Question: Please answer 19-22 & 27 will give thumbs up! 27. Dobson is wondering what the consequences would be if the duration of the first stage

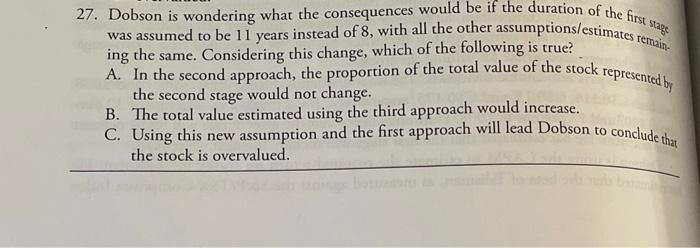

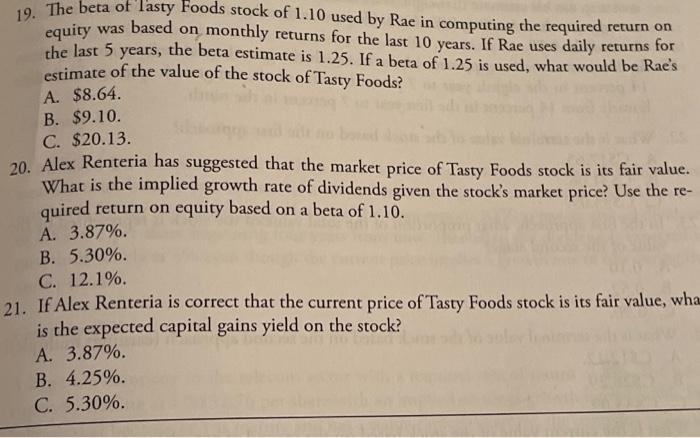

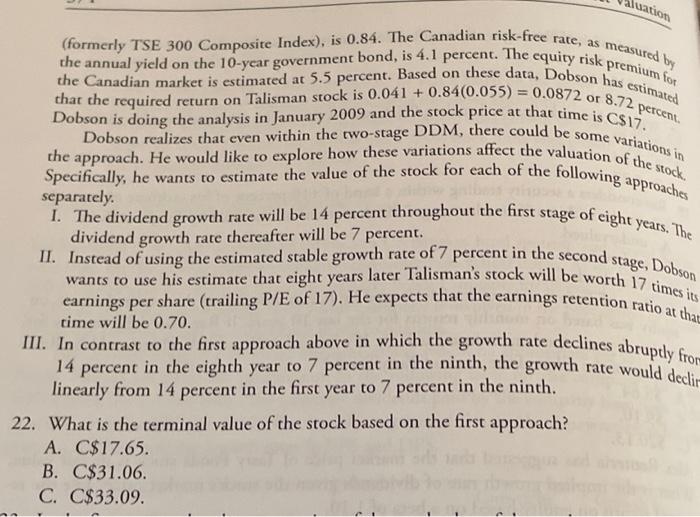

27. Dobson is wondering what the consequences would be if the duration of the first stage was assumed to be 11 years instead of 8, with all the other assumptions/estimates remaine A. In the second approach, the proportion of the total value of the stock represented by ing the same. Considering this change, which of the following is true? the second stage would not change, C. Using this new assumption and the first approach will lead Dobson to conclude that B. The total value estimated using the third approach would increase. the stock is overvalued. 19. The beta of Tasty Foods stock of 1.10 used by Rae in computing the required return for equity was based on monthly returns for the last 10 years. If Rae uses daily returns for the last 5 years, the beta estimate is 1.25. If a beta of 1.25 is used, what would be Rae's estimate of the value of the stock of Tasty Foods? A. $8.64. B. $9.10. C. $20.13. 20. Alex Renteria has suggested that the market price of Tasty Foods stock is its fair value. What is the implied growth rate of dividends given the stock's market price? Use the re- quired return on equity based on a beta of 1.10. A. 3.87%. B. 5.30%. C. 12.1%. 21. If Alex Renteria is correct that the current price of Tasty Foods stock is its fair value, wha is the expected capital gains yield on the stock? A. 3.87%. B. 4.25%. C. 5.30%. luation (formerly TSE 300 Composite Index), is 0.84. The Canadian risk-free rate, as measured by the annual yield on the 10-year government bond, is 4.1 percent. The equity risk premium for that the required return on Talisman stock is 0.041 +0.84(0.055) = 0.0872 or 8.72 percent the Canadian market is estimated at 5.5 percent. Based on these data, Dobson has estimated Dobson is doing the analysis in January 2009 and the stock price at that time is C$17. the approach. He would like to explore how these variations affect the valuation of the stock. Dobson realizes that even within the two-stage DDM, there could be some variations in Specifically, he wants to estimate the value of the stock for each of the following approaches separately. I. The dividend growth rate will be 14 percent throughout the first stage of eight years. The dividend growth rate thereafter will be 7 percent. II. Instead of using the estimated stable growth rate of 7 percent in the second wants to use his estimate that eight years later Talisman's stock will be worth 17 times its earnings per share (trailing P/E of 17). He expects that the earnings retention ratio at that time will be 0.70. 14 percent in the eighth year to 7 percent in the ninth, the growth rate would decir linearly from 14 percent in the first year to 7 percent in the ninth. 22. What is the terminal value of the stock based on the first approach? A. C$17.65. B. C$31.06. C. C$33.09. stage, Dobson III. In contrast to the first approach above in which the growth rate declines abruptly from

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts