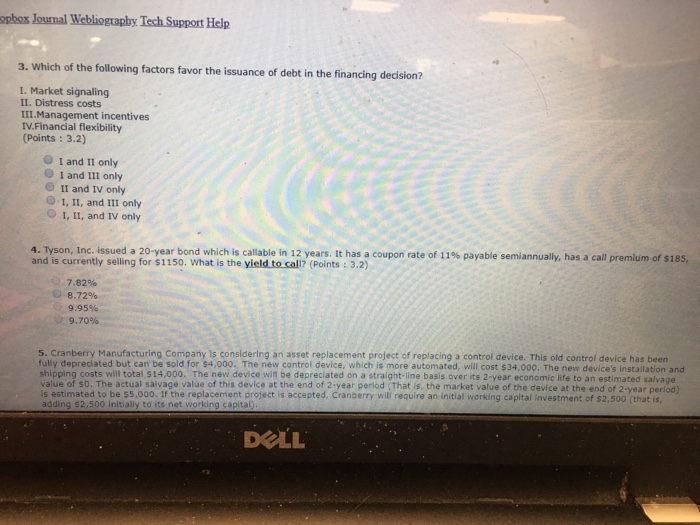

Question: Please answer 2 & 3 opbox Journal Webliogtaphy Tech Support Help 3. Which of the following factors favor the issuance of debt in the financing

opbox Journal Webliogtaphy Tech Support Help 3. Which of the following factors favor the issuance of debt in the financing decision? I. Market signaling II. Distress costs III.Management incentives 1Financial flexibility (Points : 3.2) O I and II only O I and III only e 11 and IV only 1,II, and III only O I, II, and IV only 4. Tyson, Inc. issued a 20-year bond which is callable in 12 years. It has a coupon rate of 11% payable semiannually, has a call premium of S185, and is currently selling for $1150. What is the yield to call? (Points : 3.2) 7.82% 8.72% 9.95% 9.70% 5. Cranberry Manufacturing Company is considering an asset replacement project of replacing a control device. This old control device has been fully depreciated but can be sold for $4,000. The new control device, which is more automated, will cost $34,000. The new device's installation and shipp value of so. The actual salvage value of this device at the end of 2-year period (That is, the market value of the device at the end of 2-year period) is estimated to be 55,000. If the replacement project is accepted, Cranberry will require an initial working capital Investment of $2,500 (that is, adding s2,500 initially to its net working capital costs will total $14,000. The new device will be depreciated on a straight-line basis over its 2-year economic life to an estimated salvage DOLL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts