Question: Please answer 12 and 13 using the above information. Thank you! Red Corp., a C corporation, wants to make a donation to a public charity

Please answer 12 and 13 using the above information. Thank you!

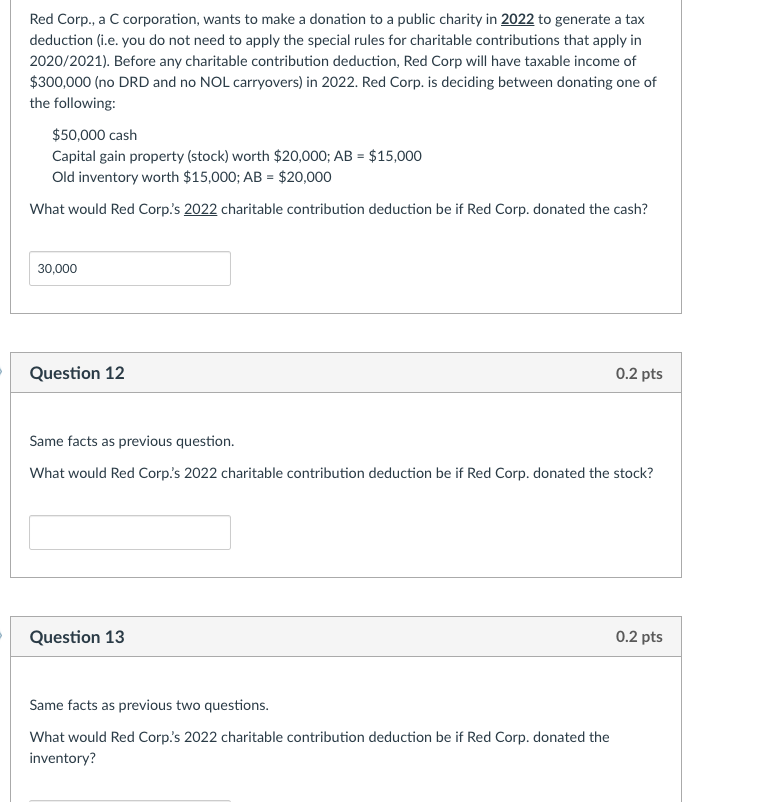

Red Corp., a C corporation, wants to make a donation to a public charity in 2022 to generate a tax deduction (i.e. you do not need to apply the special rules for charitable contributions that apply in 2020/2021). Before any charitable contribution deduction, Red Corp will have taxable income of $300,000 (no DRD and no NOL carryovers) in 2022. Red Corp. is deciding between donating one of the following: $50,000 cash Capital gain property (stock) worth $20,000; AB = $15,000 Old inventory worth $15,000; AB = $20,000 What would Red Corps 2022 charitable contribution deduction be if Red Corp. donated the cash? 30,000 Question 12 0.2 pts Same facts as previous question. What would Red Corp.'s 2022 charitable contribution deduction be if Red Corp. donated the stock? Question 13 0.2 pts Same facts as previous two questions. What would Red Corp's 2022 charitable contribution deduction be if Red Corp. donated the inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts