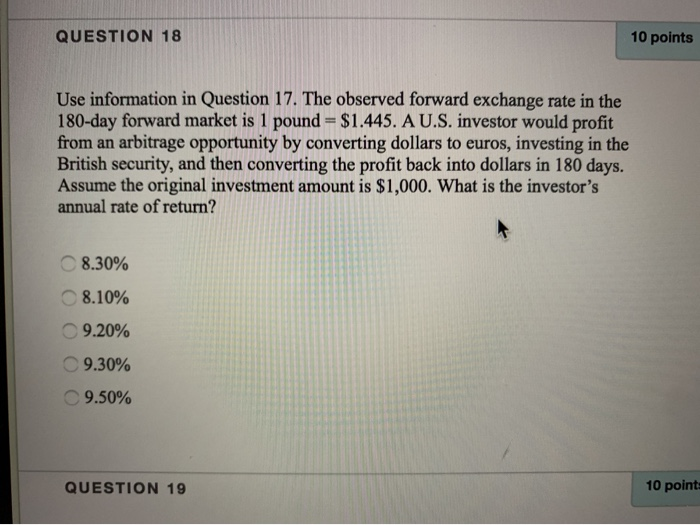

Question: please answer #18, i have invluded 17 to help answer it QUESTION 18 10 points Use information in Question 17. The observed forward exchange rate

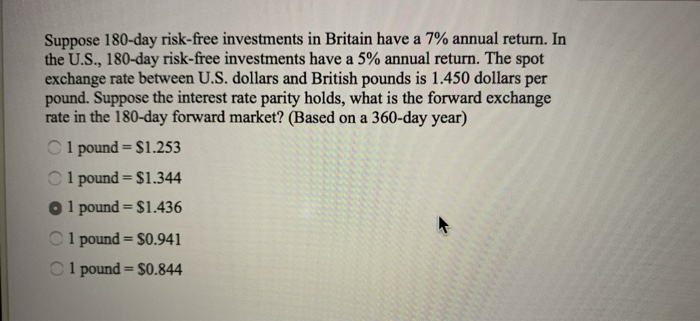

QUESTION 18 10 points Use information in Question 17. The observed forward exchange rate in the 180-day forward market is 1 pound = $1.445. A U.S. investor would profit from an arbitrage opportunity by converting dollars to euros, investing in the British security, and then converting the profit back into dollars in 180 days. Assume the original investment amount is $1,000. What is the investor's annual rate of return? 8.30% 8.10% 9.20% 9.30% 9.50% QUESTION 19 10 point: Suppose 180-day risk-free investments in Britain have a 7% annual return. In the U.S., 180-day risk-free investments have a 5% annual return. The spot exchange rate between U.S. dollars and British pounds is 1.450 dollars per pound. Suppose the interest rate parity holds, what is the forward exchange rate in the 180-day forward market? (Based on a 360-day year) o 1 pound = $1.253 1 pound = $1.344 o 1 pound = $1.436 1 pound = $0.941 1 pound = $0.844 O a QUESTION 18 10 points Use information in Question 17. The observed forward exchange rate in the 180-day forward market is 1 pound = $1.445. A U.S. investor would profit from an arbitrage opportunity by converting dollars to euros, investing in the British security, and then converting the profit back into dollars in 180 days. Assume the original investment amount is $1,000. What is the investor's annual rate of return? 8.30% 8.10% 9.20% 9.30% 9.50% QUESTION 19 10 point: Suppose 180-day risk-free investments in Britain have a 7% annual return. In the U.S., 180-day risk-free investments have a 5% annual return. The spot exchange rate between U.S. dollars and British pounds is 1.450 dollars per pound. Suppose the interest rate parity holds, what is the forward exchange rate in the 180-day forward market? (Based on a 360-day year) o 1 pound = $1.253 1 pound = $1.344 o 1 pound = $1.436 1 pound = $0.941 1 pound = $0.844 O a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts