Question: please answer 2 & 3 Question 2 (8 points) Your firm plans to issue new bonds. Citibank will charge the firm 5% to prepare the

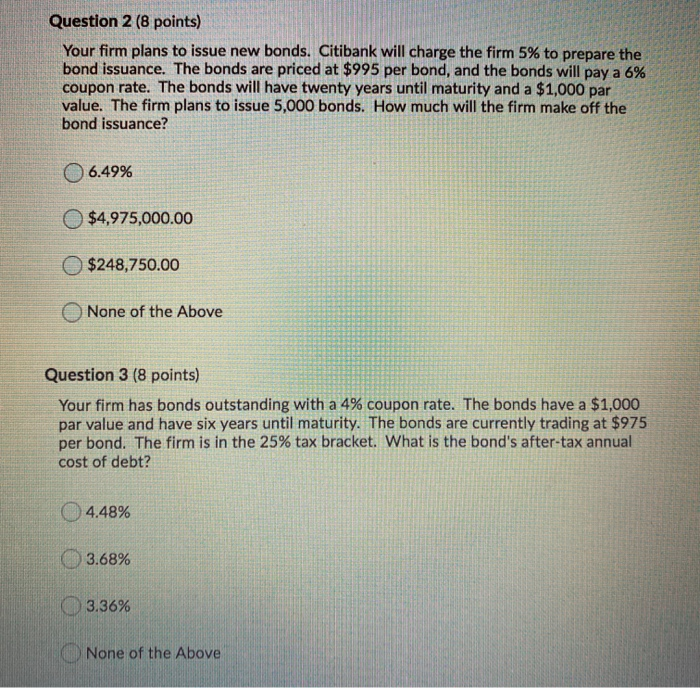

Question 2 (8 points) Your firm plans to issue new bonds. Citibank will charge the firm 5% to prepare the bond issuance. The bonds are priced at $995 per bond, and the bonds will pay a 6% coupon rate. The bonds will have twenty years until maturity and a $1,000 par value. The firm plans to issue 5,000 bonds. How much will the firm make off the bond issuance? 06.49% $4,975,000.00 $248,750.00 None of the Above Question 3 (8 points) Your firm has bonds outstanding with a 4% coupon rate. The bonds have a $1,000 par value and have six years until maturity. The bonds are currently trading at $975 per bond. The firm is in the 25% tax bracket. What is the bond's after-tax annual cost of debt? 4.48% 3.68% 3.36% None of the Above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts