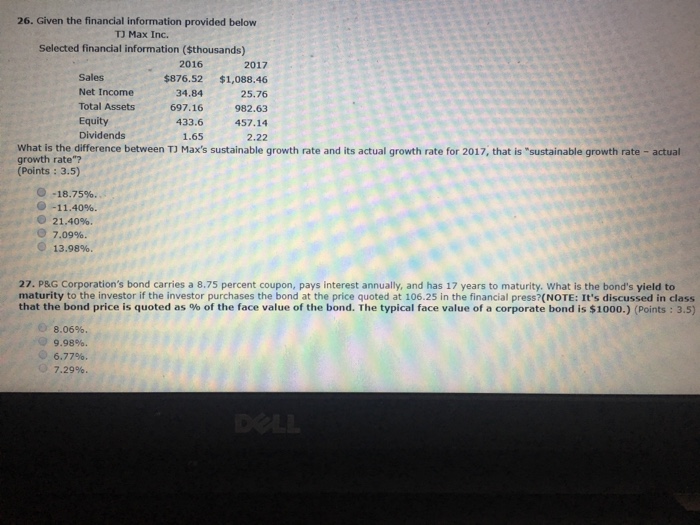

Question: Please answer 26 & 27 26. Given the financial information provided below TJ Max Inc. Selected financial information (Sthousands) 2016 Sales Net Income Total Assets

26. Given the financial information provided below TJ Max Inc. Selected financial information (Sthousands) 2016 Sales Net Income Total Assets Equity Dividends 2017 $876.52 $1,088.46 25.76 697.16 982.63 433.6 457.14 2.22 34.84 1.65 What is the difference between TJ Max's sustainable growth rate and its actual growth rate for 2017, that is "sustainable growth rate - actual growth rate"? Points: 3.5) 0-18.75% -11.40%. 21.40%. @ 7.09%. 13.98% 27. P&G Corporation's bond carries a 8.75 percent coupon, pays interest annually, and has 17 years to maturity. What is the bond's yield to maturity to the investor if the investor purchases the bond at the price quoted at 106.25 in the financial press? (NOTE: It's discussed in class that the bond price is quoted as % of the face value of the bond. The typical face value of a corporate bond is $1000.) (Points : 3.5) 8.06%. 9.98%. O 6.77%. 7.29%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts