Question: Please answer 1-3! You will get many thumbs up thanks! Question 1 Not yet Points out of 4.00 Best question Company A can borrow $40

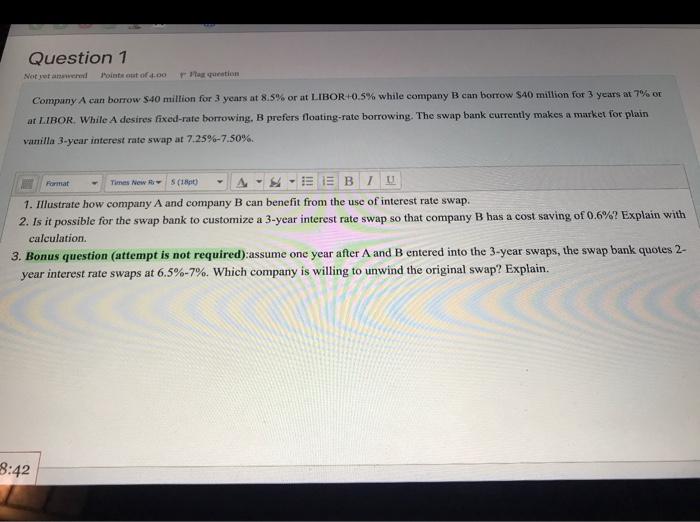

Question 1 Not yet Points out of 4.00 Best question Company A can borrow $40 million for 3 years at 8.5% or at LIBOR+0.5% while company B enn borrow $40 million for 3 years at 7% or at LIBOR. While A desires fixed-rate borrowing, prefers floating-rate borrowing. The swap bank currently makes a market for plain vanilla 3-year interest rate swap at 7.25%-7.50%. Format Times New S(186) AXEE BIU 1. Illustrate how company A and company B can benefit from the use of interest rate swap. 2. Is it possible for the swap bank to customize a 3-year interest rate swap so that company B has a cost saving of 0.6%? Explain with calculation 3. Bonus question (attempt is not required):assume one year after A and B entered into the 3-year swaps, the swap bank quotes 2- year interest rate swaps at 6.5%-7%. Which company is willing to unwind the original swap? Explain. 8:42

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts