Question: Please answer 17-9. I provided the question above with the answers because you will need the information to answer 17-9. Please show work along with

Please answer 17-9. I provided the question above with the answers because you will need the information to answer 17-9. Please show work along with answer.

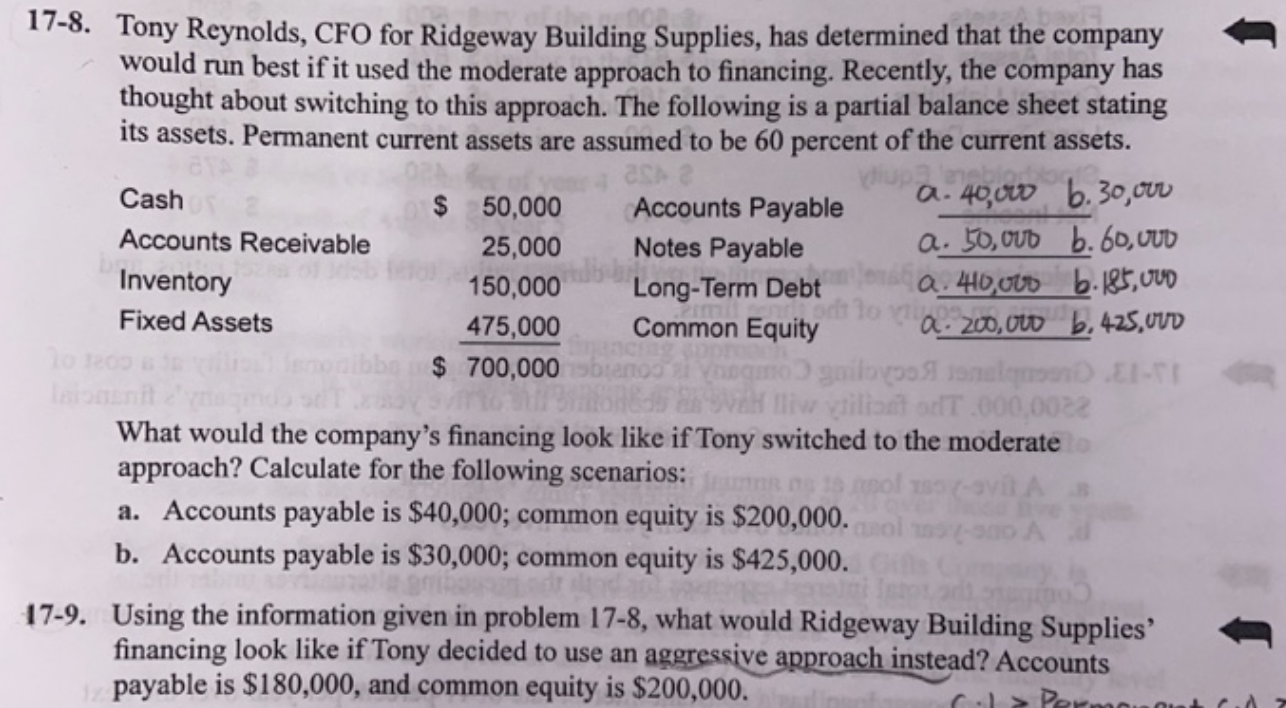

7-8. Tony Reynolds, CFO for Ridgeway Building Supplies, has determined that the company would run best if it used the moderate approach to financing. Recently, the company has thought about switching to this approach. The following is a partial balance sheet stating its assets. Permanent current assets are assumed to be 60 percent of the current assets. What would the company's financing look like if Tony switched to the moderate approach? Calculate for the following scenarios: a. Accounts payable is $40,000; common equity is $200,000. b. Accounts payable is $30,000; common equity is $425,000. 7-9. Using the information given in problem 17-8, what would Ridgeway Building Supplies' financing look like if Tony decided to use an aggressive approach instead? Accounts payable is $180,000, and common equity is $200,000. 7-8. Tony Reynolds, CFO for Ridgeway Building Supplies, has determined that the company would run best if it used the moderate approach to financing. Recently, the company has thought about switching to this approach. The following is a partial balance sheet stating its assets. Permanent current assets are assumed to be 60 percent of the current assets. What would the company's financing look like if Tony switched to the moderate approach? Calculate for the following scenarios: a. Accounts payable is $40,000; common equity is $200,000. b. Accounts payable is $30,000; common equity is $425,000. 7-9. Using the information given in problem 17-8, what would Ridgeway Building Supplies' financing look like if Tony decided to use an aggressive approach instead? Accounts payable is $180,000, and common equity is $200,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts