Question: please answer 2 question below fully and correctly as soon as possible and I will rate you 5 star. Thank you. - Question 1 Question

please answer 2 question below fully and correctly as soon as possible and I will rate you 5 star. Thank you. - Question 1

Question 2

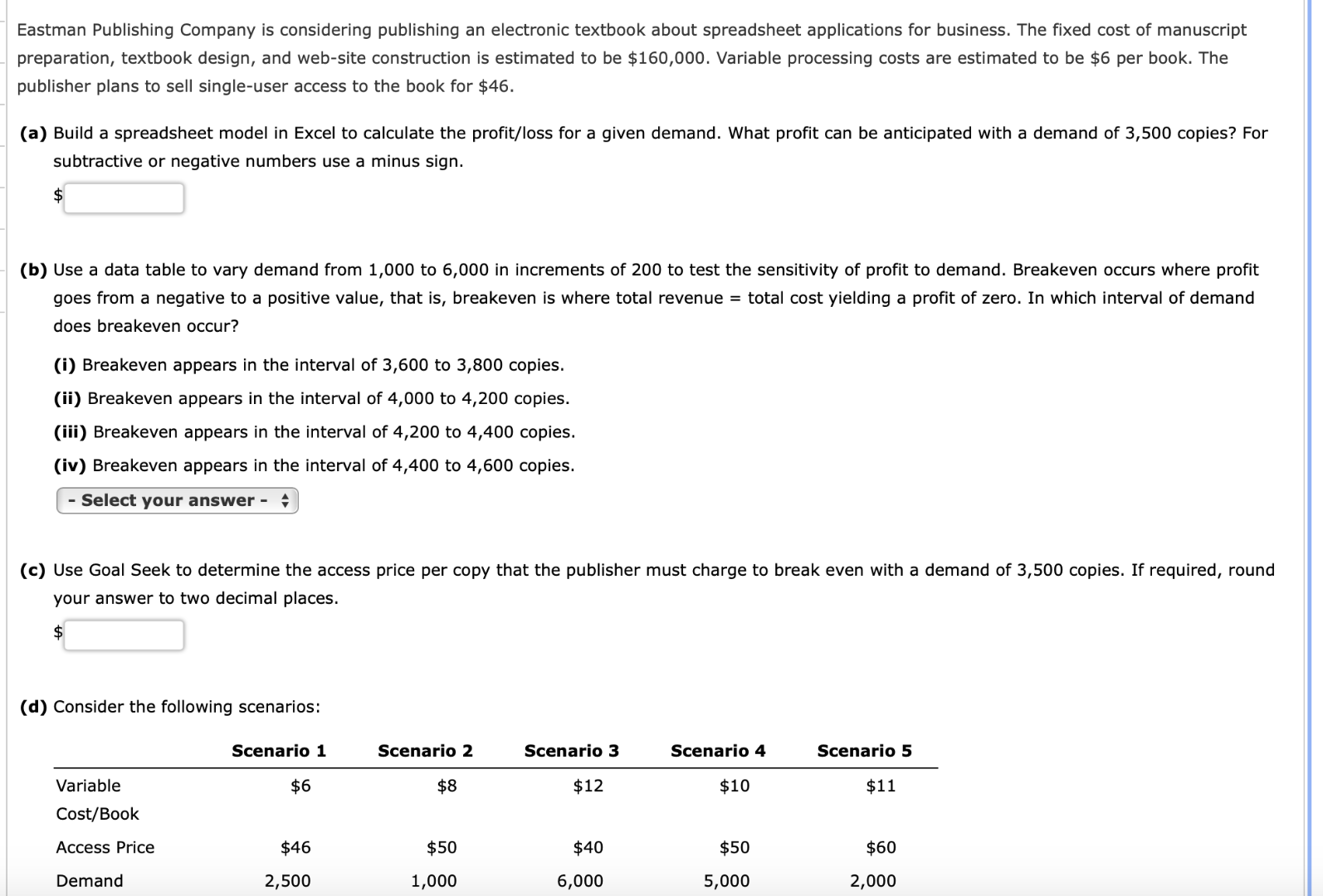

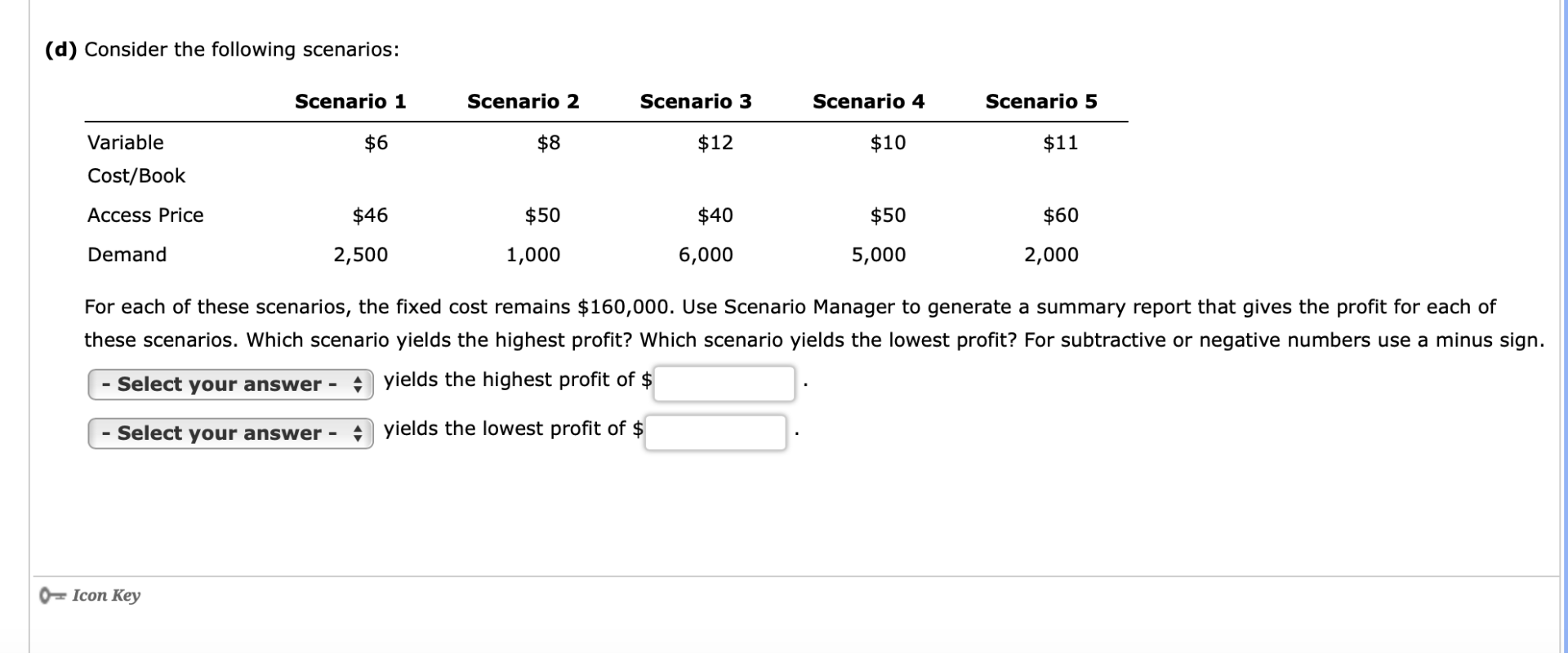

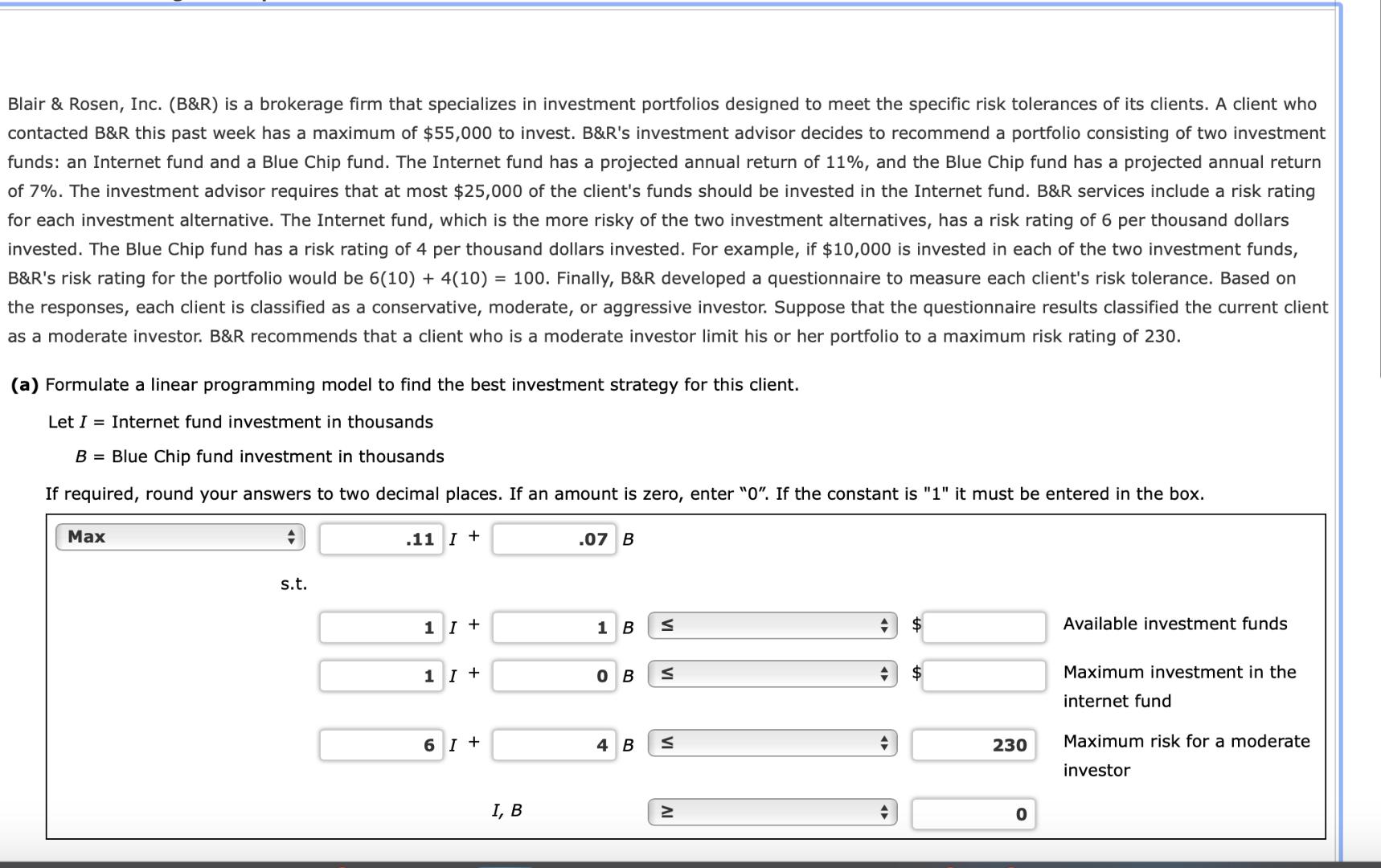

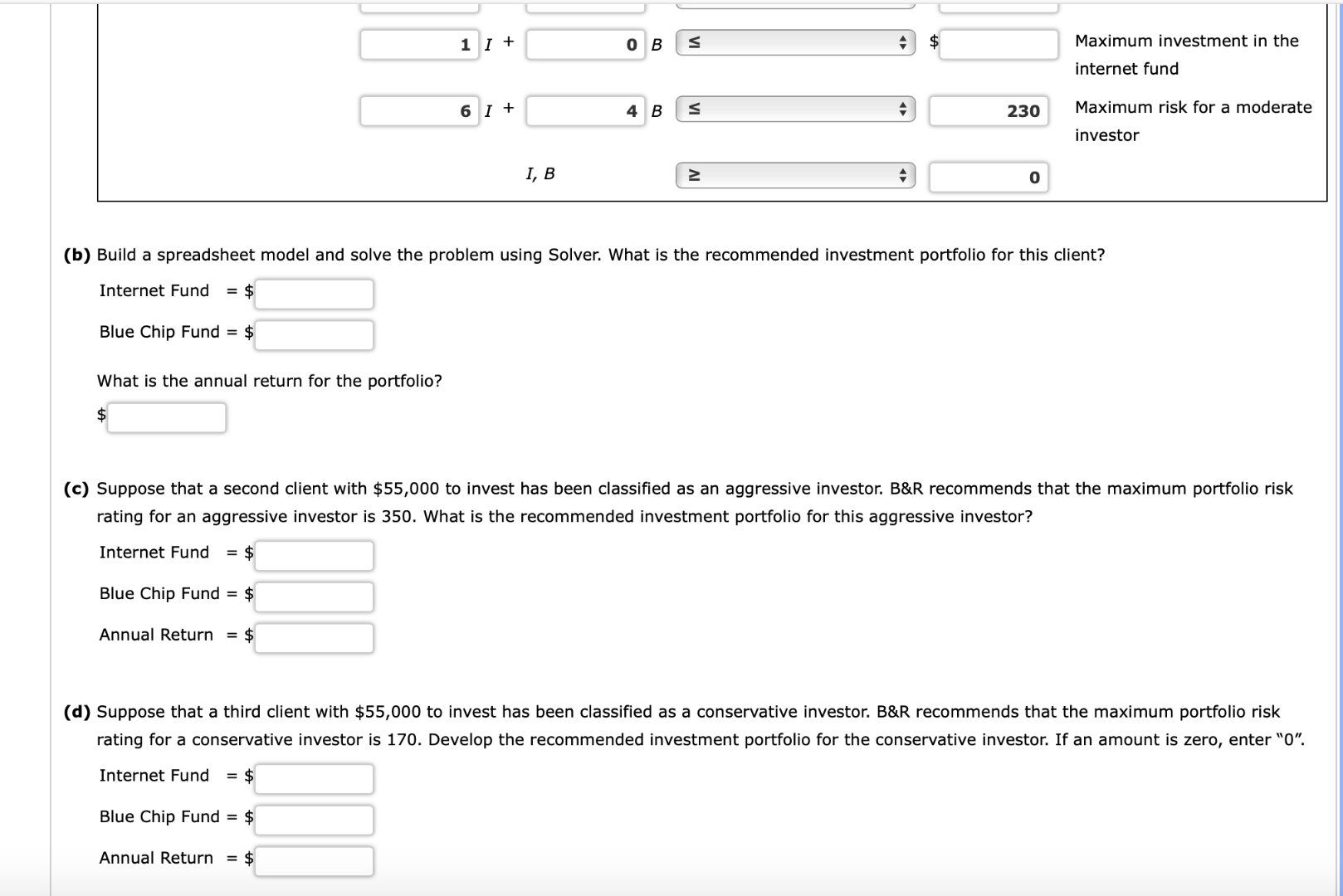

Eastman Publishing Company is considering publishing an electronic textbook about spreadsheet applications for business. The fixed cost of manuscript preparation, textbook design, and web-site construction is estimated to be $160,000. Variable processing costs are estimated to be $6 per book. The publisher plans to sell single-user access to the book for $46. (a) Build a spreadsheet model in Excel to calculate the profit/loss for a given demand. What profit can be anticipated with a demand of 300 copies? For subtractive or negative numbers use a minus sign. 9 (b) Use a data table to vary demand from 1,000 to 6,000 in increments of 200 to test the sensitivity of profit to demand. Breakeven occurs where profit goes from a negative to a positive value, that is, breakeven is where total revenue = total cost yielding a profit of zero. In which interval of demand does breakeven occur? (i) Breakeven appears in the interval of 3,600 to 3,800 copies. (ii) Breakeven appears in the interval of 4,000 to 4,200 copies. (iii) Breakeven appears in the interval of 4,200 to 4,400 copies. (iv) Breakeven appears in the interval of 4,400 to 4,600 copies. (c) Use Goal Seek to determine the access price per copy that the publisher must charge to break even with a demand of 3,500 copies. If required, round your answer to two decimal places. 9 (d) Consider the following scenarios: (d) Consider the following scenarios: For each of these scenarios, the fixed cost remains $160,000. Use Scenario Manager to generate a summary report that gives the profit for each of these scenarios. Which scenario yields the highest profit? Which scenario yields the lowest profit? For subtractive or negative numbers use a minus sign yields the highest profit of $ yields the lowest profit of $ Blair \& Rosen, Inc. (B\&R) is a brokerage firm that specializes in investment portfolios designed to meet the specific risk tolerances of its clients. A client who contacted B\&R this past week has a maximum of $55,000 to invest. B\&R's investment advisor decides to recommend a portfolio consisting of two investment funds: an Internet fund and a Blue Chip fund. The Internet fund has a projected annual return of 11%, and the Blue Chip fund has a projected annual return of 7%. The investment advisor requires that at most $25,000 of the client's funds should be invested in the Internet fund. B\&R services include a risk rating for each investment alternative. The Internet fund, which is the more risky of the two investment alternatives, has a risk rating of 6 per thousand dollars invested. The Blue Chip fund has a risk rating of 4 per thousand dollars invested. For example, if $10,000 is invested in each of the two investment funds, B\&R's risk rating for the portfolio would be 6(10)+4(10)=100. Finally, B\&R developed a questionnaire to measure each client's risk tolerance. Based on the responses, each client is classified as a conservative, moderate, or aggressive investor. Suppose that the questionnaire results classified the current client as a moderate investor. B\&R recommends that a client who is a moderate investor limit his or her portfolio to a maximum risk rating of 230 . (a) Formulate a linear programming model to find the best investment strategy for this client. Let I= Internet fund investment in thousands B= Blue Chip fund investment in thousands If required, round your answers to two decimal places. If an amount is zero, enter " 0 ". If the constant is " 1 " it must be entered in the box. What is the annual return for the portfolio? $ (c) Suppose that a second client with $55,000 to invest has been classified as an aggressive investor. B\&R recommends that the maximum portfolio risk rating for an aggressive investor is 350 . What is the recommended investment portfolio for this aggressive investor? Internet Fund =$ Blue Chip Fund =$ Annual Return =$ (d) Suppose that a third client with $55,000 to invest has been classified as a conservative investor. B\&R recommends that the maximum portfolio risk rating for a conservative investor is 170 . Develop the recommended investment portfolio for the conservative investor. If an amount is zero, enter Internet Fund =$ Blue Chip Fund =$ Annual Return =$

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts