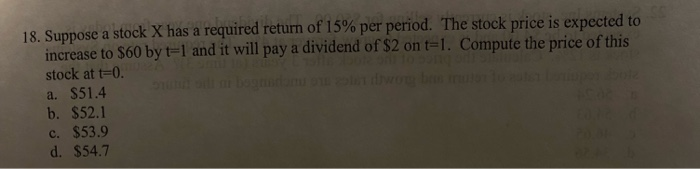

Question: please answer 18. Suppose a stock X has a required return of 15% per period. The stock price is expected to increase to $60 by

please answer

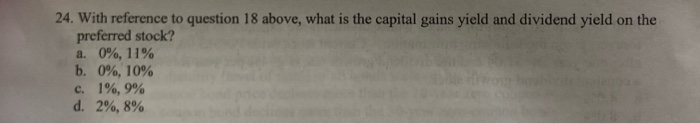

please answer18. Suppose a stock X has a required return of 15% per period. The stock price is expected to increase to $60 by t=1 and it will pay a dividend of $2 on t-1. Compute the price of this stock at t-0. a. $51.4 b. $52.1 c. $53.9 d. $54.7 24. With reference to question 18 above, what is the capital gains yield and dividend yield on the preferred stock? a. 0% , 11% b. 0%, 10 % c. 1 % , 9% d. 2 % , 8% C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts