Question: Please answer 12-14 and 12-15 please operating lease for Problem 12-14 (AICPA Adapted) At the beginning of current year, Wren Company leaser years at P500,000

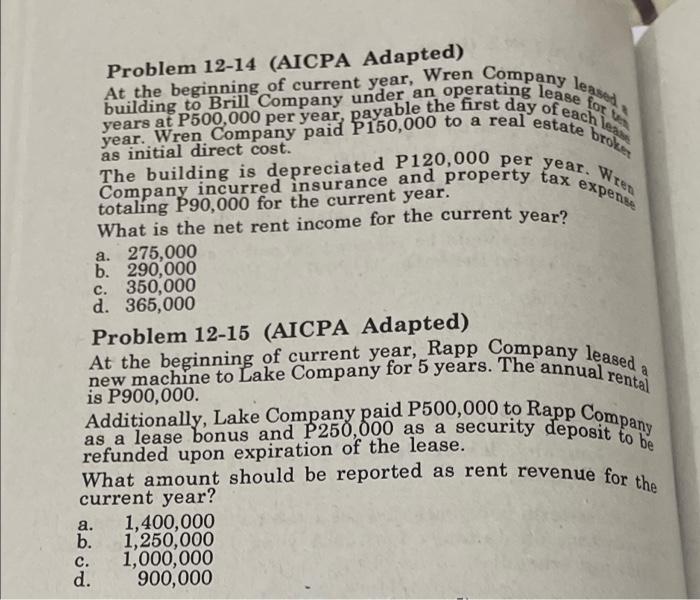

operating lease for Problem 12-14 (AICPA Adapted) At the beginning of current year, Wren Company leaser years at P500,000 per year, payable the first day of each les year. Wren Company paid P150,000 to a real estate broker building to Brill Company under an as initial direct cost. Company incurred insurance and property tax expense The building is depreciated P120,000 per year. Weet totalng P90,000 for the current year. What is the net rent income for the current year? a. 275,000 b. 290,000 c. 350,000 d. 365,000 Problem 12-15 (AICPA Adapted) new machine to Lake Company for 5 years. The annual rental At the beginning of current year, Rapp Company leased is P900,000. as a lease bonus and P250,000 as a security deposit to be Additionally, Lake Company paid P500,000 to Rapp Company What amount should be reported as rent revenue for the refunded upon expiration of the lease. current year? a 1,400,000 b 1,250,000 c 1,000,000 d. 900,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts