Question: please answer 1-A,B and 2-A,B Unit V - Partner-Partnership Transactions Problems 1. a. b. Partnership ABC, an accrual-method taxpayer, leases space from Partner A, a

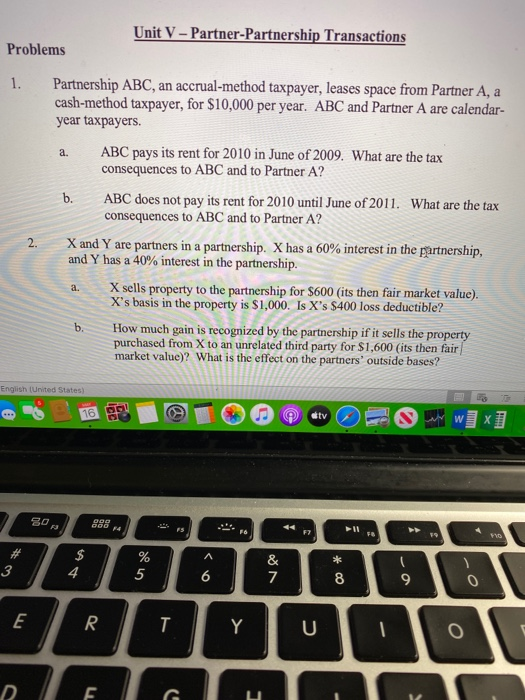

Unit V - Partner-Partnership Transactions Problems 1. a. b. Partnership ABC, an accrual-method taxpayer, leases space from Partner A, a cash-method taxpayer, for $10,000 per year. ABC and Partner A are calendar- year taxpayers. ABC pays its rent for 2010 in June of 2009. What are the tax consequences to ABC and to Partner A? ABC does not pay its rent for 2010 until June of 2011. What are the tax consequences to ABC and to Partner A? X and Y are partners in a partnership. X has a 60% interest in the partnership, and Y has a 40% interest in the partnership. X sells property to the partnership for $600 (its then fair market value). X's basis in the property is $1,000. Is X's $400 loss deductible? How much gain is recognized by the partnership if it sells the property purchased from X to an unrelated third party for $1,600 (its then fair market value)? What is the effect on the partners' outside bases? a. b. English (United States) 16 tv wwwx] 80 GOO 009 78 F2 11 FO 3 $ 4 % 5 & 7 6 8 9 0 E R T Y U 0 G

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts