Question: please answer #23 please 23. (7 points) M Service Co. reported the following for its defined- benefit pension plan for 2019: Settlement rate 4.00% Expected

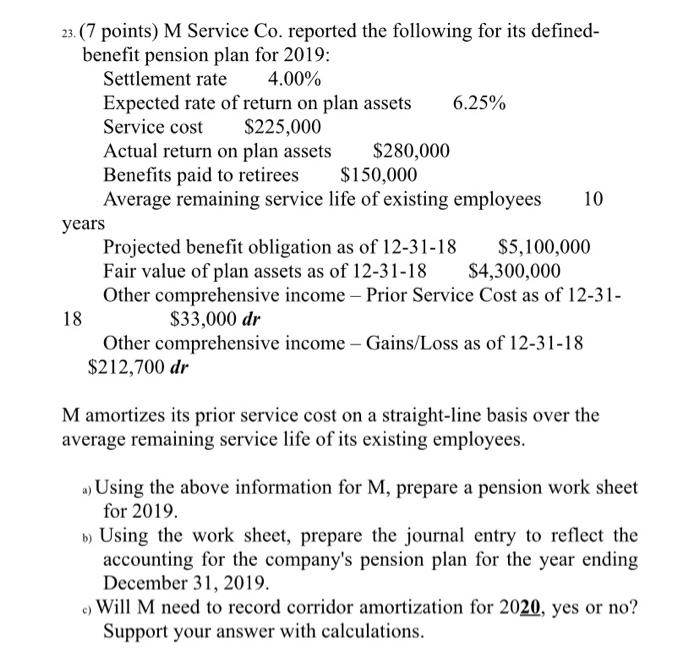

23. (7 points) M Service Co. reported the following for its defined- benefit pension plan for 2019: Settlement rate 4.00% Expected rate of return on plan assets 6.25% Service cost $225,000 Actual return on plan assets $280,000 Benefits paid to retirees $150,000 Average remaining service life of existing employees 10 years Projected benefit obligation as of 12-31-18 $5,100,000 Fair value of plan assets as of 12-31-18 $4,300,000 Other comprehensive income - Prior Service Cost as of 12-31- 18 $33,000 dr Other comprehensive income - Gains/Loss as of 12-31-18 $212,700 dr M amortizes its prior service cost on a straight-line basis over the average remaining service life of its existing employees. a) Using the above information for M, prepare a pension work sheet for 2019. b) Using the work sheet, prepare the journal entry to reflect the accounting for the company's pension plan for the year ending December 31, 2019. Will M need to record corridor amortization for 2020, yes or no? Support your answer with calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts