Question: PLEASE ANSWER #21 #23, #25 WITH EXPLANATION. THANKS 21. A share of stock is now selling for $100. It will pay a dividend of $9

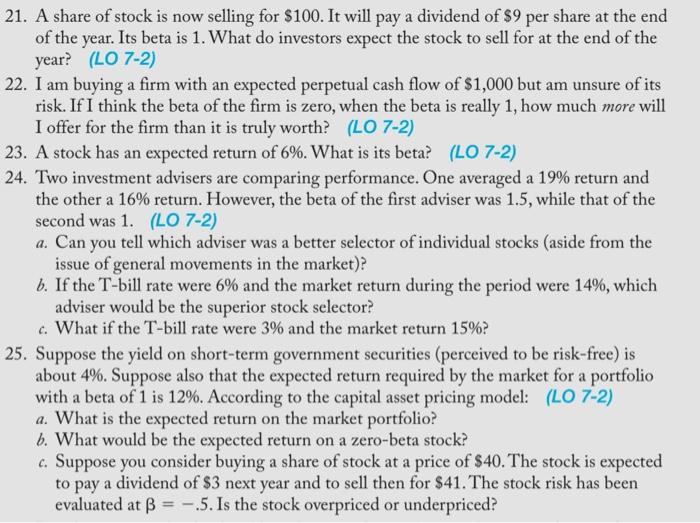

21. A share of stock is now selling for $100. It will pay a dividend of $9 per share at the end of the year. Its beta is 1 . What do investors expect the stock to sell for at the end of the year? (LO72) 22. I am buying a firm with an expected perpetual cash flow of $1,000 but am unsure of its risk. If I think the beta of the firm is zero, when the beta is really 1 , how much more will I offer for the firm than it is truly worth? (LO 7-2) 23. A stock has an expected return of 6%. What is its beta? (LO 7-2) 24. Two investment advisers are comparing performance. One averaged a 19% return and the other a 16% return. However, the beta of the first adviser was 1.5, while that of the second was 1 . (LO 7-2) a. Can you tell which adviser was a better selector of individual stocks (aside from the issue of general movements in the market)? b. If the T-bill rate were 6% and the market return during the period were 14%, which adviser would be the superior stock selector? c. What if the T-bill rate were 3% and the market return 15% ? 25. Suppose the yield on short-term government securities (perceived to be risk-free) is about 4%. Suppose also that the expected return required by the market for a portfolio with a beta of 1 is 12%. According to the capital asset pricing model: (LO 7-2) a. What is the expected return on the market portfolio? b. What would be the expected return on a zero-beta stock? c. Suppose you consider buying a share of stock at a price of $40. The stock is expected to pay a dividend of $3 next year and to sell then for $41. The stock risk has been evaluated at =.5. Is the stock overpriced or underpriced? 21. A share of stock is now selling for $100. It will pay a dividend of $9 per share at the end of the year. Its beta is 1 . What do investors expect the stock to sell for at the end of the year? (LO72) 22. I am buying a firm with an expected perpetual cash flow of $1,000 but am unsure of its risk. If I think the beta of the firm is zero, when the beta is really 1 , how much more will I offer for the firm than it is truly worth? (LO 7-2) 23. A stock has an expected return of 6%. What is its beta? (LO 7-2) 24. Two investment advisers are comparing performance. One averaged a 19% return and the other a 16% return. However, the beta of the first adviser was 1.5, while that of the second was 1 . (LO 7-2) a. Can you tell which adviser was a better selector of individual stocks (aside from the issue of general movements in the market)? b. If the T-bill rate were 6% and the market return during the period were 14%, which adviser would be the superior stock selector? c. What if the T-bill rate were 3% and the market return 15% ? 25. Suppose the yield on short-term government securities (perceived to be risk-free) is about 4%. Suppose also that the expected return required by the market for a portfolio with a beta of 1 is 12%. According to the capital asset pricing model: (LO 7-2) a. What is the expected return on the market portfolio? b. What would be the expected return on a zero-beta stock? c. Suppose you consider buying a share of stock at a price of $40. The stock is expected to pay a dividend of $3 next year and to sell then for $41. The stock risk has been evaluated at =.5. Is the stock overpriced or underpriced

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts