Question: please answer 14,15,16 show work, please do not use excel thank you :) 14. Consider a no-load mutual fund with $200 million in assets and

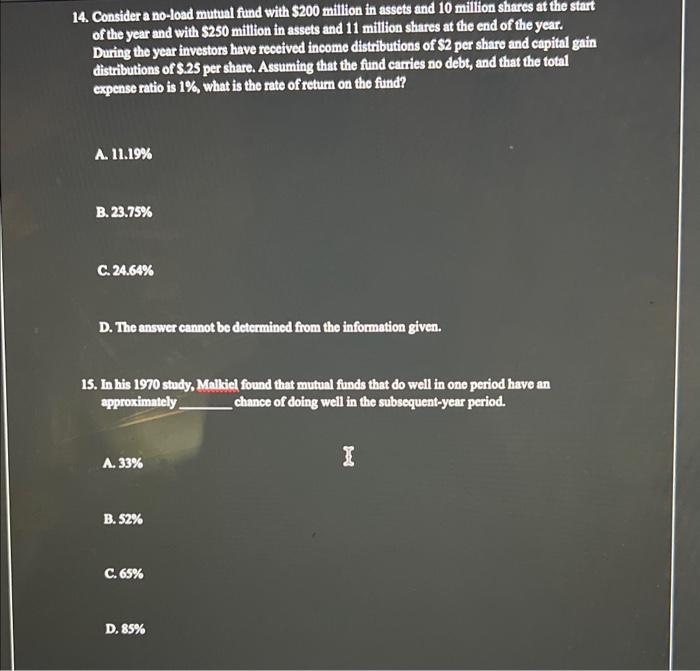

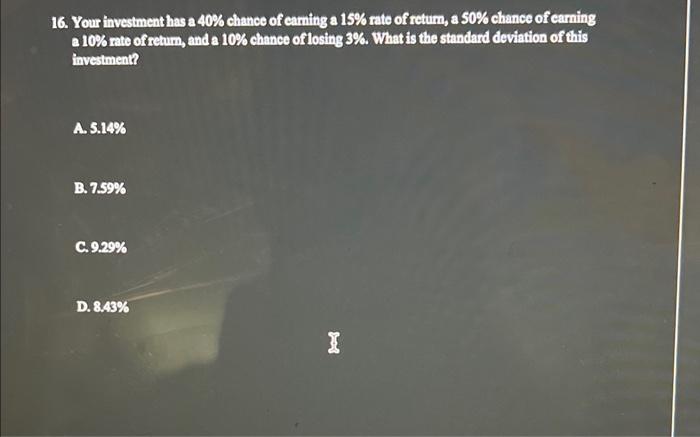

14. Consider a no-load mutual fund with $200 million in assets and 10 million shares at the start of the year and with $250 million in assets and 11 million shares at the end of the year. During the year investors have received income distributions of $2 per share and capital gain distributions of 3.25 per share. Assuming that the fund carries no debt, and that the total expense ratio is 1%, what is the rate of retum on the fund? A. 11.19% B. 23.75% C. 24.64% D. The answer cannot be determined from the information given. 15. In his 1970 study, Malkiel found that mutual funds that do well in one period have an approximately chance of doing well in the subsequent-year period. A. 33% B. 52% C. 65% D. 85% 16. Your investment has a 40% chance of eaming a 15% rate of retum, a 50% chance of carning a 10% rate of retum, and a 10% chance of losing 3%. What is the standard deviation of this investment? A. 5.14% B. 7.59% C. 9.29% D. 8.43%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts