Question: please answer 1,2 and 3 question, thank you. 3) (10 points) Nelson Inc. is considering the purchase of a $600,000 machine to manufacture a specialty

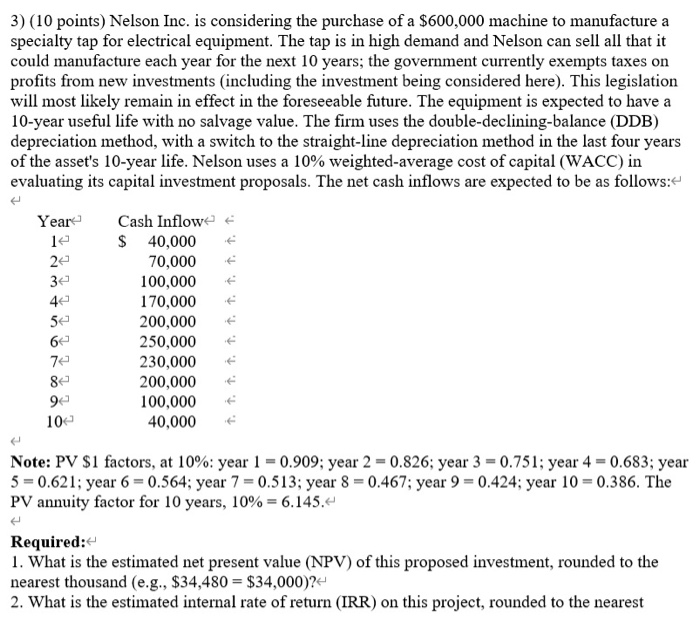

3) (10 points) Nelson Inc. is considering the purchase of a $600,000 machine to manufacture a specialty tap for electrical equipment. The tap is in high demand and Nelson can sell all that it could manufacture each year for the next 10 years, the government currently exempts taxes on profits from new investments (including the investment being considered here). This legislation will most likely remain in effect in the foreseeable future. The equipment is expected to have a 10-year useful life with no salvage value. The firm uses the double-declining-balance (DDB) depreciation method, with a switch to the straight-line depreciation method in the last four years of the asset's 10-year life. Nelson uses a 10% weighted-average cost of capital (WACC) in evaluating its capital investment proposals. The net cash inflows are expected to be as follows: Year 12 24 32 1.1.1 Cash Inflow $ 40,000 70,000 100,000 170,000 200,000 250,000 230,000 200,000 100,000 40,000 6 74 82 92 10 Note: PV $1 factors, at 10%: year 1 = 0.909; year 2 = 0.826; year 3 = 0.751; year 4 = 0.683; year 5 = 0.621; year 6 = 0.564; year 7 = 0.513; year 8 = 0.467; year 9 = 0.424; year 10 = 0.386. The PV annuity factor for 10 years, 10% = 6.145.- Required: 1. What is the estimated net present value (NPV) of this proposed investment, rounded to the nearest thousand (e.g., $34,480 = $34,000)?- 2. What is the estimated internal rate of return (IRR) on this project, rounded to the nearest whole % (e.g., 20.34% = 20%; 20.52% = 21%, etc.)? (Note: Students would have to have access to Excel to answer this question.) 3. What is the present value payback period for this proposed investment, in years (rounded to one decimal place)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts