Question: please answer 10-12 QUESTION 10 Stock B's beta coefficient is BB=0.8. The risk-free rate is 4 percent, and the expected return on an average stock

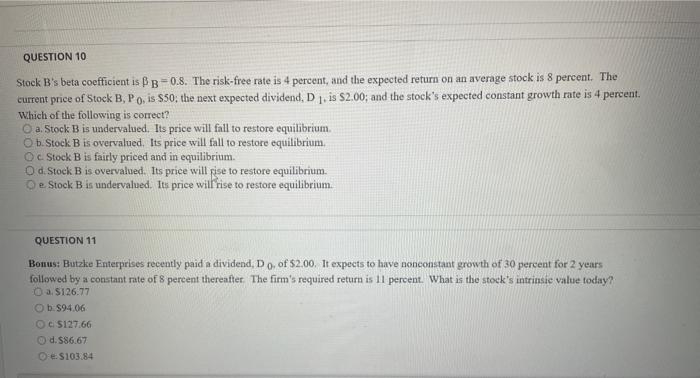

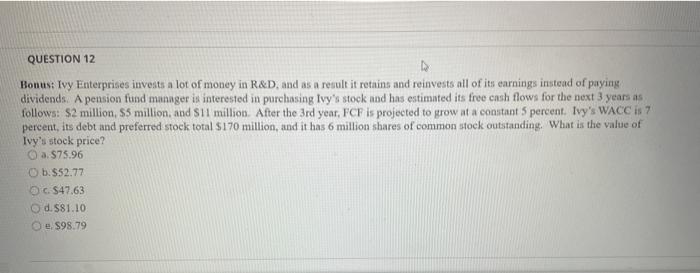

QUESTION 10 Stock B's beta coefficient is BB=0.8. The risk-free rate is 4 percent, and the expected return on an average stock is 8 percent. The current price of Stock B, Po, is $50, the next expected dividend, D1, is $2.00; and the stock's expected constant growth rate is 4 percent Which of the following is correct? a. Stock B is undervalued. Its price will fall to restore equilibrium. Ob Stock B is overvalued. Its price will fall to restore equilibrium. Oc Stock B is fairly priced and in equilibrium. Od Stock B is overvalued. Its price will rise to restore equilibrium. De Stock B is undervalued. Its price will rise to restore equilibrium. QUESTION 11 Bonus: Butzke Enterprises recently paid a dividend. Do of $2.00. It expects to have nonconstant growth of 30 percent for 2 years followed by a constant rate of 8 percent thereafter. The firm's required return is 11 percent. What is the stock's intrinsic value today? a $126.77 Ob 894.06 C 5127.66 8.586.67 O S103.84 QUESTION 12 D Bonus: Ivy Enterprises invests a lot of money in R&D and as a result it retains and reinvests all of its earnings instead of paying dividends. A pension fund manager is interested in purchasing Ivy's stock and has estimated its free cash flows for the next 3 years as follows: $2 million, S5 million, and 11 million. After the 3rd year, FCF is projected to grow at a constant 5 percent . Ivy's WACC i7 percent, its debt and preferred stock total $170 million, and it has 6 million shares of common stock outstanding. What is the value of Ivy's stock price? a. 575.96 Ob.$52.77 c. $47.63 O d. 581.10 eS98.79

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts