Question: Please answer! 1. Using the example balance sheet and income statement to calculate Teddy Feb Inc. a. Current Ratio b. Cash ratio c. Dept to

Please answer!

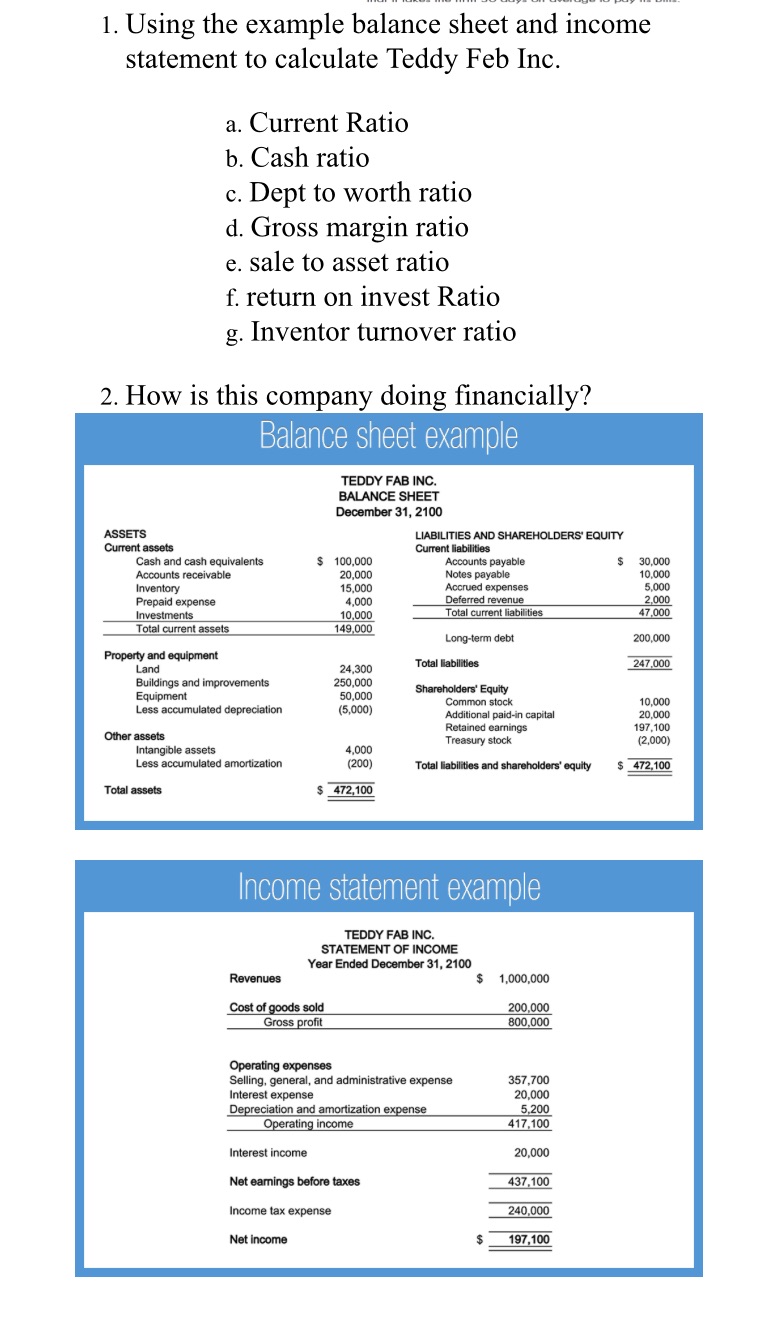

1. Using the example balance sheet and income statement to calculate Teddy Feb Inc. a. Current Ratio b. Cash ratio c. Dept to worth ratio d. Gross margin ratio e. sale to asset ratio f. return on invest Ratio g. Inventor turnover ratio 2. How is this company doing financially? Balance sheet example TEDDY FAB INC. BALANCE SHEET December 31, 2100 ASSETS LIABILITIES AND SHAREHOLDERS' EQUITY Current assets Current liabilities Cash and cash equivalents $ 100,000 Accounts payable $ 30,000 Accounts receivable 20,000 Notes payable 10,000 Inventory 15,000 Accrued expenses 5.000 Prepaid expense 4,000 Deferred revenue 2,000 Investments 10,000 Total current liabilities 47,000 Total current assets 149,000 Long-term debt 200,000 Property and equipment Land 24,300 Total liabilities 247,000 Buildings and improvements 250,000 Shareholders' Equity Equipment 50,000 Common stock 10,000 Less accumulated depreciation (5,000) Additional paid-in capital 20,000 Retained earnings 197,100 Other assets Treasury stock (2,000 Intangible assets 4,000 Less accumulated amortization (200) Total liabilities and shareholders' equity $ 472,100 Total assets $ 472,100 Income statement example TEDDY FAB INC. STATEMENT OF INCOME Year Ended December 31, 2100 Revenues $ 1,000,000 Cost of goods sold 200,000 Gross profit 800,000 Operating expenses Selling, general, and administrative expense 357,700 Interest expense 20,000 Depreciation and amortization expense 5,200 Operating income 417,100 Interest income 20,000 Net earnings before taxes 437,100 me tax ex 240,000 Net income 197,100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts