Question: please answer 11,14,16,20 0 0 0 0 0 0 0 0 11. If the last dividend paid = $5, the dividend growth rate - 6%

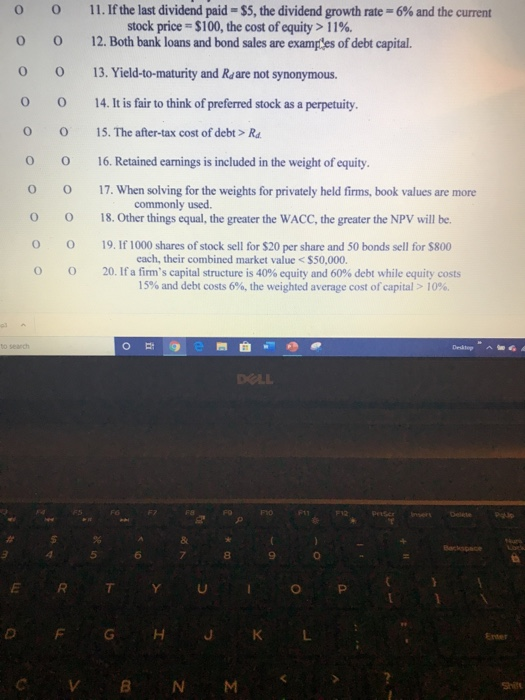

0 0 0 0 0 0 0 0 11. If the last dividend paid = $5, the dividend growth rate - 6% and the current stock price = $100, the cost of equity > 11%. 12. Both bank loans and bond sales are examp'es of debt capital. 13. Yield-to-maturity and Reare not synonymous. 14. It is fair to think of preferred stock as a perpetuity. 15. The after-tax cost of debt > Rd. 16. Retained earnings is included in the weight of equity. 17. When solving for the weights for privately held firms, book values are more commonly used 18. Other things equal, the greater the WACC, the greater the NPV will be. 19. If 1000 shares of stock sell for $20 per share and 50 bonds sell for 5800 cach, their combined market value 10%. 0 0 0 O 0 0 O 0 O 0 O to search ii Det DOLL FO F11 F12 Backspace 7 8 9 O E R. DF G H J K L V BNM SNEL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts