Question: Please answer 2 & 3 profit to fall by 29%. How does the Return on Assets Debt to Equity Revenue Total Debt Payout ratio EPS

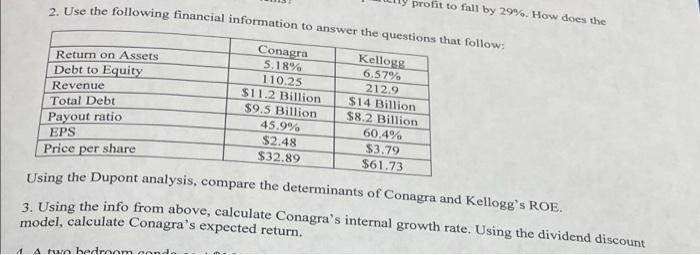

profit to fall by 29%. How does the Return on Assets Debt to Equity Revenue Total Debt Payout ratio EPS Price per share 2. Use the following financial information to answer the questions that follow: Conagra Kellogg 5.18% 6.57% 110.25 212.9 $11.2 Billion $14 Billion $9.5 Billion $8.2 Billion 45.9% 60.4% $2.48 $3.79 $32.89 $61.73 Using the Dupont analysis, compare the determinants of Conagra and Kellogg's ROE. 3. Using the info from above, calculate Conagras internal growth rate. Using the dividend discount model, calculate Conagra's expected return. Ahedrama

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts