Question: Please answer 12-19 and 12-20 please a Problem 12-19 (IAA) On July 1, 2020, Hutch Company leased equipment to Eldet Company for a one-year period

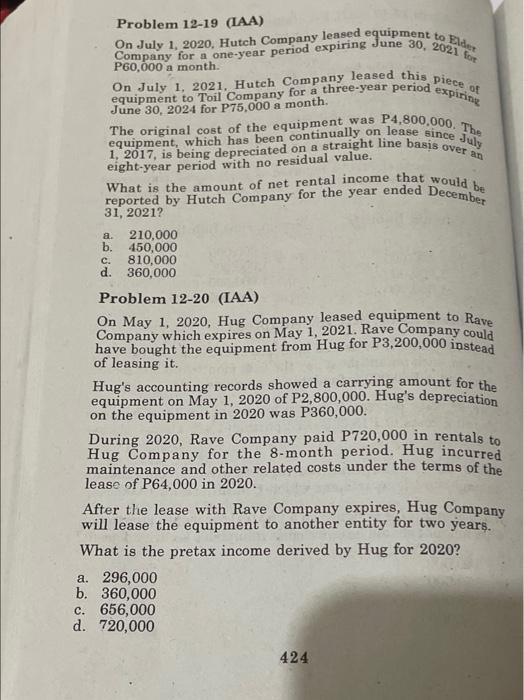

a Problem 12-19 (IAA) On July 1, 2020, Hutch Company leased equipment to Eldet Company for a one-year period expiring June 30, 2021 tot P60,000 a month. On July 1, 2021, Hutch Company leased this piece of equipment to Toil Company for a three-year period expinne June 30, 2024 for P75,000 a month. The original cost of the equipment was P4.800,000. The equipment, which has been continually on lease since July 1, 2017, is being depreciated on a straight line basis over an eight-year period with no residual value. What is the amount of net rental income that would be reported by Hutch Company for the year ended December 31, 2021? 210,000 b 450,000 810,000 d. 360,000 Problem 12-20 (IAA) On May 1, 2020, Hug Company leased equipment to Rave Company which expires on May 1, 2021. Rave Company could have bought the equipment from Hug for P3,200,000 instead of leasing it. Hug's accounting records showed a carrying amount for the equipment on May 1, 2020 of P2,800,000. Hug's depreciation on the equipment in 2020 was P360,000. During 2020, Rave Company paid P720,000 in rentals to Hug Company for the 8-month period. Hug incurred maintenance and other related costs under the terms of the lease of P64,000 in 2020. After the lease with Rave Company expires, Hug Company will lease the equipment to another entity for two years. What is the pretax income derived by Hug for 2020? a. 296,000 b. 360,000 c. 656,000 d. 720,000 424

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts