Question: please answer 17,20,21 show work and do not use excel please. thank you :) 17. Consider a Treasury bill with a rate of retum of

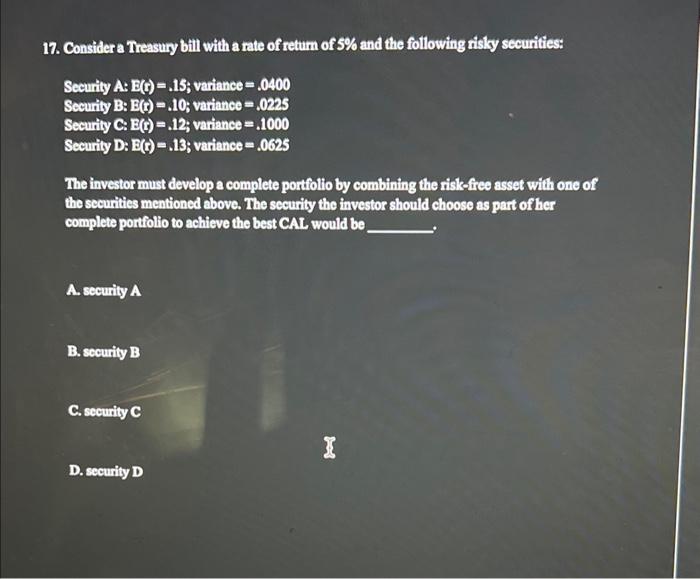

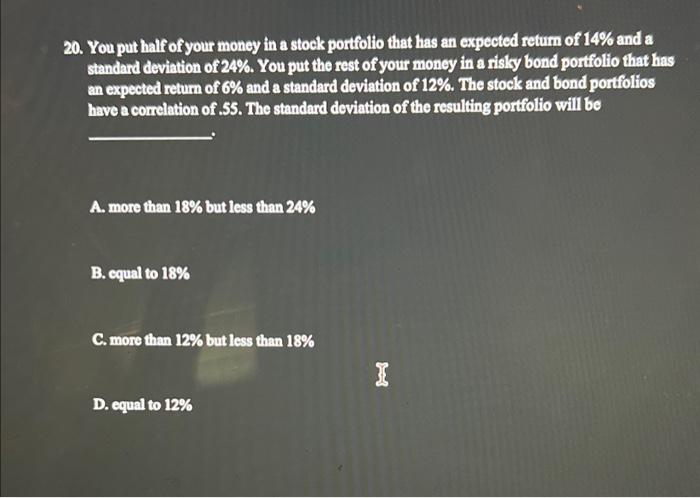

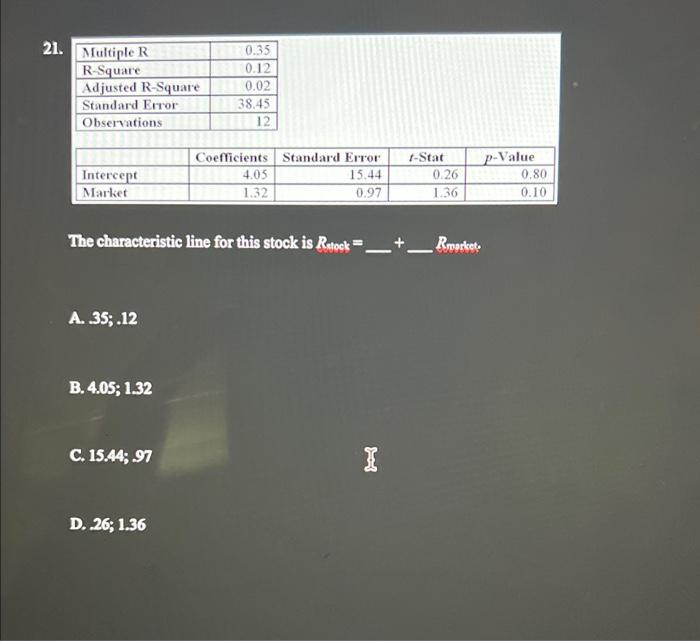

17. Consider a Treasury bill with a rate of retum of 5% and the following risky securities: Security A:E(0)=.15; variance =.0400 Security B:E(t)=.10; variance =.0225 Security C:E(t)=.12; variance =.1000 Security D:E(c)=.13; variance =.0625 The investor must develop a complete portiolio by combining the risk-free asset with one of the securities mentioned above. The security the investor should choose as part of her complete portfolio to achieve the best CAL would be A. secuity A B. sccurity B C. security C D. security D 20. You put half of your money in a stock portfolio that has an expected retum of 14% and a standard deviation of 24%. You put the rest of your money in a risiy bond portiolio that has an expected return of 6% and a standard deviation of 12%. The stock and bond portfolios have a correlation of . 55 . The standard deviation of the resulting portifolio will be A. more than 18% but less than 24% B. equal to 18% C. more than 12% but less than 18% D. equal to 12% The characteristic line for this stock is Rsock=_+Rnotket: A. 35;.12 B. 4.05;1.32 C. 15.44;97 D. 26;1.36

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts