Question: please answer 1 and 2. Show the work to solve as well. 1. Based on the CAPM, what return should Jordan expect from a security

please answer 1 and 2. Show the work to solve as well.

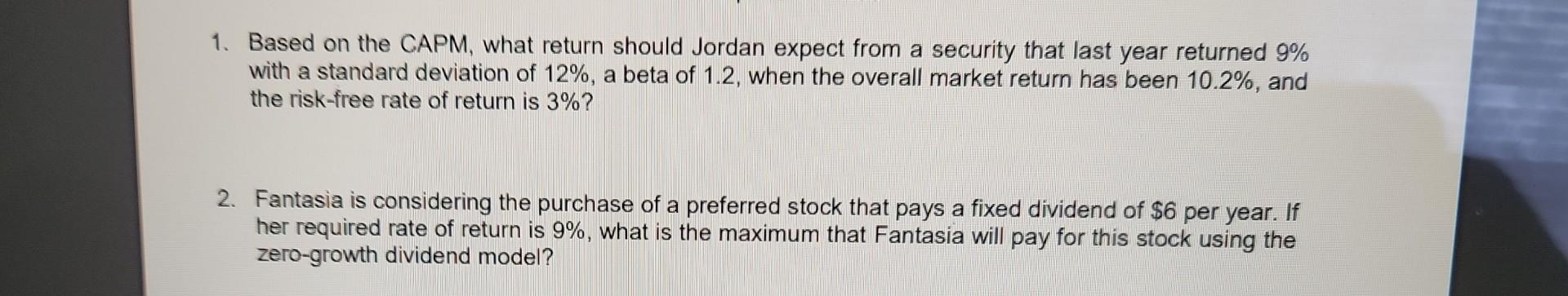

1. Based on the CAPM, what return should Jordan expect from a security that last year returned 9% with a standard deviation of 12%, a beta of 1.2 , when the overall market return has been 10.2%, and the risk-free rate of return is 3% ? 2. Fantasia is considering the purchase of a preferred stock that pays a fixed dividend of $6 per year. If her required rate of return is 9%, what is the maximum that Fantasia will pay for this stock using the zero-growth dividend model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts