Question: please answer #2 A homeowner has $200,000 home with a 20-year mortgage, paid monthly at a quoted interest rate of 7.25% per year compounded semi-annually.

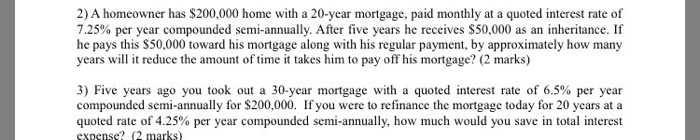

A homeowner has $200,000 home with a 20-year mortgage, paid monthly at a quoted interest rate of 7.25% per year compounded semi-annually. After five years he receives $50,000 as an inheritance. If he pays this $50,000 toward his mortgage along with his regular payment, by approximately how many years will it reduce the amount of time it takes him to pay off his mortgage? Five years ago you took out a 30-year mortgage with a quoted interest rate of 6.5% per year compounded semi-annually for $200,000. If you were to refinance the mortgage today for 20 years at a quoted rate of 4.25% per year compounded semi-annually, how much would you save in total interest expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts