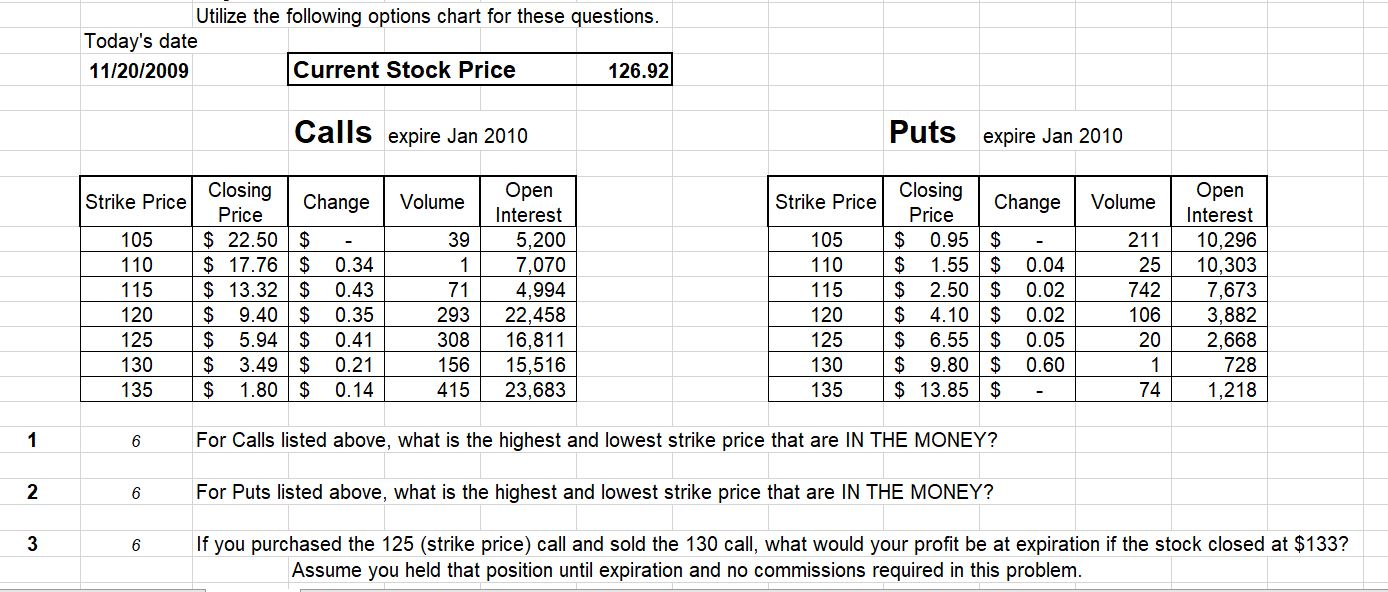

Question: Please answer 1-3. Utilize the following options chart for these questions. Today's date 126.92 Current Stock Price 11/20/2009 Calls expire Jan 2010 Puts expire Jan

Please answer 1-3.

Utilize the following options chart for these questions. Today's date 126.92 Current Stock Price 11/20/2009 Calls expire Jan 2010 Puts expire Jan 2010 Closing Open Open Closing Strike Price Change Strike Price Change Volume Volume Price Interest Price Interest $ 22.50 $ $ 17.76 $ 13.32 $ $ 9.40 $ 5.94 $ 0.95 1.55 $ 2$ $ 2.50 $ $ 4.10 $ 2$ 105 39 5,200 7,070 4,994 22,458 16,811 105 211 10,296 10,303 7,673 3,882 2,668 110 110 0.34 0.04 25 0.02 115 0.43 71 115 742 120 0.35 293 120 0.02 106 6.55 $ 9.80 $ $ 13.85 $ 125 0.41 308 125 0.05 20 130 3.49 0.21 156 15,516 23,683 130 0.60 728 2$ $ 135 1.80 0.14 415 135 74 1,218 For Calls listed above, what is the highest and lowest strike price that are IN THE MONEY? 6 For Puts listed above, what is the highest and lowest strike price that are IN THE MONEY? 2 6 If you purchased the 125 (strike price) call and sold the 130 call, what would your profit be at expiration if the stock closed at $133? 6 Assume you held that position until expiration and no commissions required in this problem. 3. Utilize the following options chart for these questions. Today's date 126.92 Current Stock Price 11/20/2009 Calls expire Jan 2010 Puts expire Jan 2010 Closing Open Open Closing Strike Price Change Strike Price Change Volume Volume Price Interest Price Interest $ 22.50 $ $ 17.76 $ 13.32 $ $ 9.40 $ 5.94 $ 0.95 1.55 $ 2$ $ 2.50 $ $ 4.10 $ 2$ 105 39 5,200 7,070 4,994 22,458 16,811 105 211 10,296 10,303 7,673 3,882 2,668 110 110 0.34 0.04 25 0.02 115 0.43 71 115 742 120 0.35 293 120 0.02 106 6.55 $ 9.80 $ $ 13.85 $ 125 0.41 308 125 0.05 20 130 3.49 0.21 156 15,516 23,683 130 0.60 728 2$ $ 135 1.80 0.14 415 135 74 1,218 For Calls listed above, what is the highest and lowest strike price that are IN THE MONEY? 6 For Puts listed above, what is the highest and lowest strike price that are IN THE MONEY? 2 6 If you purchased the 125 (strike price) call and sold the 130 call, what would your profit be at expiration if the stock closed at $133? 6 Assume you held that position until expiration and no commissions required in this problem. 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts