Question: please answer 2 questions i will thumbs up Required information [The following information applies to the questions displayed below] AMP Corporation (calendar year-end) has 2022

![following information applies to the questions displayed below] AMP Corporation (calendar year-end)](https://s3.amazonaws.com/si.experts.images/answers/2024/08/66cd5f5332287_31466cd5f52df7b1.jpg)

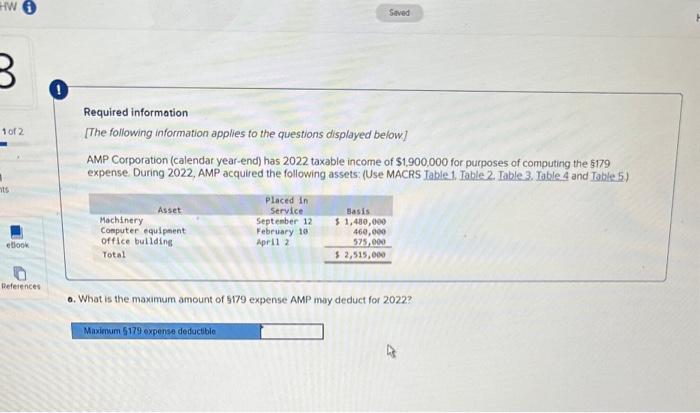

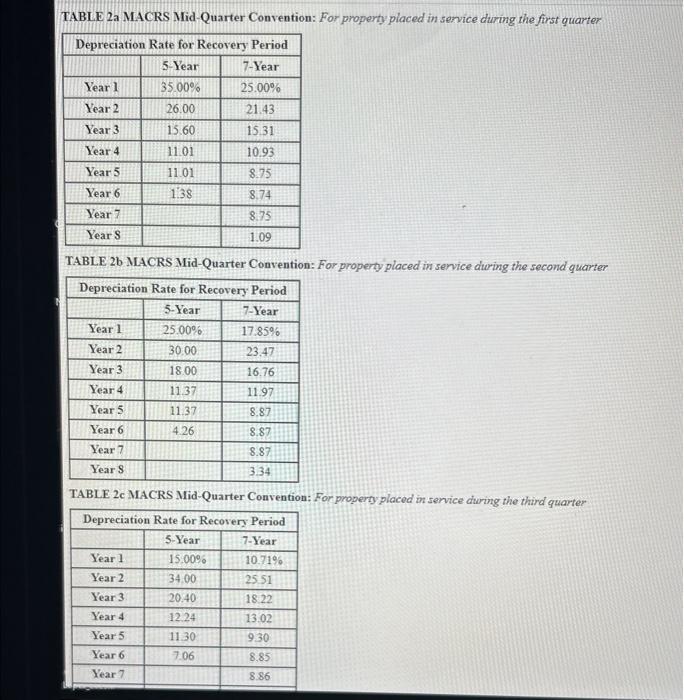

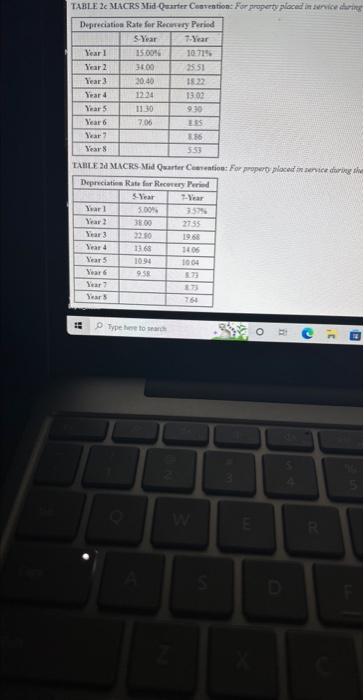

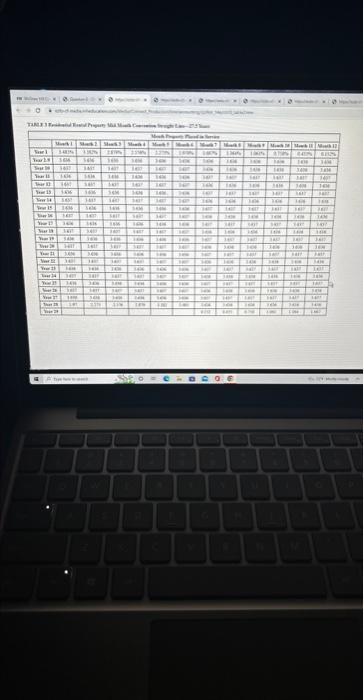

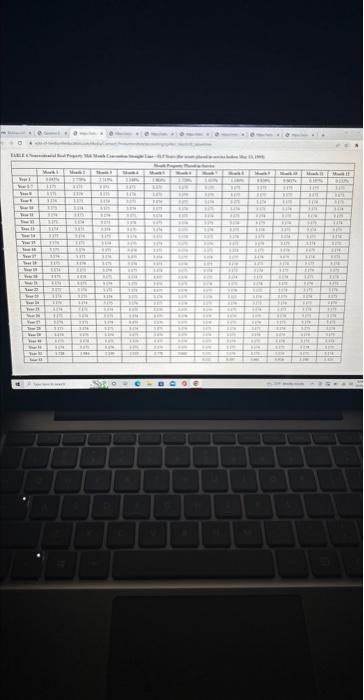

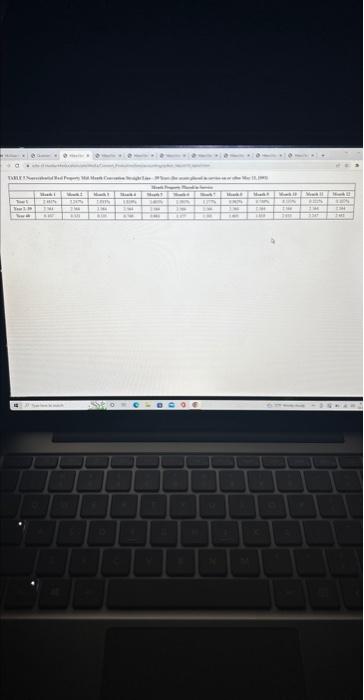

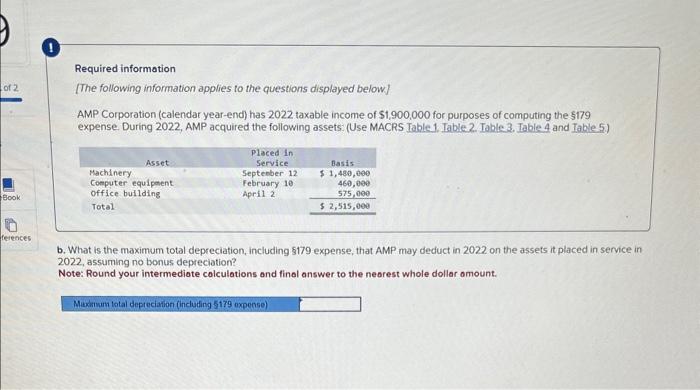

Required information [The following information applies to the questions displayed below] AMP Corporation (calendar year-end) has 2022 taxable income of $1,900,000 for purposes of computing the 5179 expense During 2022, AMP acquired the following assets: (Use MACRS Table 1, Iable 2. Table 3. Table 4 and Table 5 ) o. What is the maximum amount of 5179 expense AMP moy deduct for 2022 ? Table 1 MACRS Half-Year Convention TABLE 2 a MACRS Mid-Quarter Convention: For property placed in senvice during the first quarter TABLE 2b MLARS Mid-Quarter Convention: For property placed in senvice dwing the second quarter TABLE 2c MACRS Mid-Quarter Convention: For property placed in service dwing the third quarter TABILE 2e M.tCRS Mifid Quarter Cesteation: For property ploced in ienvice thrigs Required information [The following information applies to the questions displayed below] AMP Corporation (calendar year-end) has 2022 taxable income of $1,900,000 for purposes of computing the $179 expense. During 2022, AMP acquired the following assets: (Use MACRS Table 1. Table2. Table 3. Table 4 and Table 5.) b. What is the maximum total depreciation, including 5179 expense, that AMP may deduct in 2022 on the assets it placed in service in 2022, assuming no bonus depreciation? Note: Round your intermediate calculations and final answer to the neorest whole dollar amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts