Question: Please answer 17 John was issued Incentive Stock Options (ISOs) in 2014, he exercised the options in 2016 and sold the stock in 2020. The

Please answer 17

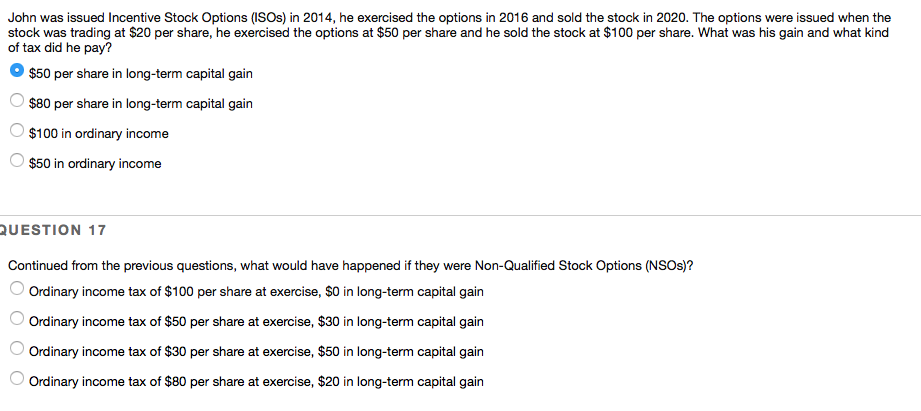

John was issued Incentive Stock Options (ISOs) in 2014, he exercised the options in 2016 and sold the stock in 2020. The options were issued when the stock was trading at $20 per share, he exercised the options at $50 per share and he sold the stock at $100 per share. What was his gain and what kind of tax did he pay? $50 per share in long-term capital gain $80 per share in long-term capital gain $100 in ordinary income $50 in ordinary income QUESTION 17 Continued from the previous questions, what would have happened if they were Non-Qualified Stock Options (NSOs)? Ordinary income tax of $100 per share at exercise, $ in long-term capital gain Ordinary income tax of $50 per share at exercise, $30 in long-term capital gain Ordinary income tax of $30 per share at exercise, $50 in long-term capital gain Ordinary income tax of $80 per share at exercise, $20 in long-term capital gain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts