Question: Please answer 20-25. Thank you 19. In an efficient markel, l A. positively correlated. B. negatively correlated C. uncorrelated. D. none of the above. 20.

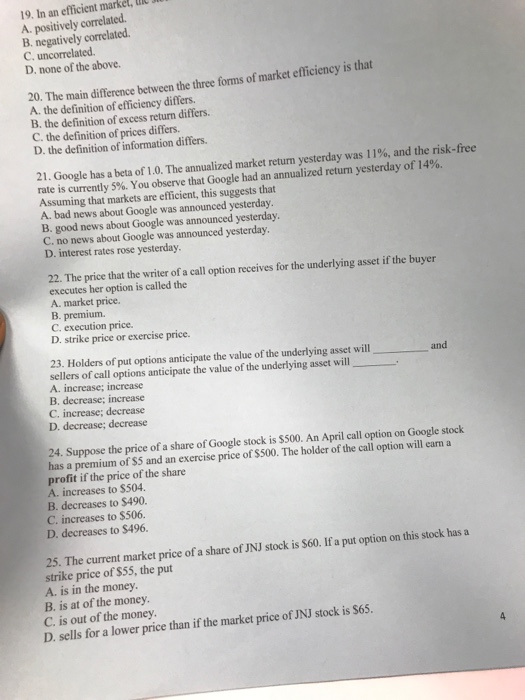

19. In an efficient markel, l A. positively correlated. B. negatively correlated C. uncorrelated. D. none of the above. 20. The main difference between the three foms of market efficiency is that A. the definition of efficiency differs. B. the definition of excess return differs C. the definition of prices differs. D. the definition of information differs. 21. Google has a beta of 10. The annualized market return yesterday was 11%, and the risk-free rate is currently 5%. You observe that Google had an annualized return yesterday of 14%. Assuming that markets are efficient, this suggests that A. bad news about Google was announced yesterday. B. good news about Google was announced yesterday. C. no news about Google was announced yesterday. D. interest rates rose yesterday. 22. The price that the writer of a call option receives for the underlying asset if the buyer executes her option is called the A. market price. B. premium. C. execution price. D. strike price or exercise price. 23. Holders of put options anticipate the value of the underlying asset will and sellers of call options anticipate the value of the underlying asset will A. increase; increase B. decrease; increase C. increase; decrease D. decrease; decrease 24. Suppose the price of a share of Google stock is $500. An April call option on Google stock has a premium of S5 and an exercise price of s500. The holder of the call option will earn a profit if the price of the share A. increases to $504. B. decreases to $490. C. increases to $506. D. decreases to $496. 25. The current market price of a share of JNJ stock is $60. If a put option on this stock has a strike price of $55, the put A. is in the money B. is at of the money C. is out of the money. D. sells for a lower price than if the market price of JNJ stock is S65

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts