Question: Please answer 10-12 QUESTIONS A project requires an initial investment of $1,200,000 and is depreciated straight-line to zero salvage over its 10- year life. The

Please answer 10-12

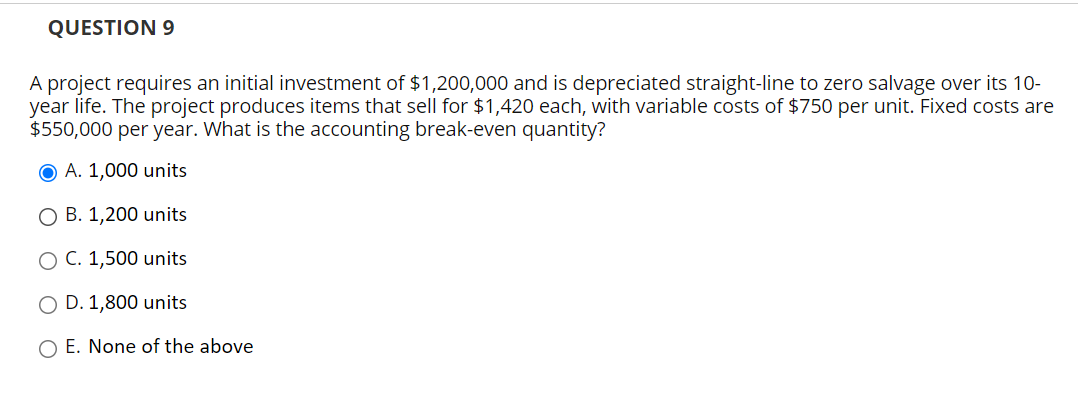

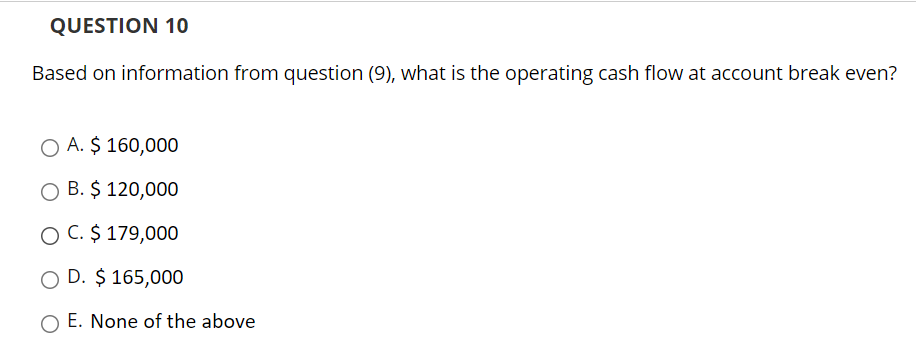

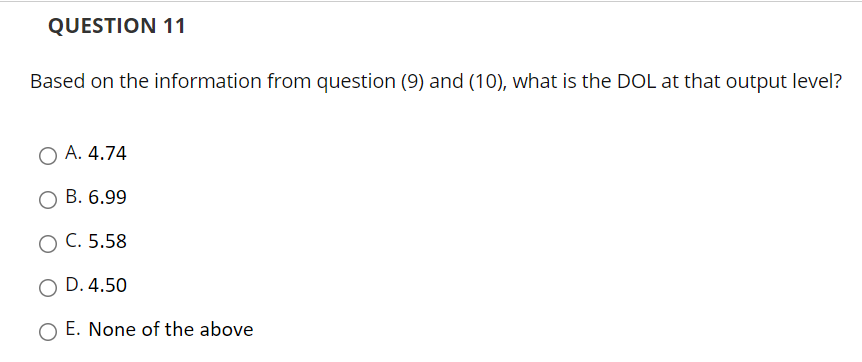

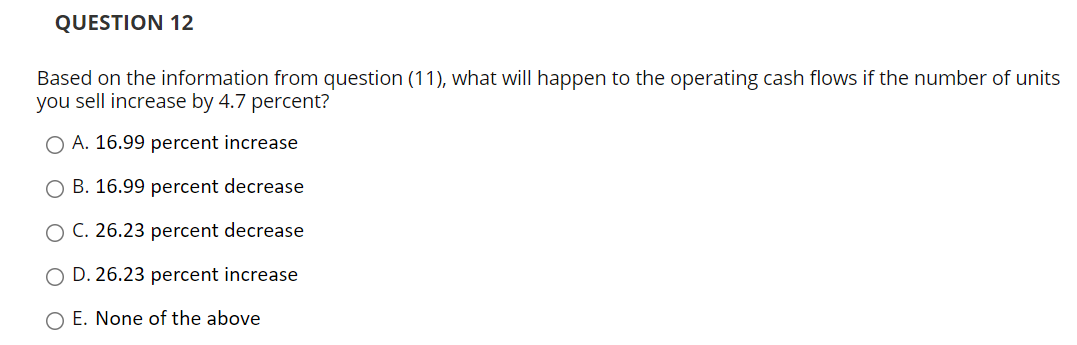

QUESTIONS A project requires an initial investment of $1,200,000 and is depreciated straight-line to zero salvage over its 10- year life. The project produces items that sell for $1,420 each, with variable costs of $750 per unit. Fixed costs are $550,000 per year. What is the accounting break-even quantity? O A. 1,000 units O B. 1,200 units O C. 1,500 units D. 1,800 units O E. None of the above QUESTION 10 Based on information from question (9), what is the operating cash flow at account break even? O A. $ 160,000 OB. $ 120,000 O C. $ 179,000 D. $ 165,000 O E. None of the above QUESTION 11 Based on the information from question (9) and (10), what is the DOL at that output level? O A. 4.74 B. 6.99 O C. 5.58 OD. 4.50 O E. None of the above QUESTION 12 Based on the information from question (11), what will happen to the operating cash flows if the number of units you sell increase by 4.7 percent? O A. 16.99 percent increase O B. 16.99 percent decrease C. 26.23 percent decrease OD. 26.23 percent increase O E. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts