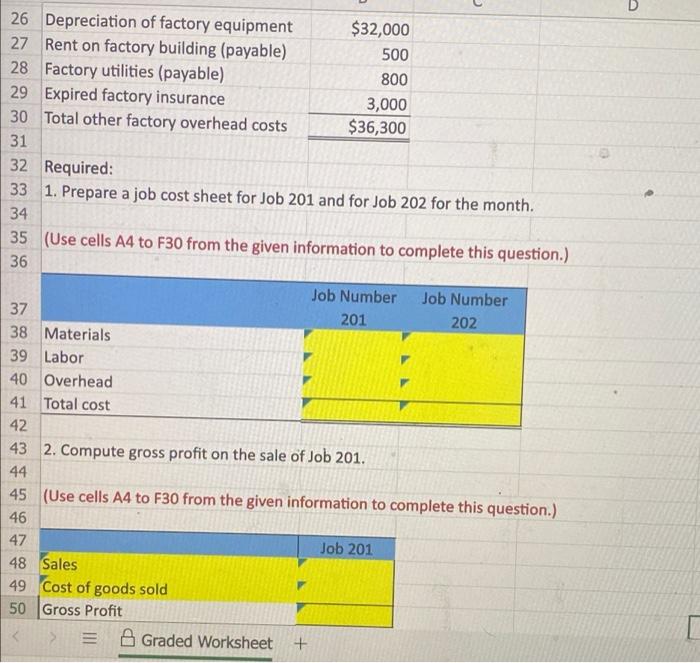

2 Information on Kwon Manufacturing's activities for its first month of operations follows: 3 4 a. Purchased raw materials on credit. $100,000 5 b. Materials requisitions show the following materials used for the month. 6 Job 201 $48,200 Job 202 23,600 9 Total direct materials 71,800 10 Indirect materials 8,620 11 Total materials used $80,420 12 13 c. Time tickets show the following labor used for the month. 14 15 Job 201 $39,200 16 Job 202 12,600 17 Total direct labor 51,800 18 Indirect labor 24,200 19 Total labor used. $76,000 20 21 d. Applied overhead to jobs using the predetermined overhead rate. 22 e. Transferred Job 201 to Finished Goods Inventory. f. (1) Sold Job 201 on credit for: 23 24 g. Incurred the following actual other overhead costs for the month. 25 7 8 80% of direct materials cost $163,760 (2) Record cost of goods sold for Job 201. $32,000 26 Depreciation of factory equipment 27 Rent on factory building (payable) 28 Factory utilities (payable) 500 800 29 Expired factory insurance 3,000 30 Total other factory overhead costs $36,300 31 32 Required: 33 1. Prepare a job cost sheet for Job 201 and for Job 202 for the month. 34 35 (Use cells A4 to F30 from the given information to complete this question.) 36 Job Number Job Number 201 202 37 38 Materials 39 Labor 40 Overhead 41 Total cost 42 43 2. Compute gross profit on the sale of Job 201. 44 45 (Use cells A4 to F30 from the given information to complete this question.) 46 47 Job 201 48 Sales 49 Cost of goods sold 50 Gross Profit Graded Worksheet +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts