Question: Please answer #17 with the formulas through excel. Will up vote! $150 5% 6 2% Instructions: Build a model to calculate the present value of

Please answer #17 with the formulas through excel. Will up vote!

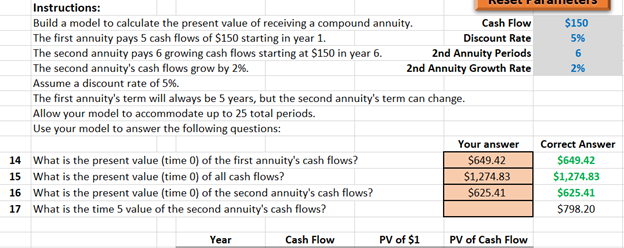

$150 5% 6 2% Instructions: Build a model to calculate the present value of receiving a compound annuity. Cash Flow The first annuity pays 5 cash flows of $150 starting in year 1. Discount Rate The second annuity pays 6 growing cash flows starting at $150 in year 6. 2nd Annuity Periods The second annuity's cash flows grow by 2%. 2nd Annuity Growth Rate Assume a discount rate of 5%. The first annuity's term will always be 5 years, but the second annuity's term can change. Allow your model to accommodate up to 25 total periods. Use your model to answer the following questions: Your answer 14 What is the present value (time () of the first annuity's cash flows? $649.42 15 What is the present value (time 0) of all cash flows? $1,274.83 16 What is the present value (time () of the second annuity's cash flows? $625.41 17 What is the time 5 value of the second annuity's cash flows? Correct Answer $649.42 $1,274.83 $625.41 $798.20 Year Cash Flow PV of $1 PV of Cash Flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts