Question: Please answer 10, 11, 13 10. Using Fedenal Tax Rate Schedules. Using the tax rate schedule in [ Exhibit 46, determine the amount of taxes

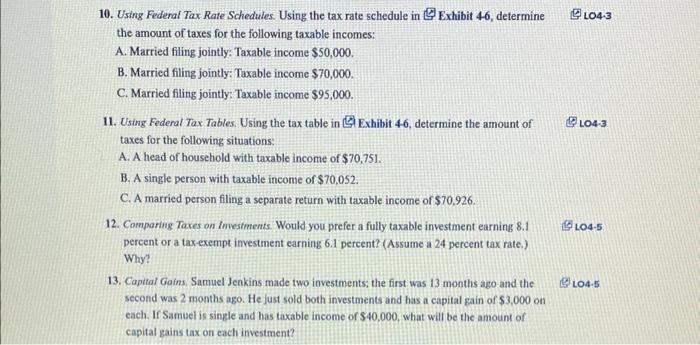

10. Using Fedenal Tax Rate Schedules. Using the tax rate schedule in [ Exhibit 46, determine the amount of taxes for the following taxable incomes: A. Married filing jointly: Taxable income $50,000. B. Married filing jointly: Taxable income $70,000. C. Married filing jointly: Taxable income $95,000. 11. Using Federal Tax Tables. Using the tax table in 9 Exhibit 46, determine the amount of (9) LOA-3 taxes for the following situations: A. A head of household with taxable income of $70,751. B. A single person with taxable income of $70,052. C. A married person filing a separate return with taxable income of $70,926. 12. Comparing Taxes on Imvestments. Would you prefer a fully taxable investment earning 8.1 Lo4-5 percent or a tax-exempt investment earning 6.1 percent? (Assume a 24 percent tax rate.) Why? 13. Capital Gains, Samuel Jenkins made two investments; the first was 13 months ago and the (i) 1045 second was 2 months ago. He just sold both investments and has a capital gain of $3,000 on each. If Samuel is single and has taxable income of $40,000, what will be the amount of capital gains tax on each investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts