Question: please answer 13.1, a-d with formula and explanation 13.1 Seattle Health Plans currently uses zero-debt financing. Its operating income earnings before interest and taxes, or

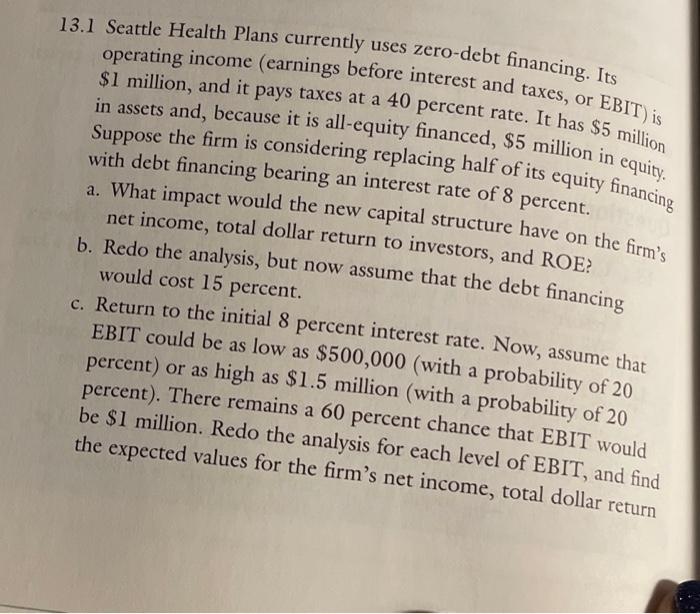

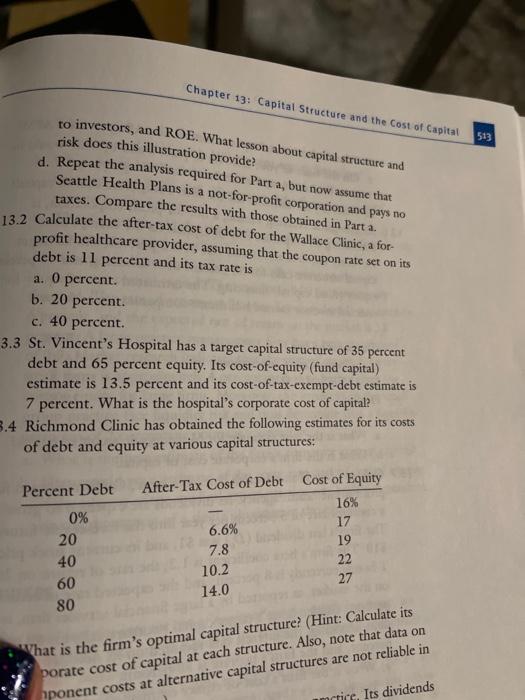

13.1 Seattle Health Plans currently uses zero-debt financing. Its operating income earnings before interest and taxes, or EBIT) is $1 million, and it pays taxes at a 40 percent rate. It has $5 million in assets and, because it is all-equity financed, $5 million in equity. Suppose the firm is considering replacing half of its equity financing a. What impact would the new capital structure have on the firm's (, ) with debt financing bearing an interest rate of 8 percent. net income, total dollar return to investors, and ROE b. Redo the analysis, but now assume that the debt financing would cost 15 percent. c. Return to the initial 8 percent interest rate. Now, assume that EBIT could be as low as $500,000 (with a probability of 20 percent) or as high as $1.5 million (with a probability of 20 percent). There remains a 60 percent chance that EBIT would be $1 million. Redo the analysis for each level of EBIT, and find the expected values for the firm's net income, total dollar return Chapter 13: Capital Structure and the cost of Capital 513 to investors, and ROE. What lesson about capital structure and risk does this illustration provide? d. Repeat the analysis required for Parta, but now assume that Seattle Health Plans is a not-for-profit corporation and pays no taxes. Compare the results with those obtained in Part a. 13.2 Calculate the after-tax cost of debt for the Wallace Clinic, a for- profit healthcare provider, assuming that the coupon rate set on its debt is 11 percent and its tax rate is a. O percent. b. 20 percent. c. 40 percent. 3.3 St. Vincent's Hospital has a target capital structure of 35 percent debt and 65 percent equity. Its cost-of-equity (fund capital) estimate is 13.5 percent and its cost-of-tax-exempt-debt estimate is 7 percent. What is the hospital's corporate cost of capital? 3.4 Richmond Clinic has obtained the following estimates for its costs of debt and equity at various capital structures: Percent Debt After-Tax Cost of Debt 0% 20 40 6.6% 7.8 10.2 14.0 Cost of Equity 16% 17 19 22 27 60 80 What is the firm's optimal capital structure? (Hint: Calculate its porate cost of capital at each structure. Also, note that data on Aponent costs at alternative capital structures are not reliable in matice, Its dividends

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts