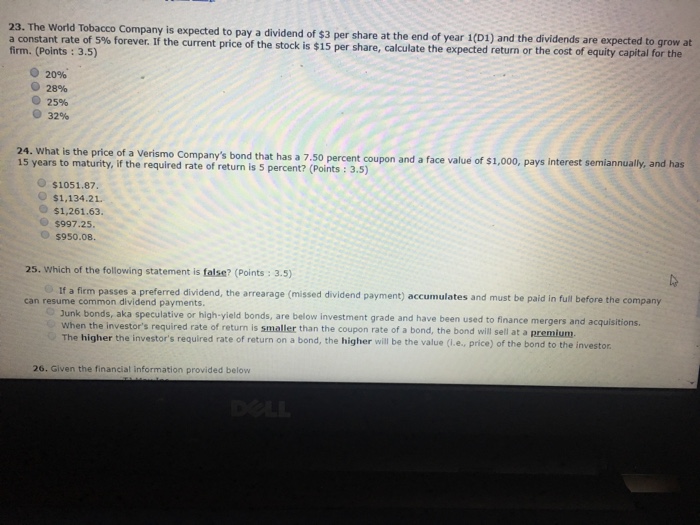

Question: Please answer 23,24,&25. Thank you! expected to pay a dividend of $3 per share at the end of year 1(D1) and the dividends are expected

expected to pay a dividend of $3 per share at the end of year 1(D1) and the dividends are expected to grow at a constant rate of5% forever. If the current price of the stock is $15 per share, calculate the expected return or the cost of equity capital for the firm. (Points: 3.5) 20% O 28% 25% O 32% 25 whas t the price of a Verismo Company's bond that has a 7.50 percent coupon and a face value of $1,000, pays interest semiannualy, and has 5 years to maturity, if the required rate of return is 5 percent? (Points : 3.5) d a face value of $1,000, pays interest semiannually, and has O $1051.87 O $1,134.21. o $1,261.63. $997.25. O s950.08. 25. Which of the following statement is false? (Points : 3.5) If a firm passes a preferred dividend, the arrearage (missed dividend payment) accumulates and must be paid in full before the company can resume common dividend payments. Dunk bonds, aka speculative or high-yield bonds, are below investment grade and have been used to finance mergers and acquisitions. When the investor's required rate of return is smaller than the coupon rate of a bond, the bond will sell at a premium. The higher the investor's required rate of return on a bond, the higher will be the value (I.e., price) of the bond to the investor 26. Given the financial information provided below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts