Question: please answer #101 part A thanks Question 1 (4 points) QUESTION 101. (answer both part A and B) As the portfolio manager of the pension

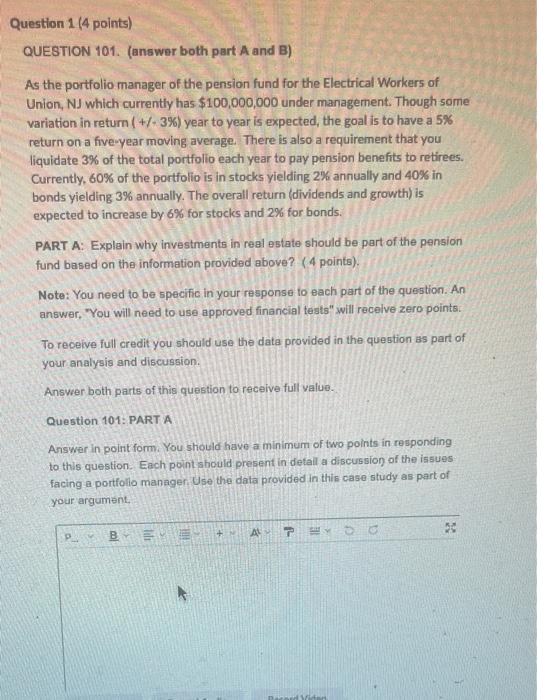

Question 1 (4 points) QUESTION 101. (answer both part A and B) As the portfolio manager of the pension fund for the Electrical Workers of Union, NJ which currently has $100,000,000 under management. Though some variation in return ( +/- 3%) year to year is expected, the goal is to have a 5% return on a five-year moving average. There is also a requirement that you liquidate 3% of the total portfolio each year to pay pension benefits to retirees. Currently, 60% of the portfolio is in stocks yielding 2% annually and 40% in bonds yielding 3% annually. The overall return (dividends and growth) is expected to increase by 6% for stocks and 2% for bonds. PART A: Explain why investments in real estate should be part of the pension fund based on the information provided above? (4 points) Note: You need to be specific in your response to each part of the question. An answer, "You will need to use approved financial tests" will receive zero points. To receive full credit you should use the data provided in the question as part of your analysis and discussion Answer both parts of this question to receive full value. Question 101: PARTA Answer in point form. You should have a minimum of two points in responding to this question. Each point should present in detalla discussion of the issues facing a portfolio manager. Use the data provided in this case study as part of your argument + B AN P 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts