Question: please answer 1-3 alternatives have submitted question multiple times and a Chegg expert is yet to achieve the correct answer... please help! BBC (Australia). Botany

please answer 1-3 alternatives

have submitted question multiple times and a Chegg expert is yet to achieve the correct answer... please help!

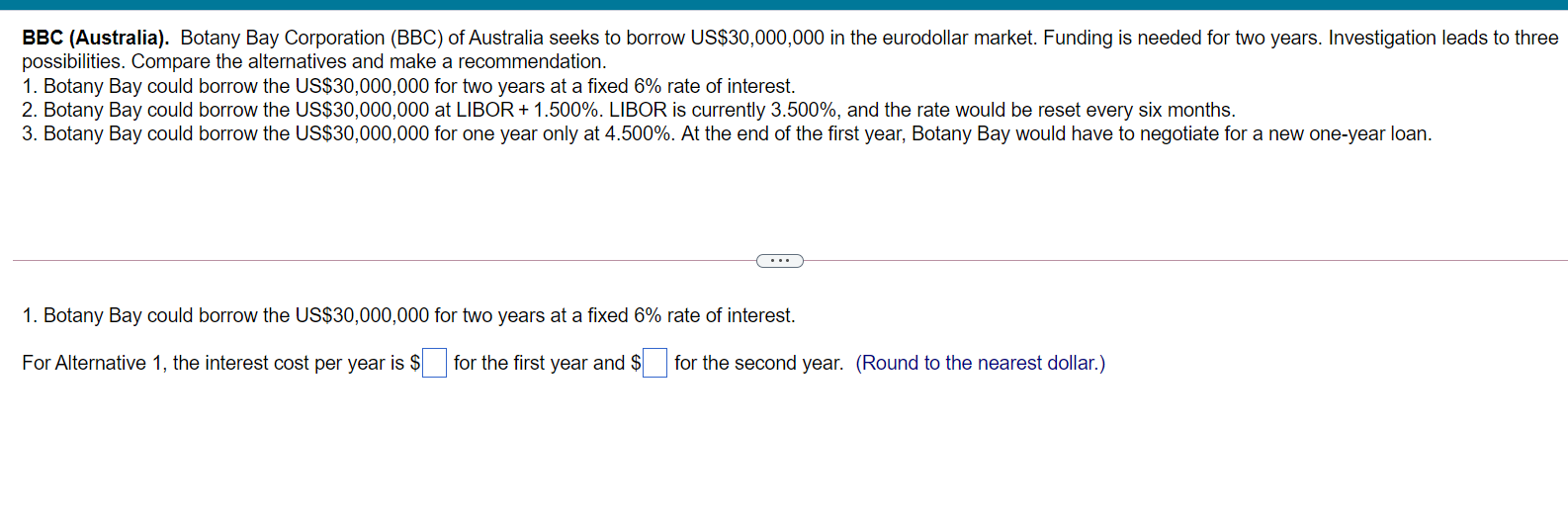

BBC (Australia). Botany Bay Corporation (BBC) of Australia seeks to borrow US$30,000,000 in the eurodollar market. Funding is needed for two years. Investigation leads to three possibilities. Compare the alternatives and make a recommendation. 1. Botany Bay could borrow the US$30,000,000 for two years at a fixed 6% rate of interest. 2. Botany Bay could borrow the US$30,000,000 at LIBOR + 1.500%. LIBOR is currently 3.500%, and the rate would be reset every six months. 3. Botany Bay could borrow the US$30,000,000 for one year only at 4.500%. At the end of the first year, Botany Bay would have to negotiate for a new one-year loan. 1. Botany Bay could borrow the US$30,000,000 for two years at a fixed 6% rate of interest. For Alternative 1, the interest cost per year is $(for the first year and for the second year. (Round to the nearest dollar.) BBC (Australia). Botany Bay Corporation (BBC) of Australia seeks to borrow US$30,000,000 in the eurodollar market. Funding is needed for two years. Investigation leads to three possibilities. Compare the alternatives and make a recommendation. 1. Botany Bay could borrow the US$30,000,000 for two years at a fixed 6% rate of interest. 2. Botany Bay could borrow the US$30,000,000 at LIBOR + 1.500%. LIBOR is currently 3.500%, and the rate would be reset every six months. 3. Botany Bay could borrow the US$30,000,000 for one year only at 4.500%. At the end of the first year, Botany Bay would have to negotiate for a new one-year loan. 1. Botany Bay could borrow the US$30,000,000 for two years at a fixed 6% rate of interest. For Alternative 1, the interest cost per year is $(for the first year and for the second year. (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts