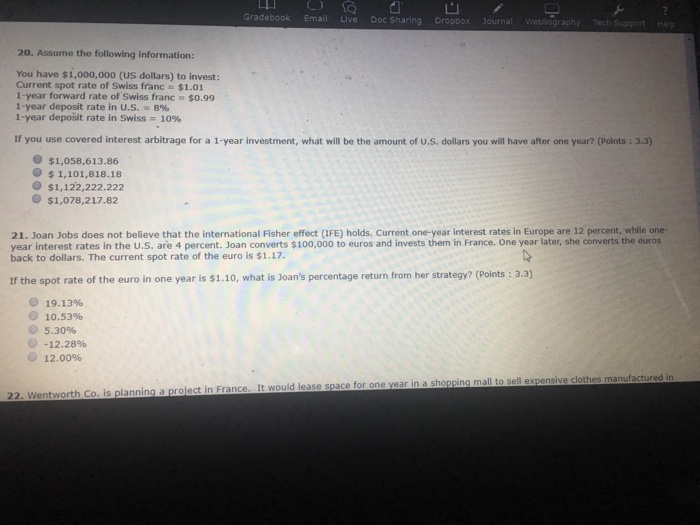

Question: Please answer 20&21 Gradebook Email Live Doc Sharing Dropbox Journal Webliography Tech Support H 20. Assume the following information: You have $1,000,000 (US dollars) to

Gradebook Email Live Doc Sharing Dropbox Journal Webliography Tech Support H 20. Assume the following information: You have $1,000,000 (US dollars) to invest: Current spot rate of Swiss franc $1.01 1-year forward rate of Swiss franc $0.99 1-year deposit rate in US. 8% 1-year deposit rate in Swiss-10% If you use covered interest arbitrage for a 1-year investment, what will be the amount of U.S. dollars you will have after one year? (Points : 3.3) $1,058,613.86 O $1,101,818.18 O $1,122,222.222 $1,078,217.82 21. Joan Jobs does not believe that the international Fisher effect (IFE) holds. Current one-year interest rates in Europe are 12 percent, while one- year interest rates in the Uu.S. are 4 percent. Joan converts $100,000 to euros and invests them in France. One year later, she converts the euros back to dollars. The current spot rate of the euro is $1.17. If the spot rate of the euro in one year is $1.10, what is Joan's percentage return from her strategy? (Points : 3.3) @ 19.13% ? 10.53% ? 5.30% -12.28% 12.00% 22. Wentworth Co, is planning a project in France. It would lease space for one year in a shopping mall to sell expensive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts