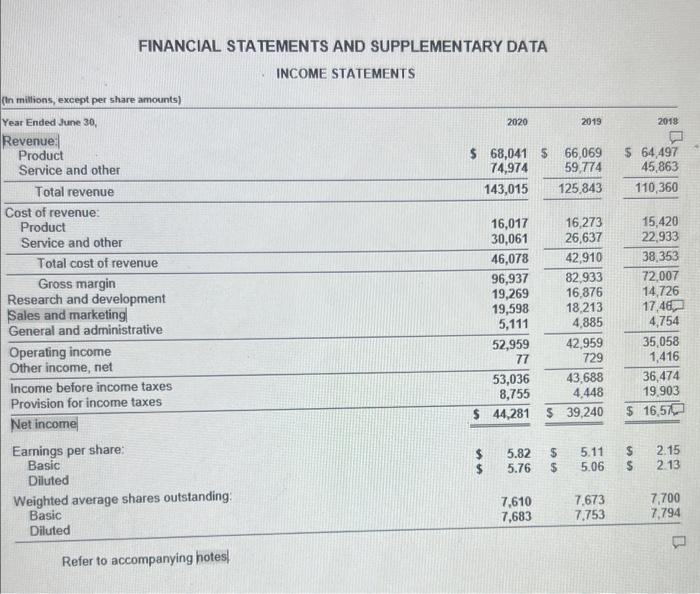

Question: please answer 1-3 FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA ICASH|FLOWS STATEMENTS (In mitions) Use the following formula to calculate the company's accounts receivable turnover for the

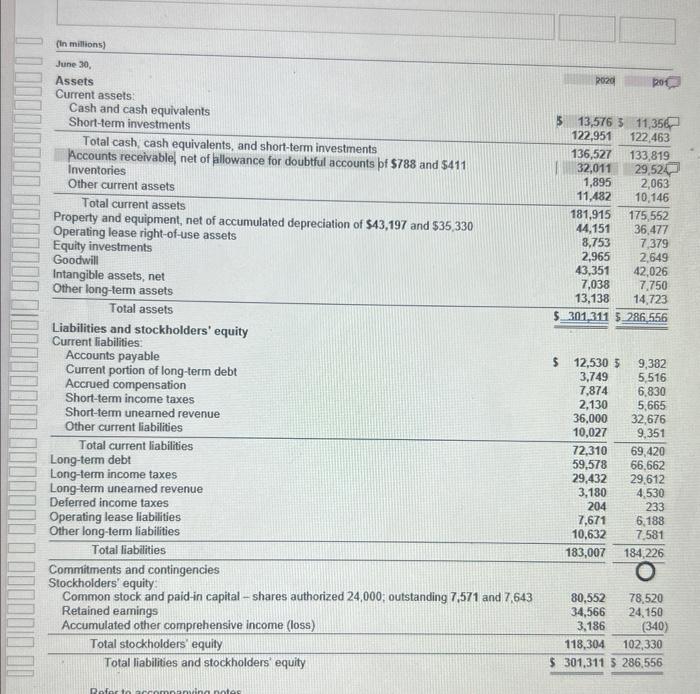

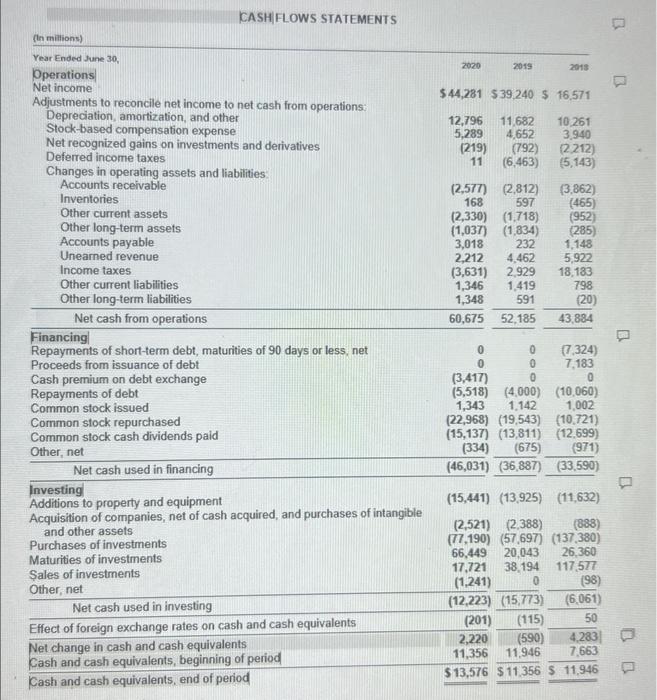

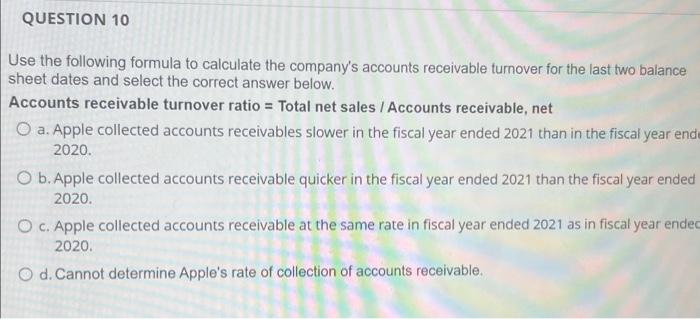

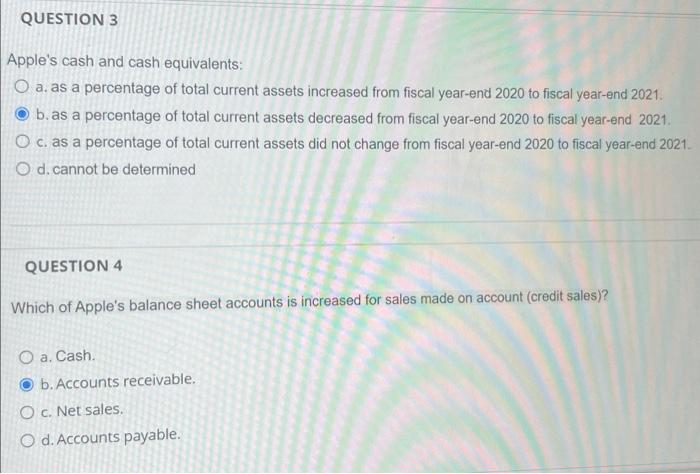

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA ICASH|FLOWS STATEMENTS (In mitions) Use the following formula to calculate the company's accounts receivable turnover for the last two balance sheet dates and select the correct answer below. Accounts receivable turnover ratio = Total net sales / Accounts receivable, net a. Apple collected accounts receivables slower in the fiscal year ended 2021 than in the fiscal year end 2020. b. Apple collected accounts receivable quicker in the fiscal year ended 2021 than the fiscal year ended 2020. c. Apple collected accounts receivable at the same rate in fiscal year ended 2021 as in fiscal year ende 2020. d. Cannot determine Apple's rate of collection of accounts receivable. Apple's cash and cash equivalents: a. as a percentage of total current assets increased from fiscal year-end 2020 to fiscal year-end 2021. b. as a percentage of total current assets decreased from fiscal year-end 2020 to fiscal year-end 2021. c. as a percentage of total current assets did not change from fiscal year-end 2020 to fiscal year-end 2021 . d. cannot be determined QUESTION 4 Which of Apple's balance sheet accounts is increased for sales made on account (credit sales)? a. Cash. b. Accounts receivable. c. Net sales. d. Accounts payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts