Question: Please answer #2. Posted before but did not get correct answer. Please explain how to do this numerically and why each is either premium or

Please answer #2. Posted before but did not get correct answer. Please explain how to do this numerically and why each is either premium or discount.

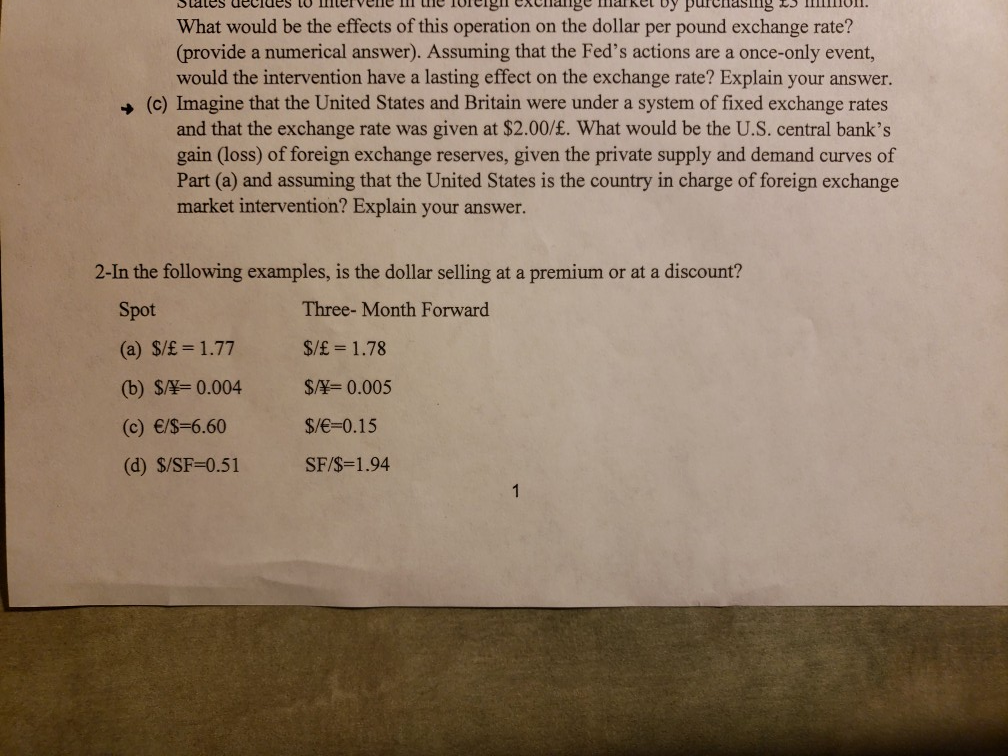

states decides to ier velne m tuie forer8 eachange e by purChasngion What would be the effects of this operation on the dollar per pound exchange rate? (provide a numerical answer). Assuming that the Fed's actions are a once-only event, would the intervention have a lasting effect on the exchange rate? Explain your answer. (c) Imagine that the United States and Britain were under a system of fixed exchange rates and that the exchange rate was given at $2.00/. What would be the U.S. central banks gain (loss) of foreign exchange reserves, given the private supply and demand curves of Part (a) and assuming that the United States is the country in charge of foreign exchange market intervention? Explain your answer 2-In the following examples, is the dollar selling at a premium or at a discount? Three- Month Forward Spot (a) S/E- 1.77 b) SAY- 0.004 S/N- 0.005 (c) /S-6.60 (d) S/SF-0.51 $/ = 1.78 $/e-0.15 SF/S=1.94

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts